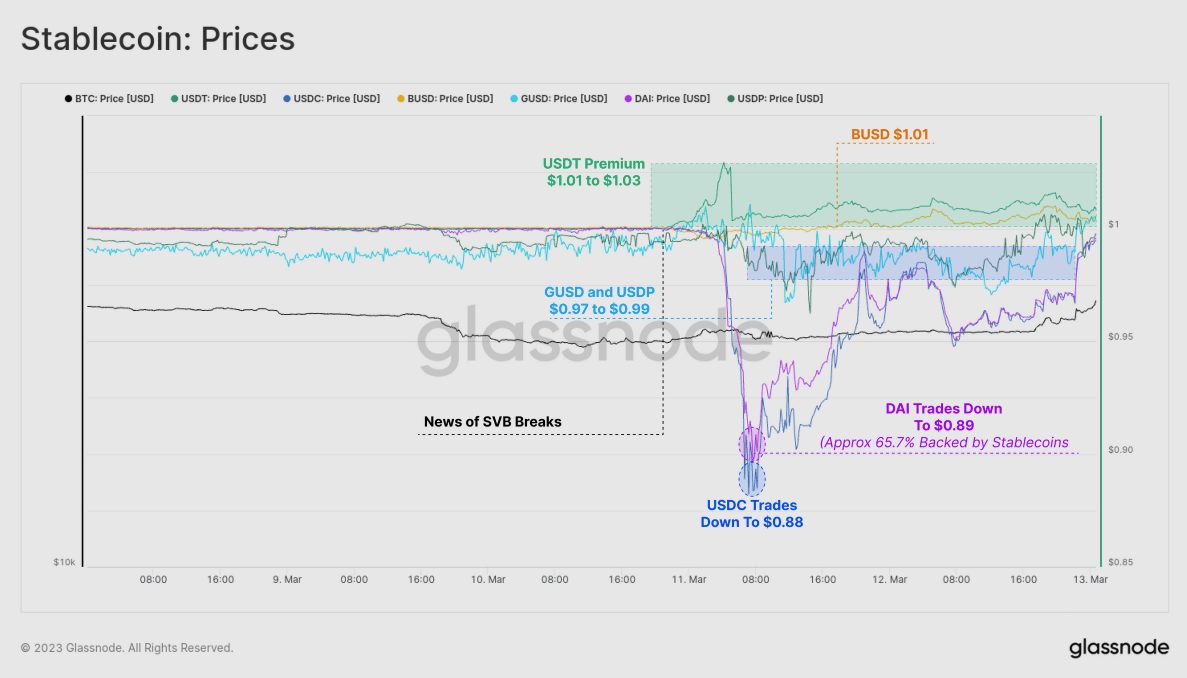

This week’s on-chain information report by the analytics firm Glassnode seems to be into three main occasions — the depegging of the USDC stablecoin, web capital outflows and futures open curiosity information.

This has induced USDC and DAI to commerce at decrease values of $0.88 and $0.89 respectively. DAI’s worth drop is as a result of it’s backed by stablecoin collateral of solely about 65.7%. Gemini’s GUSD and Paxos’ USDP additionally dipped under their $1 peg, whereas BUSD and Tether traded at a premium.

Tether, specifically, traded at a premium between $1.01 and $1.03 through the weekend, which is ironic as a result of it’s seen as a secure haven within the face of potential dangers within the closely regulated US banking sector. That is the primary time for the reason that LUNA-UST undertaking collapse that there was volatility in stablecoin costs.

