Please see this week’s market overview from eToro’s international analyst group, which incorporates the most recent market information and the home funding view.

Sturdy jobs report, oil, China, and an eventful week forward

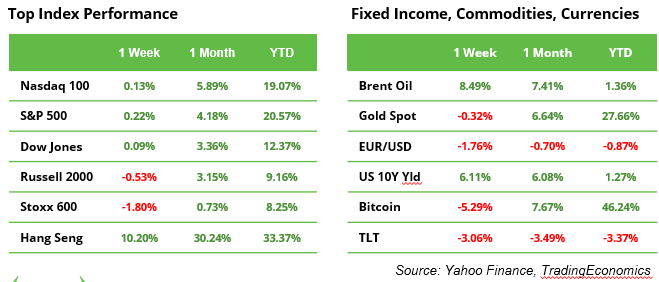

Final week ended with a bang as a brand new jobs report confirmed that US corporations and the federal government collectively added 254K payrolls in September, considerably larger than the 150K anticipated, preserving unemployment down at 4.1%. This helps the Fed’s “goldilocks” situation and retains the prospect of a delicate touchdown for the financial system firmly on the desk. Following the information, the US greenback strengthened to its highest degree since mid-August, and the US 10-year rate of interest rose by 13 foundation factors to three.98%, moderating future fee reduce expectations.

Essentially the most mentioned matter, nonetheless, was the oil value, which rose 8.5% over the week because of fears that oil manufacturing websites could also be drawn into the increasing battle within the Center East.

The largest gainer final week was the Dangle Seng Index, marking its second consecutive week on the high. The China-focused fairness index added one other 10%, bringing the overall to +30% during the last thirty days. Buyers are anticipating additional will increase within the Chinese language authorities’s help bundle aimed toward reviving the native financial system.

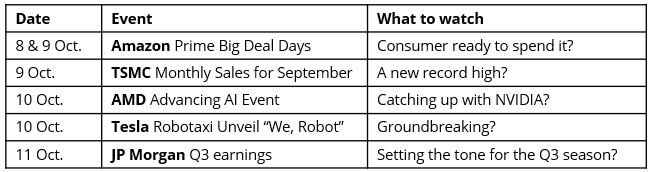

This week is especially eventful, with “Champions League” corporations Amazon, TSMC, AMD, Tesla, and JP Morgan making headlines. JP Morgan will unofficially kick off the Q3 earnings season on Friday.

Oil costs rise most in a single week since January 2023

The oil value has firmly reversed course. The worth of a barrel of Brent rose to $78 from a current low of $70 on Tuesday, whereas North American crude (WTI) climbed from $66 to $74 (see chart).

