Centralized change (CEX) listings have lengthy been seen as a milestone for crypto initiatives, promising elevated publicity, liquidity, and value surges. Nonetheless, the fact usually follows a predictable sample: a pointy preliminary pump, adopted by a extra dramatic dump. CryptoNinjas, in collaboration with Storible, analysed high 6 main CEXs (Binance, Bybit, Upbit,..), to uncover the precise influence of CEX listings on token costs, revealing simply how fleeting the advantages might be.

Key Findings

- 98% of Binance listed tokens are dumped.

- Binance itemizing has essentially the most optimistic impacts on value, pumping tokens by 87%.

- On common, CEX itemizing pumps tokens by 54%.

- On common, 89% CEX listed tokens are dumped.

Methodology

We started by gathering all tokens listed in 2024 from six main CEXs: Binance, Bybit, OKX, Coinbase, Bithumb, and Upbit, totalling 389 tokens. We then collected the value at itemizing, present value (at Feb 4th, 2025), and ATH value of collected tokens.

The info was gathered between Feb 2nd and Feb 4th, 2025.

The Preliminary Surge: CEX Listings Pump Tokens by 54%

Itemizing on a significant change usually triggers a shopping for frenzy. On common, newly listed tokens expertise a 54% value surge upon itemizing. This phenomenon is essentially pushed by FOMO (worry of lacking out) and deep liquidity, as merchants rush to purchase the token earlier than it skyrockets additional.

The ATH Impact: 37% of Tokens Attain Peak Costs at Itemizing

A staggering 37% of newly listed tokens hit their all-time excessive (ATH) on the time of itemizing, by no means reaching such valuations once more. This highlights how CEX listings are sometimes the height of a token’s market efficiency, pushed by hypothesis moderately than long-term fundamentals.

The Harsh Actuality: Dumping Follows Shortly

Whereas the preliminary surge creates pleasure, the sell-off that follows is nearly inevitable. Our findings reveal that 89% of listed tokens expertise a big value drop post-listing, with a median decline of 52% from their peak at CEX itemizing.

The Lifecycle of a CEX-Listed Token

- Pump: Token value spikes 54% on common at itemizing.

- ATH: 37% of tokens attain their peak value at itemizing.

- Dump: 89% of tokens decline sharply post-listing.

- Value drop: Tokens lose a median of 52% of their worth after the itemizing hype fades.

This sample means that many merchants view CEX listings as exit alternatives moderately than long-term investments.

