Este artículo también está disponible en español.

Bitcoin is navigating turbulent waters as its value continues to slip, trying to find a steady help degree amid rising uncertainty. The present downward momentum has sparked issues amongst traders and analysts, with many questioning whether or not Bitcoin has reached its cycle prime. Sentiment available in the market has shifted dramatically, with worry changing the as soon as euphoric optimism that drove the cryptocurrency to current highs.

Associated Studying

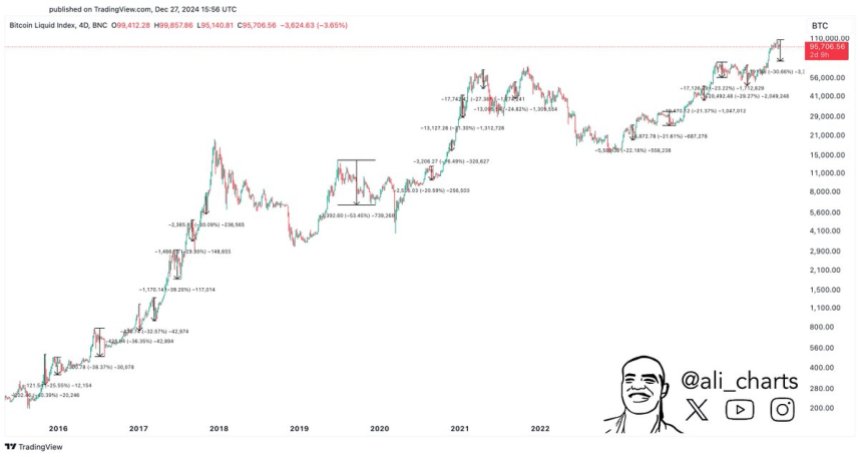

Regardless of the unease, crypto analyst Ali Martinez provides a extra optimistic perspective on the state of affairs. In a current evaluation shared on X, Martinez advised {that a} 20% to 30% correction may truly be probably the most bullish final result for Bitcoin at this stage. He highlights how such pullbacks have traditionally set the stage for stronger rallies by shaking out weaker fingers and permitting the market to reset earlier than resuming its upward trajectory.

As Bitcoin’s value motion teeters on the sting of a possible breakdown, all eyes are on the important thing help ranges that might decide the following transfer. Will Bitcoin verify the fears of a cycle prime, or will a wholesome correction present the muse for the following leg of its rally? The approaching weeks might be essential in shaping the narrative for the world’s main cryptocurrency.

Bitcoin Correction Looms

Bitcoin seems on the verge of getting into a crucial correction section, with the $92K degree rising as the road within the sand. Analysts and traders are more and more involved {that a} drop under this threshold—and doubtlessly the $90K mark—may set off a wave of promoting stress, driving the value into sub-$80K territory. The rising worry has solid a shadow over Bitcoin’s bullish narrative as many brace for potential draw back dangers.

Associated Studying

Nonetheless, not everybody sees this potential correction as bearish. Martinez provides a contrarian viewpoint, suggesting {that a} 20% to 30% correction may very well be probably the most bullish final result for Bitcoin throughout the context of a bull pattern.

Martinez offered a compelling chart showcasing each Bitcoin correction exceeding 20% throughout previous bull markets. His findings reveal that every of those corrections acted as a reset for the market, shaking out weaker fingers and paving the best way for stronger rallies.

Martinez emphasizes that corrections are a pure and wholesome part of Bitcoin’s value cycles, particularly throughout bull runs. By permitting the market to recalibrate, they set the stage for sustained upward momentum. If Bitcoin does expertise a major pullback, it may very well be the precursor to a extra strong and extended rally within the coming months.

BTC Testing ‘The Final Line Of Protection’

Bitcoin is at present buying and selling at $94,500, grappling with sustained promoting stress and bearish value motion. The market sentiment has shifted considerably in current days, with fears of a deeper retracement gaining traction amongst analysts and traders. Many consider that if Bitcoin loses the $92,000 mark, it may open the door for an accelerated decline.

The $90,000 degree is rising because the crucial help zone that Bitcoin should maintain to keep up its bullish outlook. This degree represents a psychological and technical barrier that might decide the cryptocurrency’s trajectory within the weeks forward. If BTC manages to remain above $90K, analysts anticipate a powerful restoration that might reignite bullish momentum and result in a push towards earlier highs.

Associated Studying

Nonetheless, the stakes are excessive. A decisive break under the $90,000 degree would possible exacerbate promoting stress, driving Bitcoin into deeper correction territory. In such a state of affairs, costs may fall as little as $75,000, marking a major pullback from current highs.

Featured picture from Dall-E, chart from TradingView