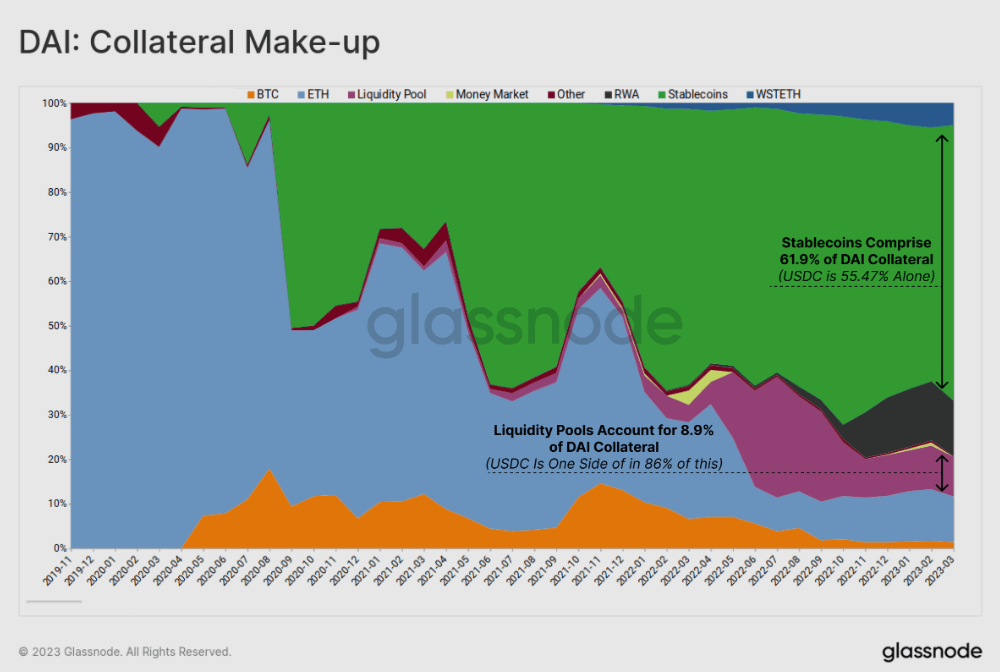

DAI / USDC

Stablecoins, significantly USDC, have turn into the first type of collateral supporting DAI. This development has been constant since mid-2020, with USDC making up round 55.5% of direct collateral and a good portion of Uniswap liquidity positions, totaling to about 63% of all collateral.

In accordance with Glassnode information, dependence on stablecoins for collateral raises questions concerning the decentralized nature of DAI. This latest occasion highlights how DAI’s value is carefully tied to the normal banking system resulting from its collateral combine, which additionally consists of 12.4% in tokenized real-world property.

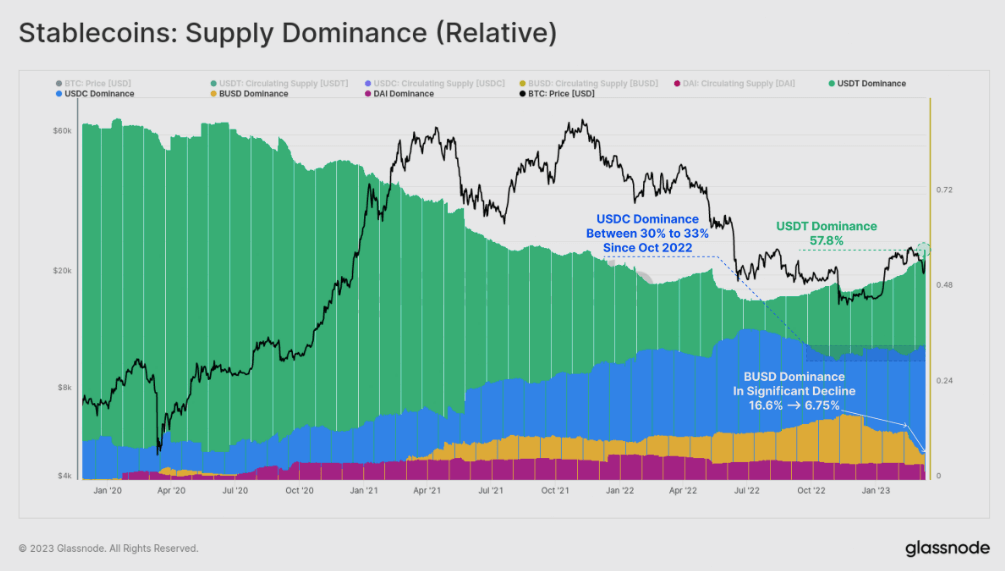

Tether USDT dominance

In mid-2022, Glassnode reported that Tether’s dominant place within the stablecoin market had been declining structurally since mid-2020. Nonetheless, resulting from regulatory actions in opposition to BUSD and issues relating to USDC stemming from its latest depegging, Tether’s dominance has rebounded to over 57.8%, it’s highest degree in 18-months.

Since October 2022, USDC has maintained a dominant market share of between 30% and 33%. Nonetheless, it stays to be seen whether or not its provide will lower because the redemption window reopens on March 20. However, BUSD has skilled a major decline in latest months, with issuer Paxos ceasing new minting, and its dominance falling from 16.6% in November to solely 6.8% at current.

