Up to date on March 24, 2023

Parabolic SAR indicator is a technical evaluation software developed by Welles J. Wilder. It stands for “cease and reverse”. The primary purpose of this indicator is to observe the worth motion over a sure time period and determine potential pattern reversals.

✍️

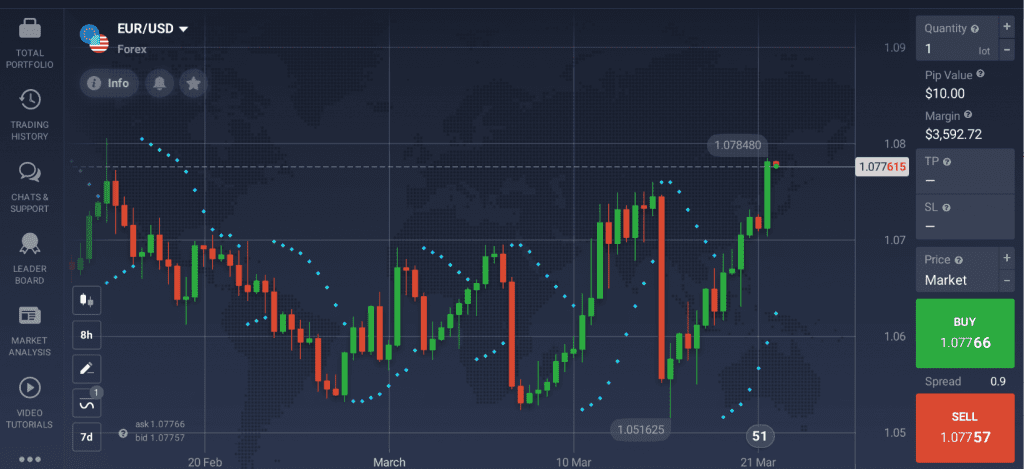

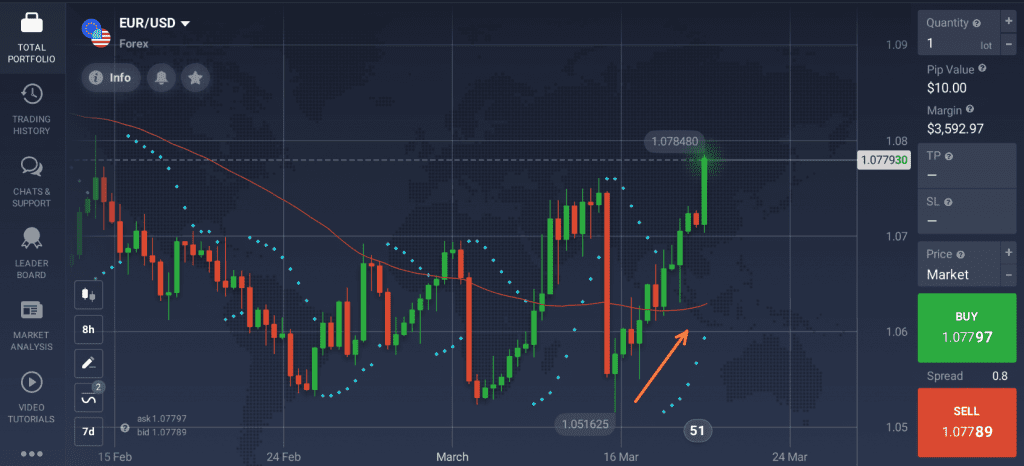

Parabolic SAR usually seems under the worth throughout an uptrend. And it strikes above the worth throughout a downtrend.

With a view to perceive tips on how to use Parabolic SAR indicator successfully, it’s essential to know the way it works. So let’s go over the principle options and study extra concerning the Parabolic SAR settings, in addition to potential indicator combos.

How does Parabolic SAR work?