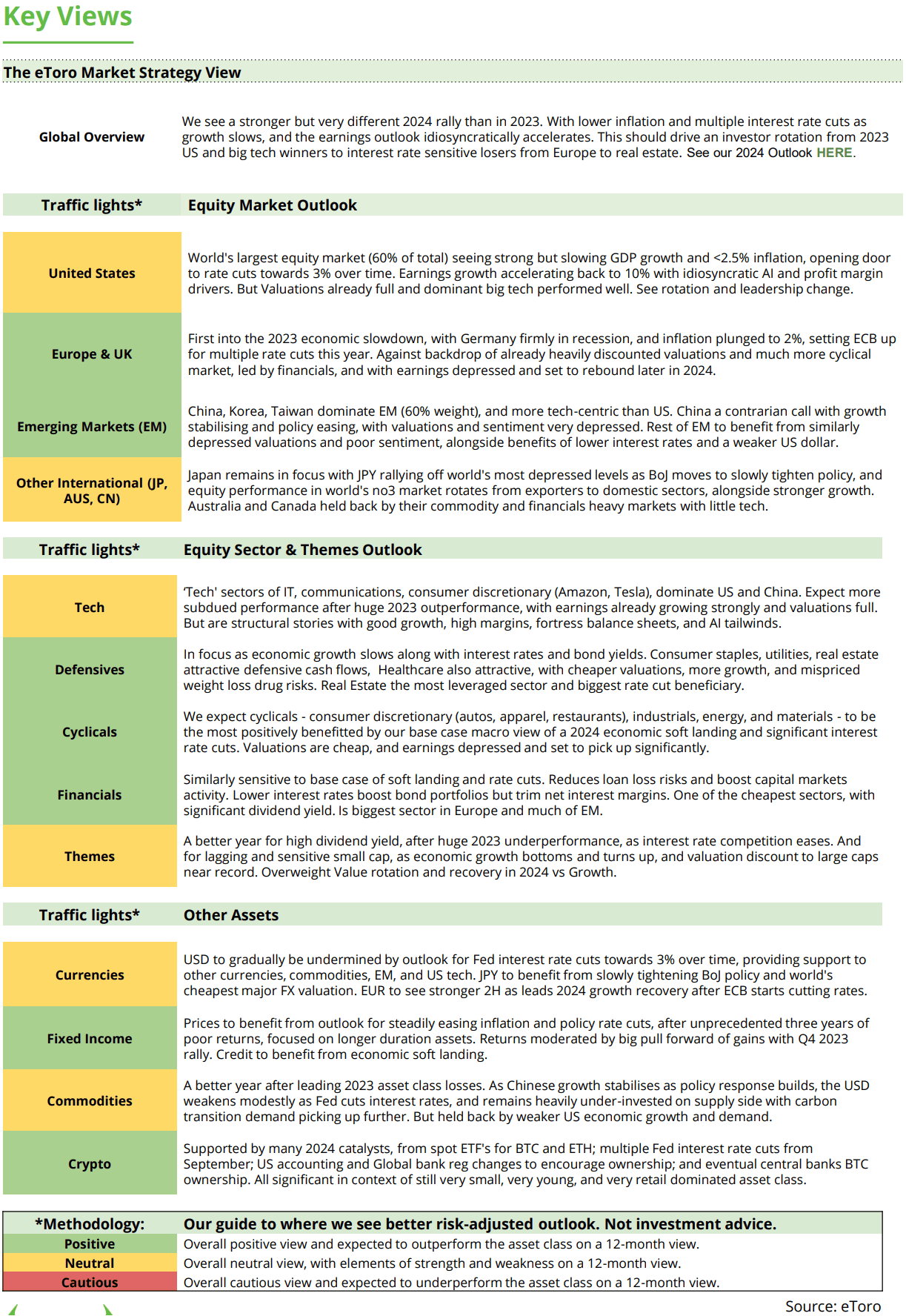

General, oil costs have been trending downward on hypothesis that Saudi Arabia, the world’s largest oil producer, might abandon its $100 per barrel value goal with the intention to seize a larger market share—a transfer anticipated to materialise with an official enhance in manufacturing ranges on the upcoming OPEC+ assembly on 1 December. Moreover, lacklustre demand for oil was highlighted in an replace from ExxonMobil, which acknowledged that strain on refining margins would considerably affect its Q3 earnings, because of be revealed on 1 November. Nevertheless, higher-than-anticipated financial development in key markets might reverse this development.

Q3 earnings, what to anticipate?

Pepsico, Delta Airways, JP Morgan, Wells Fargo, and Blackrock are amongst the primary corporations to report their monetary outcomes for the third quarter. As a median for the S&P 500, the market expects 4.7% income development and 4.2% earnings development, making Q3 stand out because the weakest quarter of the yr. With earnings development projected to bounce again to 14.6% in This autumn and furthermore 14.9% for 2025, buyers might be particularly targeted on ahead steering to guage whether or not these excessive expectations will be maintained. Ought to the numbers fall quick, the present P/E ratio of 21.4 might turn into too demanding. Danger is clearly on the draw back. One other focus within the coming weeks is on rate-sensitive shares in actual property, utilities, and healthcare, which have carried out effectively lately.

Upcoming IPOs

Sentiment for brand new inventory change listings seems to be cautiously bettering. Cerebras, a competitor to NVIDIA, is aiming for a valuation of $7 to $8 billion by means of a Nasdaq itemizing. On-line style retailer Shein is focusing on a $60 billion valuation through a London itemizing. In the meantime, Hyundai plans to boost $19 billion by itemizing shares of Hyundai Motor India in what could be the primary automobile IPO in India since Maruti Suzuki’s in 2003. All three have filed their regulatory paperwork and will begin buying and selling in October.

Earnings and occasions

Main macro launch embody Germany’s commerce steadiness and US CPI and PPI.

This week is especially eventful, with Amazon, TSMC, AMD, Tesla, and JP Morgan in focus.