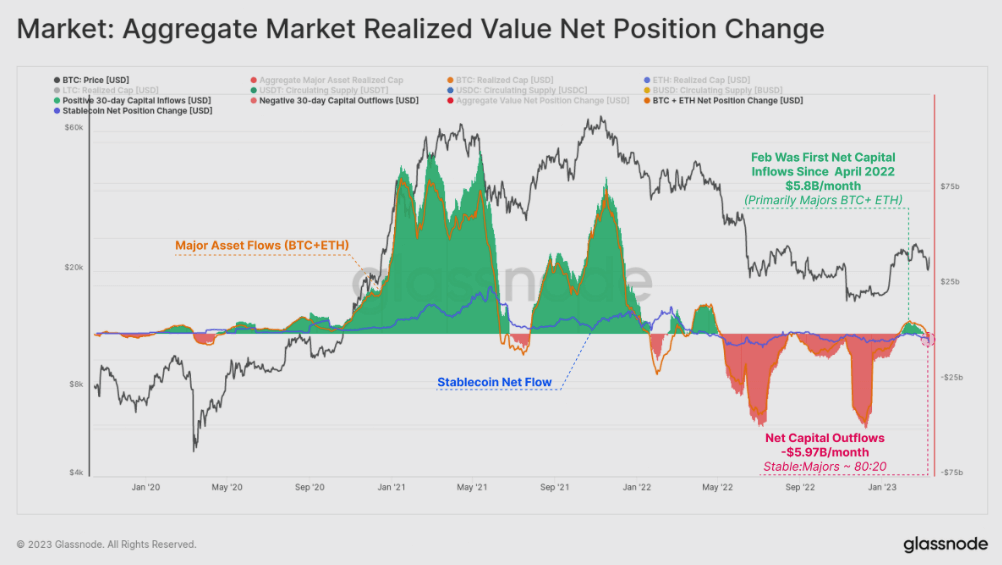

Mixture Capital Outflows

Estimation of the true capital inflows and outflows, Glassnode estimates that the final month, the market has seen a reversal outflow of -$5.97B, with 80% of {that a} results of stablecoin redemption (BUSD primarily), and 20% from realized losses throughout BTC and ETH.

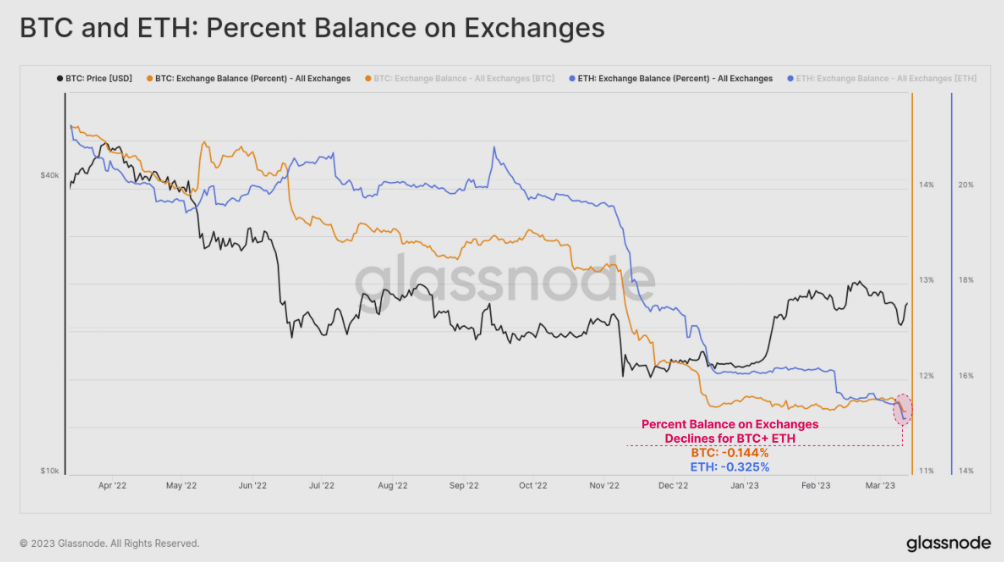

SVB fall out on share of BTC and ETH on exchanges

Roughly 0.144% of all BTC, and 0.325% all ETH in circulation was withdrawn from alternate reserves, demonstrating an identical self-custody response sample to the FTX collapse. On a USD foundation, the final month noticed over $1.8B in mixed BTC and ETH worth circulate out of exchanges.