Fast Take

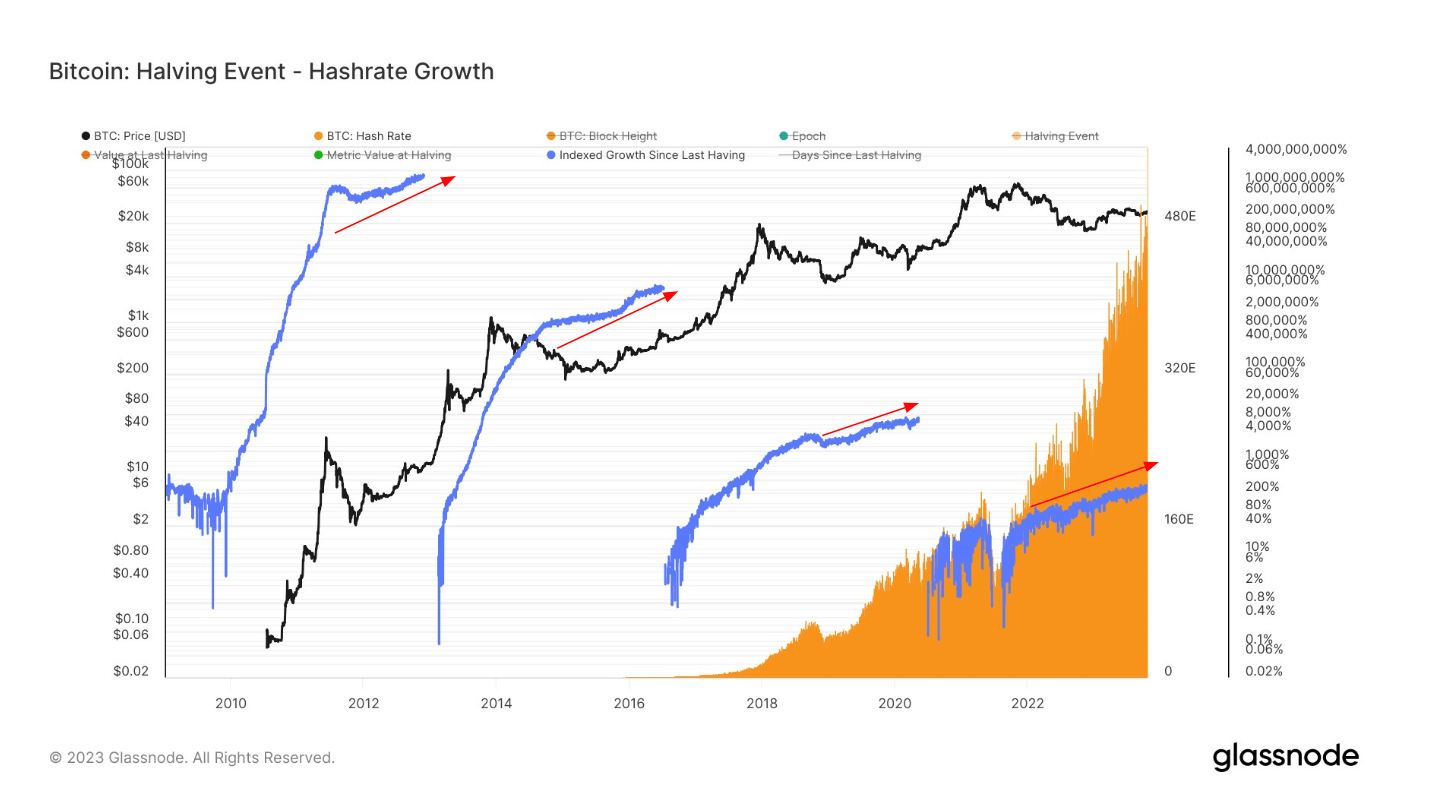

As Bitcoin (BTC) approaches its subsequent halving occasion in April 2024, a novel sample of progress marked by diminishing returns is changing into obvious. The hash charge, a essential measure of miners’ efficiency, is at present hovering above 400 Eh/s, sustaining a strong development momentum. But, every successive Bitcoin halving occasion reveals a nuanced story: progress, although regular, doesn’t mirror the surges seen within the early halving levels.

Within the wake of Bitcoin’s first halving, the hash charge development skyrocketed by an astounding 1,364,787,820%. The second halving, whereas nonetheless spectacular, noticed a major discount to five,448,118%. The third halving additional moderated the expansion tempo to eight,520%. Presently, the fourth halving initiatives an approximate development of 250%.

Notably, these figures don’t denote a regression however a transition to a extra sustainable development charge. Every halving incrementally reduces the Bitcoin block reward, intensifying the mining competitors. This aggressive strain, whereas difficult, forces the trade in direction of effectivity and evolution. Consequently, the panorama is prone to favor the survival of essentially the most superior and environment friendly mining firms.

Hash Price Progress: (Supply: Glassnode)

The publish Advancing mining effectivity in mild of Bitcoin’s diminishing returns appeared first on CryptoSlate.