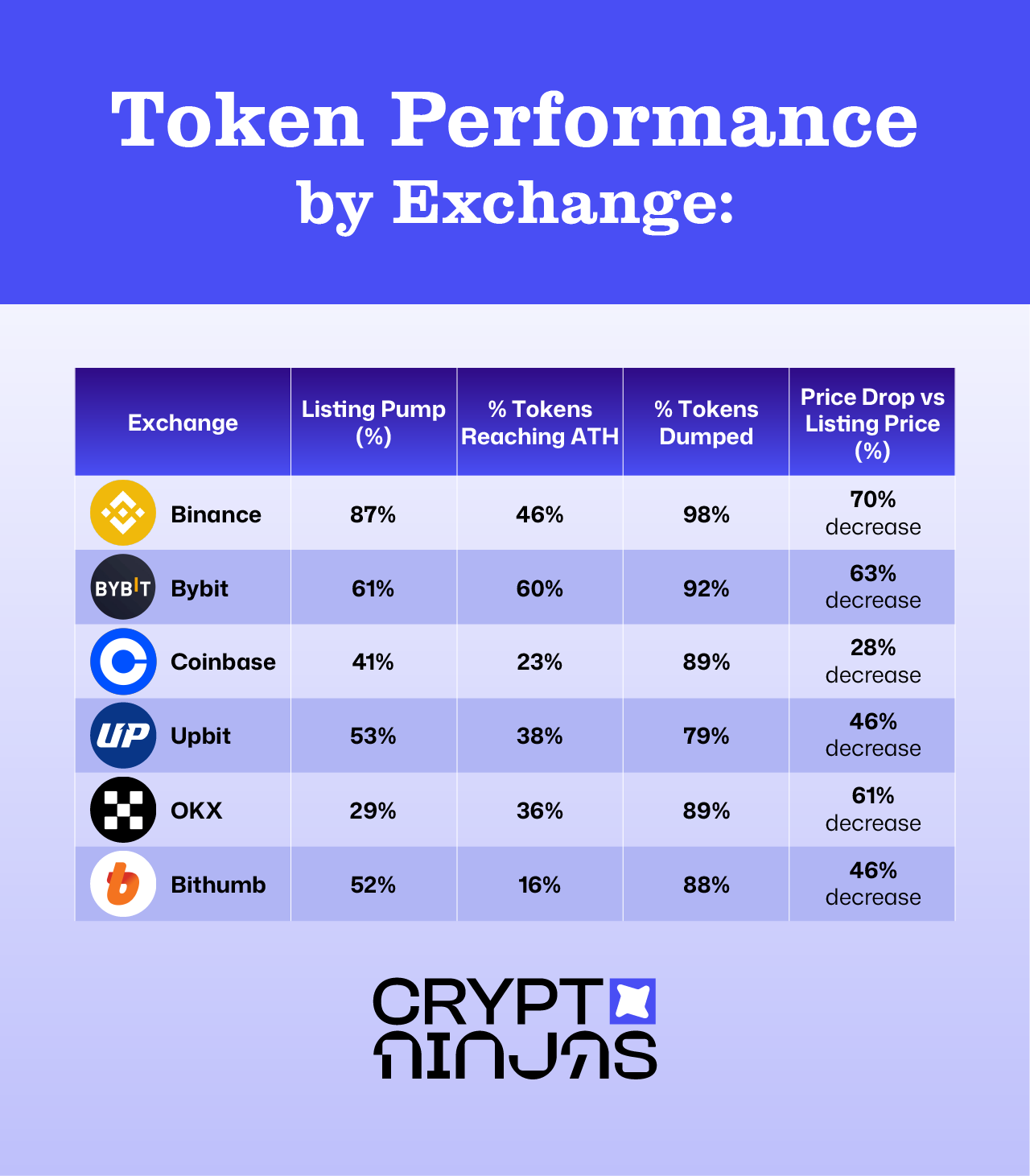

Alternate Comparisons: Which CEX Pumps and Dumps the Most?

Totally different exchanges have various impacts on token efficiency. Our analysis compares six main exchanges—Binance, Coinbase, Upbit, OKX, Bithumb, and Bybit—to evaluate their affect on token costs.