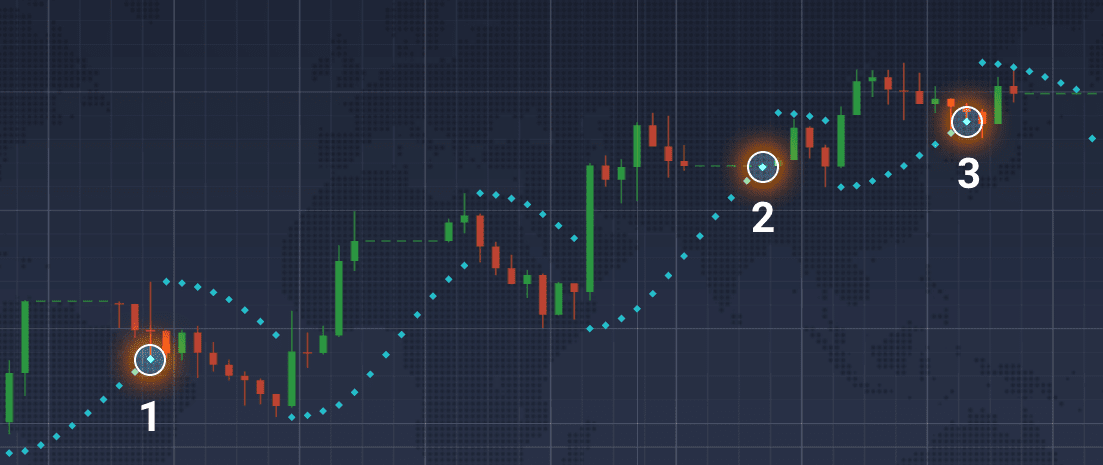

The thought behind the indicator is kind of easy. When the value crosses one of many Parabolic SAR dots, the indicator could also be anticipated to show round and seem on the alternative aspect of the worth line. Such conduct could also be thought of as a signal of an upcoming pattern reversal or not less than a pattern slowdown.

It may be seen within the image above that when the Parabolic SAR indicator touches the worth, the pattern adjustments its route. Moreover, this indicator can also be helpful for estimating optimum entry/exit factors.

Parabolic SAR settings for intraday buying and selling

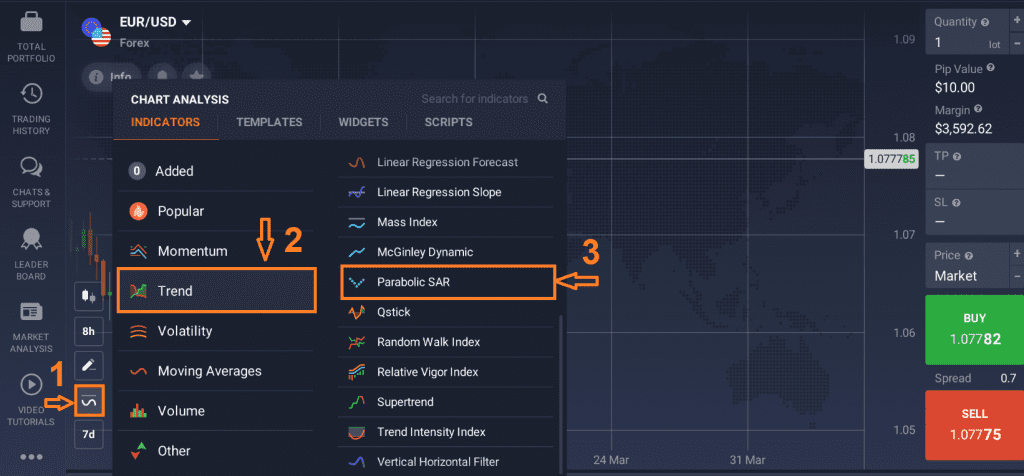

With a view to use Parabolic SAR technical evaluation indicator, chances are you’ll take the next steps.

