On-chain information exhibits that altcoin quantity dominance is now on the highest stage since January 2021, whereas Bitcoin’s is at its lowest.

Altcoin Dominance By Quantity Lately Touched A Excessive Of 64%

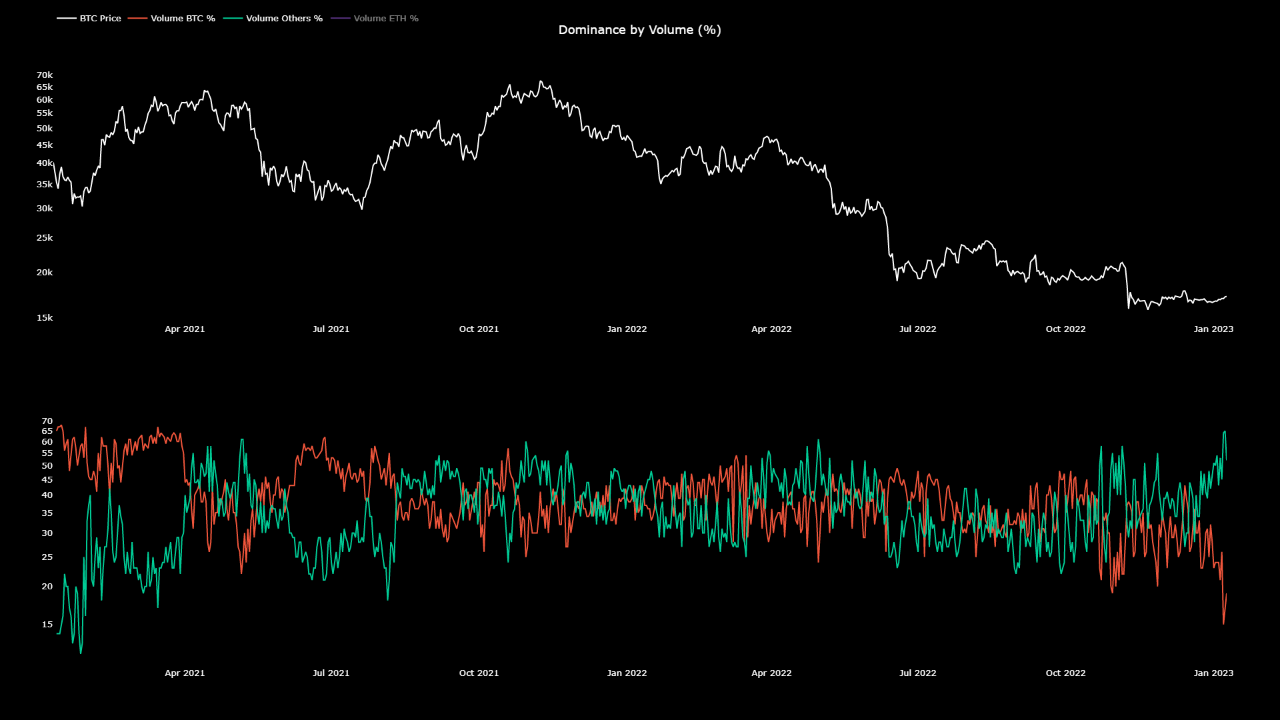

As identified by an analyst in a CryptoQuant put up, Bitcoin’s dominance is simply at 16% now. The “dominance by quantity” is an indicator that measures the share of the entire crypto market buying and selling quantity that’s being contributed by a particular coin.

When the worth of this metric goes up for any crypto, it implies that explicit crypto is observing the next quantity of exercise relative to the remainder of the market at the moment. This means that the coin is garnering extra curiosity from traders proper now. Alternatively, low values can suggest that the crypto is shedding mindshare in the mean time as its quantity proportion goes down.

Now, here’s a chart that exhibits the development within the dominance by quantity for the complete altcoin sector mixed (minus Ethereum), in addition to for Bitcoin, over the previous couple of years:

The 2 metrics appear to have gone reverse methods in current days | Supply: CryptoQuant

As proven within the above graph, Bitcoin’s dominance by quantity has sharply decreased lately and has touched a worth of simply 16%. That is the bottom worth BTC has noticed over the past couple of years.

The altcoins (aside from Ethereum), quite the opposite, have noticed their dominance shoot up within the final week or so, because the metric now has a worth of 64%. This means that BTC has misplaced its market share to those alts lately.

The quant finds this development “very regarding,” nonetheless. The explanation behind that’s the truth that every time rallies have kicked off with altcoins being on prime, they haven’t often lasted for too lengthy, and the costs have shortly come again down.

This may be very clearly seen within the chart. For instance, the tops of each the bull rallies of 2021 (those within the first and second half of the yr) took formation whereas the altcoins had the next buying and selling quantity dominance than Bitcoin. The most recent FTX crash additionally befell whereas alts have been dominating the market.

It will seem that typically any sustainable and wholesome value rallies have solely began with the dominance of BTC being greater than these alts. One distinguished instance is that the July 2021 backside, which kicked off the second-half bull run of 2021, befell with the Bitcoin quantity proportion being greater than altcoins.

The whole market has been rallying within the final week, but when the historic sample is something to go by, this uplift could not final too lengthy because the dominance of altcoins is at very excessive ranges proper now. This might spell bother not just for Bitcoin but in addition for these alts themselves.

BTC Value

On the time of writing, Bitcoin is buying and selling round $17,400, up 3% within the final week.

Appears like the worth of the crypto has gone up over the previous few days | Supply: BTCUSD on TradingVIew

Featured picture from Artwork Rachen on Unsplash.com, charts from TradingView.com, Arcane Analysis