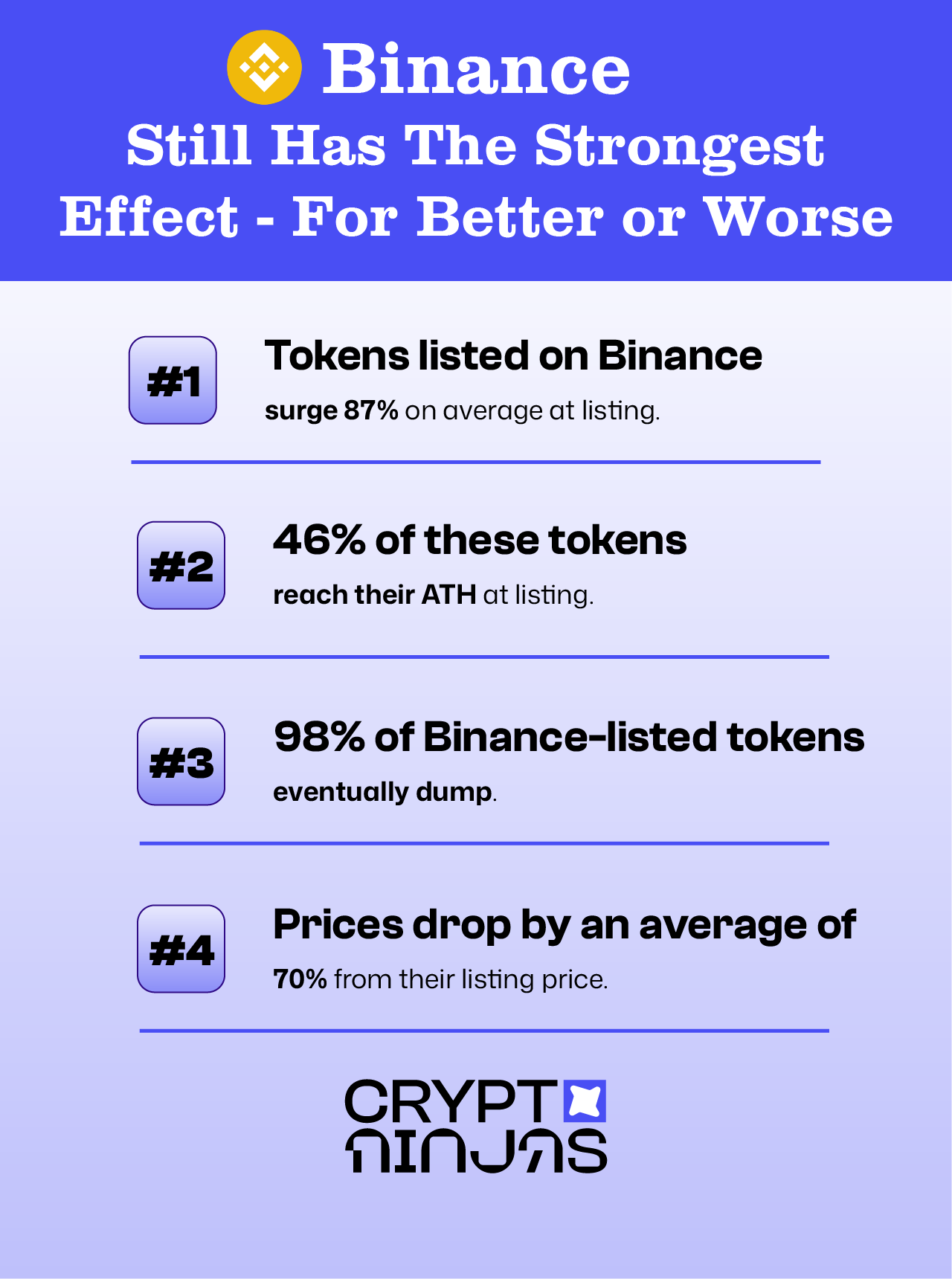

Binance Nonetheless Has the Strongest Impact—For Higher or Worse

Binance stays essentially the most influential CEX for token listings, delivering the strongest preliminary pump but additionally the most extreme dumps:

- Tokens listed on Binance surge 87% on common at itemizing.

- 46% of those tokens attain their ATH at itemizing.

- Nonetheless, 98% of Binance-listed tokens ultimately dump.

- Costs drop by a median of 70% from their itemizing value.

Whereas a Binance itemizing can generate huge short-term beneficial properties, the aftermath is commonly brutal for late patrons.

Bybit: The Second Strongest Itemizing Impact

Bybit emerges because the second most impactful change, with notable value actions:

- Tokens listed on Bybit pump 61% on common.

- Bybit boasts the very best share of tokens reaching ATHs at itemizing (60%).

- 92% of those tokens expertise a post-listing dump.

- Costs fall by 63% on common.

Bybit listings appeal to excessive hypothesis, however the sustainability of those value beneficial properties stays questionable.

Coinbase: The Weakest Pump and the Least Extreme Dump

Not like Binance or Bybit, Coinbase listings have a weaker preliminary pump but additionally a much less drastic decline:

- Tokens listed on Coinbase rise 41% on common at itemizing.

- Solely 23% attain ATH at itemizing—the bottom amongst all exchanges.

- 89% of tokens nonetheless expertise a post-listing decline, however the drop is milder (28% lower).

Coinbase-listed tokens are likely to have much less excessive value actions, presumably on account of a extra conservative investor base.

Conclusion: CEX Listings Are a Double-Edged Sword

CEX listings stay an important second for crypto initiatives, providing speedy liquidity and publicity. Nonetheless, our knowledge proves that the value motion follows a predictable pump-and-dump cycle, making it a dangerous guess for traders.

For merchants, the lesson is obvious: CEX listings are sometimes the height of a token’s value efficiency, and shopping for into the hype can result in important losses. Understanding the market dynamics behind these listings is essential to avoiding the pitfalls of speculative buying and selling.