The world’s insatiable urge for food for power reveals no indicators of slowing down. From the rise of synthetic intelligence, with its voracious demand for electrical energy, to the explosive development of knowledge centres, the necessity for energy is skyrocketing. Whereas the promise of nuclear power looms on the horizon, the fact right this moment is that oil and pure gasoline stay the cornerstones of our world power infrastructure. This presents a novel alternative for discerning buyers, and Chevron could possibly be a hidden gem on this dynamic panorama.

Chevron ($CVX): A International Power Powerhouse

Chevron isn’t just one other oil firm. It’s a vertically built-in power behemoth, spanning your entire power worth chain. From exploring for and producing oil and pure gasoline to refining, advertising and marketing, and distributing power merchandise worldwide, Chevron has a commanding presence within the world power market.

However Chevron is greater than only a conventional power firm. It’s actively embracing the longer term, investing in cutting-edge applied sciences like carbon seize and storage, and exploring avenues for sustainable power options. With operations spanning the globe, Chevron is well-positioned to navigate the complexities of the fashionable power panorama and capitalize on rising alternatives.

Why Chevron ($CVX) May Be Undervalued

Our evaluation means that Chevron’s present inventory worth could not absolutely mirror its true worth. A number of elements contribute to this potential undervaluation:

- Development on the Horizon: Chevron is poised for vital development. Elevated manufacturing in key areas just like the Permian Basin, coupled with the profitable integration of latest acquisitions, such because the strategic acquisition of Hess, is anticipated to drive substantial income development.

- Effectivity Drives: Chevron is relentlessly centered on optimizing its operations and driving down prices. By leveraging technological developments and streamlining processes, the corporate is enhancing its profitability and creating worth for shareholders.

- A Dividend Dynamo: Chevron has an extended and spectacular historical past of rewarding shareholders with a beneficiant dividend. The corporate’s present dividend yield is compelling 4.5% (US inflation 2024: 2.6%), offering a strong basis of earnings for buyers looking for a dependable stream of money circulate. Dividends elevated on common over 6% up to now 5 years.

- Power demand: Power demand within the US is anticipated to double and the EU should discover cost-effective different sources of power after Russian gasoline stopped flowing by the Ukraine to EU on expiry of the deal.

Takeaway from Evaluation

There’s a potential upside of 36% from the present inventory worth when evaluating to the truthful worth primarily based on the discounted money circulate (DCF) assuming a 2% development price, margin will increase and WACC of 8%. The typical inventory forecast is USD179 which has an upside of 17%.

The valuation is derived from a five-year forecast of projected free money flows, with an assumed perpetual development price of two%. An 8% WACC (Weighted Common Value of Capital) is utilized to low cost the longer term money flows to their current worth (DCF). The corporate’s debt is then subtracted from this worth to reach on the web worth. Lastly, the web worth is split by the whole variety of shares excellent to find out a good worth per share of $208.11, posing a big upside to the present market worth of $153.14.

The power business is at present navigating a interval of reasonable crude oil and pure gasoline costs alongside vital price inflation. Chevron is well-positioned to capitalize on the anticipated enhance in power costs over the subsequent decade.

Navigating the Power Cycle

The power sector is inherently cyclical. Costs fluctuate, provide and demand dynamics shift, and firms should adapt to outlive and thrive. Chevron, with its built-in enterprise mannequin, sturdy monetary place, and skilled management, is well-equipped to navigate these cyclical challenges.

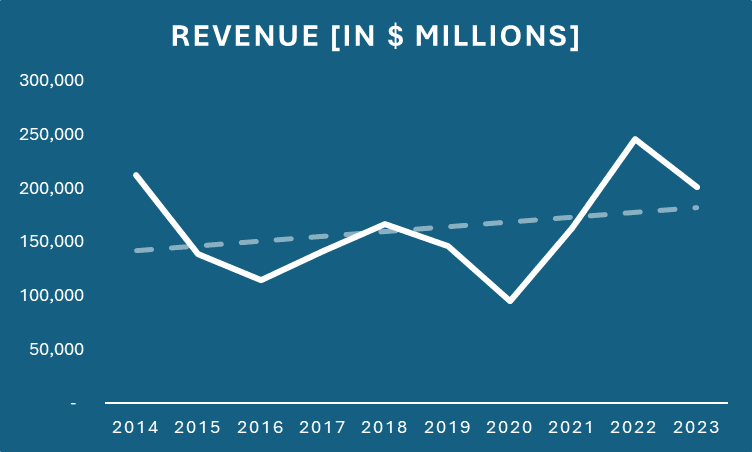

Under is Chevron’s income over a interval of 10 years with the cycles typical to the business.

Knowledge supply: macrotrends.web

A Have a look at the Competitors

In comparison with its main opponents, Chevron’s valuation seems enticing. Its price-to-book ratio is comparatively low, suggesting a margin of security for buyers. This means that Chevron’s belongings could also be undervalued relative to its friends.

| Firm | Market Cap [in $ Millions] | PB | PE |

|---|---|---|---|

| Saudi Aramco (2222.SR) | 1 808.000 | 4.01 | 13.62 |

| ExxonMobil Company (XOM) | 471.638 | 1.72 | 12.48 |

| Chevron (CVX) | 263.651 | 1.65 | 12.82 |

| Royal Dutch Shell plc (Shell) | 194.170 | 1.00 | 7.43 |

| BP plc (BP) | 79.971 | 1.21 | 7.73 |

| TotalEnergies SE (TTE) | 130.068 | 1.07 | 7.87 |

| ConocoPhillips (COP) | 115.183 | 2.59 | 12.02 |

| Equinor ASA (EQNR) | 68.619 | 1.56 | 7.61 |

| Eni S.p.A (E) | 46.470 | 0.83 | 6.99 |

| Common | 353.086 | 1.74 | 9.84 |

| Chevron | 263.651 | 1.65 | 12.82 |

Management and Imaginative and prescient

Beneath the management of CEO Mike Wirth, a seasoned business veteran, Chevron is charting a course for sustainable development and long-term success. Wirth’s emphasis on operational excellence, technological innovation, and shareholder worth creation evokes confidence within the firm’s future trajectory.

Dangers to Think about

Whereas Chevron presents a compelling funding alternative, it’s essential to acknowledge the inherent dangers related to the power sector:

- Acquisition-Associated Uncertainties: The continued arbitration associated to the Hess acquisition may create headwinds and impression the corporate’s monetary efficiency.

- Execution Dangers: Bringing main initiatives on-line could be advanced and difficult, and unexpected delays or technical difficulties may impression money circulate and profitability.

- Market Volatility: Fluctuations in oil and gasoline costs, pushed by geopolitical occasions, financial situations, and altering demand patterns, can considerably impression the corporate’s income and earnings.

- Regulatory Headwinds: Growing environmental laws and potential legislative modifications may impression operational prices, prohibit manufacturing, and enhance the corporate’s compliance burden.

The Backside Line

Regardless of the challenges and uncertainties inherent within the power sector, Chevron presents a compelling funding case. Its sturdy fundamentals, strong development prospects, and enticing dividend yield make it a possible sleeping big within the power sector.