After rallying over 170% from June 2023 lows, there are indicators that Maker (MKR) bulls are dropping momentum, taking a look at worth motion and choices by varied whales performing through an middleman. At spot charges, MKR is altering palms at close to 2023 highs however is down 16% from October highs.

Maker (MKR) Is Promoting Off: The Bull Run Is Over?

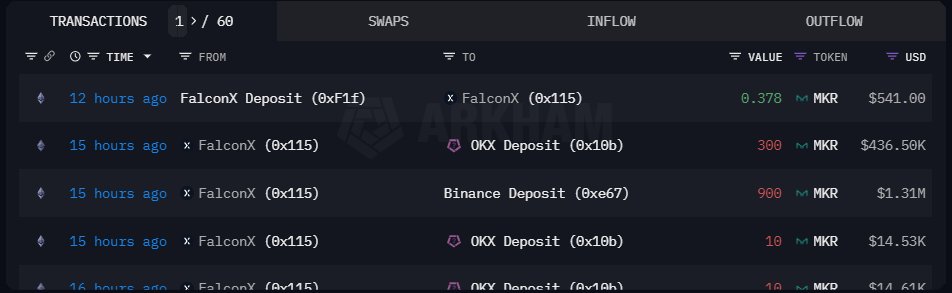

MKR is dumping at an unexpectedly quicker tempo, reversing features posted in early This fall 2023, a priority. In accordance with The Information Nerd, Falcon X sent 5,690 MKR price $8.52 million to a number of exchanges, primarily OKX and Binance, at a mean worth of $1,497.

Usually, every time crypto whales start sending tokens to centralized ramps, as at present is the case, it may be interpreted as bearish. That whales are transferring their cash to exchanges may point out that they’re planning to liquidate and exit their place. Subsequently, this will dent sentiment, forcing the token to dump.

Nonetheless, the timeliness of the switch additionally issues. In some cases, tokens will be moved to exchanges and interpreted as bullish. It is because, relying on the state of affairs, whales may transfer them to supply liquidity for different merchants.

This may be the case with Falcon X. The platform gives institutional traders entry to liquidity and execution providers. Notably, Falcon X has, prior to now, been utilized by different crypto exchanges and liquidity suppliers to supply different providers. Because it acts on behalf of establishments and whales, it can’t be ascertained which of its purchasers is promoting MKR.

As of October 27, The Information Nerd statistics present that the platform holds 10,150 MKR price $14.17 million at spot charges. Following the switch, the tracker additionally reveals that MKR is down 4%.

The “Finish Recreation” Pumps MKR To New Highs, A Pull Again Incoming?

Presently, MKR stays beneath strain. As talked about earlier, the token, although in an uptrend, rallying 170% in 4 months, is down 15% from October’s peaks. On the identical time, there’s a double high, a technical formation which will sign an area high.

This sample will solely be invalidated if there’s a sharp growth above $1,650. Conversely, losses beneath $1,350 behind excessive participation ranges may catalyze the sell-off.

In Could 2023, MakerDAO, the issuer of MKR–the governance token of the underlying borrowing and lending protocol, introduced the launch of the “Finish Recreation.” Herein, the protocol plans to deploy on its unbiased blockchain, introduce new options, and launch two tokens.

As well as, Maker has launched a sensible burn mechanism that includes buying MKR tokens from the open market and burning them while not having to shut any collateralized debt positions (CDPs).

Function picture from Canva, chart from TradingView