1. Click on on the ‘Indicators’ part within the bottom-left nook of the display screen;

2. Go to the ‘Pattern’ tab;

3. Select Parabolic SAR from the checklist of obtainable indicators.

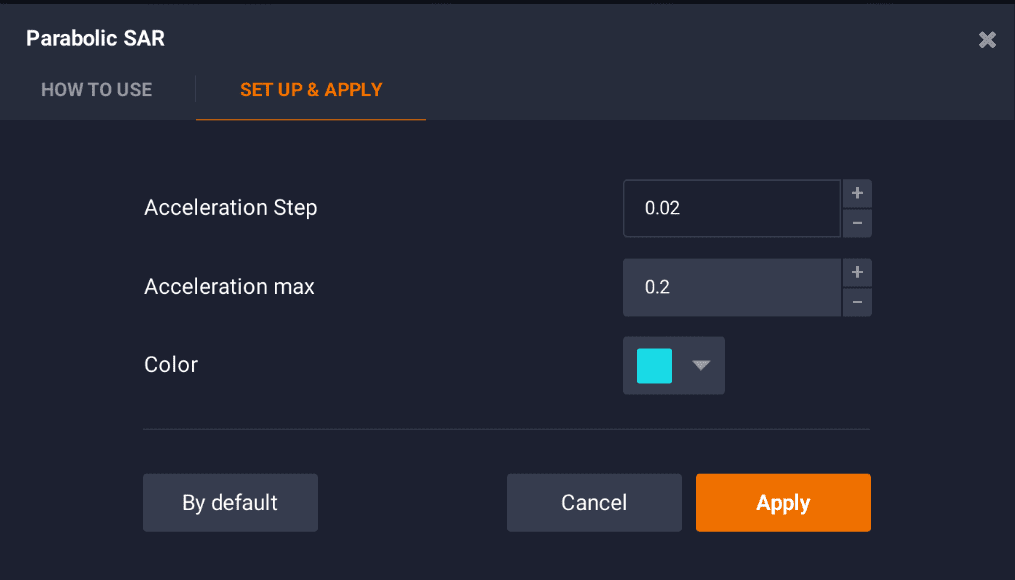

4. Click on ‘Apply’ if you wish to use the indicator with normal parameters. Or swap to the ‘Set Up & Apply’ tab and configure the indicator in accordance with your liking.

✍️

The other impact could be achieved by reducing the values of acceleration and acceleration max: the indicator will change into much less delicate however will even present much less false alerts.

Discovering the suitable steadiness between accuracy and sensitivity is a first-rate activity for merchants fascinated by utilizing Parabolic SAR settings for intraday buying and selling.

Methods to use Parabolic SAR indicator successfully?

In keeping with Welles J. Wilder himself, the indicator ought to solely be used throughout sturdy traits, that often don’t exceed 30% of the time. Using Parabolic SAR on brief time intervals and in the course of the sideways motion isn’t suggested because the indicator loses its predictive potential and might return false alerts.

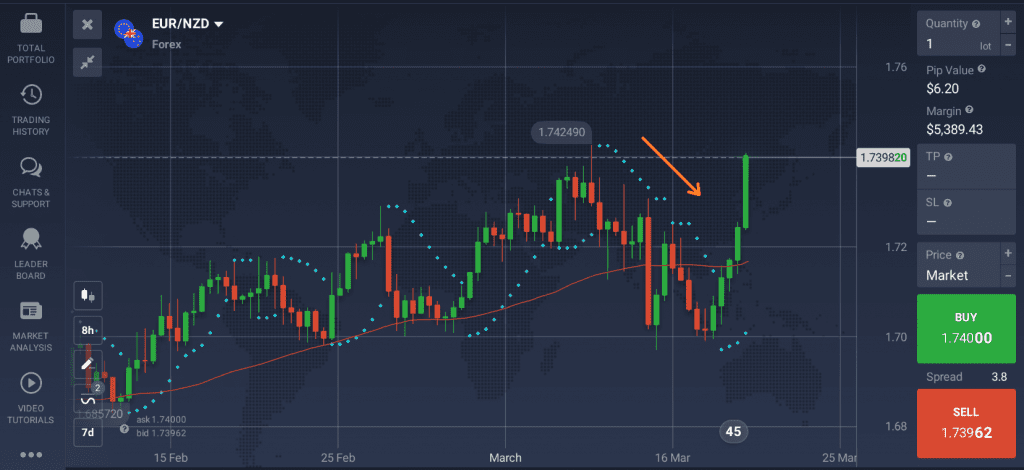

Skilled merchants typically mix this software with different indicators to make use of the Parabolic SAR successfully. One of many potential combos — Parabolic SAR and Easy Shifting Common — and its sensible purposes are described under. It’s suggested to double-check Parabolic SAR alerts with the assistance of different indicators.

Parabolic SAR and SMA mixture

The mixture of those two technical evaluation instruments is common amongst skilled merchants. On this case, the Parabolic SAR settings could also be utilized as acceleration = 0.04, acceleration max = 0.4. The SMA could also be set at interval = 55. When used collectively, these two indicators may have the ability to affirm one another’s alerts.

Anticipating a bullish pattern

A bullish pattern could also be arising if:

- The worth is under the SMA line;

- The Parabolic SAR demonstrates upward motion.

Anticipating a bearish pattern

A bearish pattern could also be arising if:

- The worth is above the SMA line;

- The Parabolic SAR demonstrates downward motion.

It’s value noting that no indicator can assure correct alerts 100% of the time. Often, all indicators will present false alerts, and Parabolic SAR isn’t an exception. Nonetheless, after getting gained extra expertise and realized tips on how to use Parabolic SAR indicator successfully, chances are you’ll improve your buying and selling strategy and obtain optimistic outcomes.