Crypto analyst Justin Bennett is predicting a breakout in costs for altcoins after an extended and quiet interval of consolidation.

Bennett tells his 109,900 Twitter followers that the general market cap for altcoins has been coiling in an extended wedge sample, hinting at an enormous imminent transfer.

“This quiet interval for crypto is about to finish. The longer a market coils, the extra explosive the breakout. Prepare.”

Bennett backs up his bullish place by suggesting that the US Greenback Index (DXY) is on the verge of breaking out. The DXY pins the US greenback towards a basket of different fiat currencies, and a falling DXY historically suggests upside for threat belongings like crypto.

In keeping with Bennett, DXY might be within the strategy of being rejected on the high of a big ascending channel.

“DXY linear chart. Not one of the best time to be bearish on shares and crypto, for my part.”

Benett says Ethereum (ETH), the world’s second-largest cryptocurrency, can be making a break towards its resistance across the $1,300 stage in a descending channel.

“ETH help continues to be holding. Now testing channel resistance.”

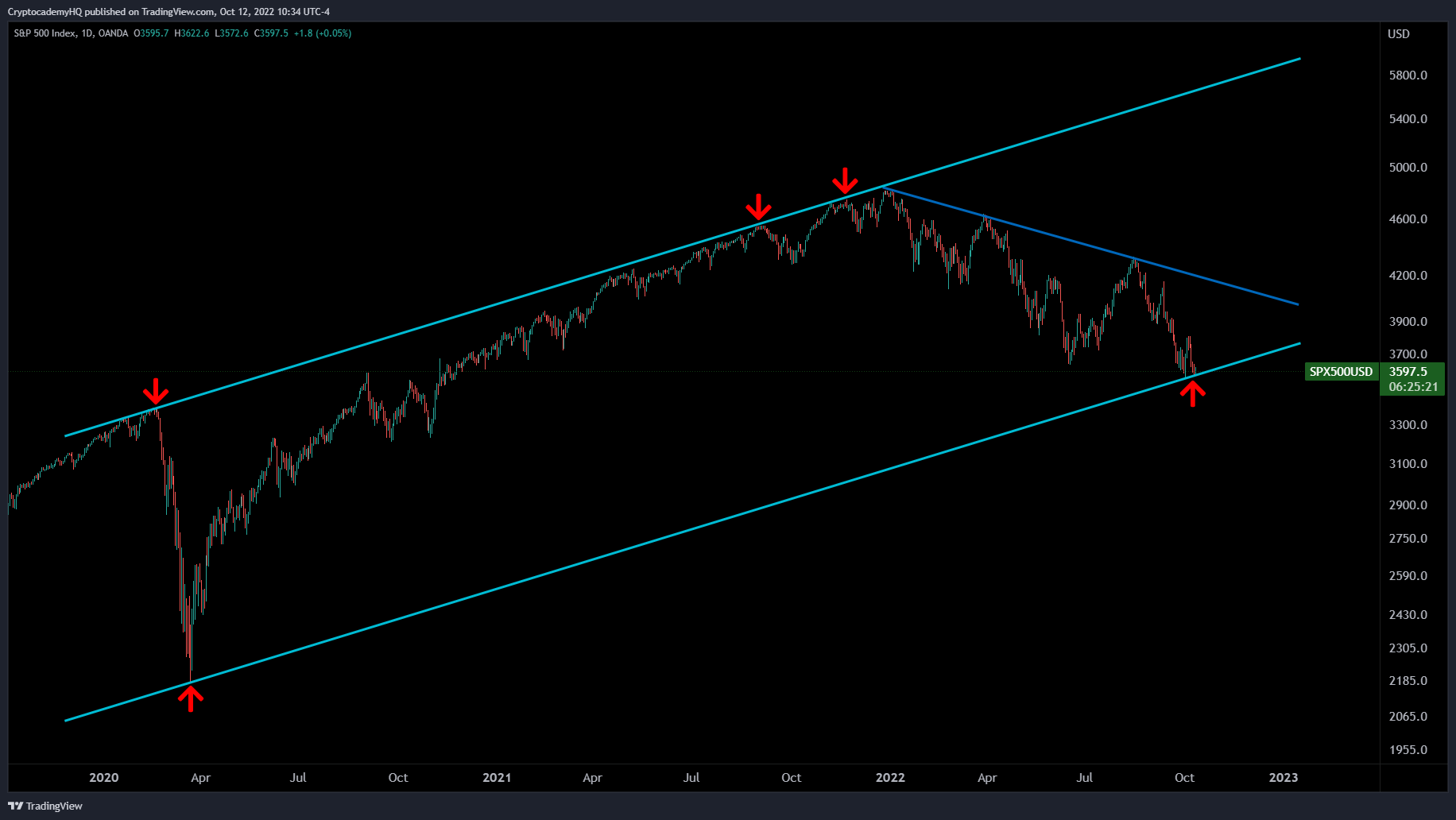

Wanting on the S&P 500 (SPX), which has been correlated with crypto markets for the final a number of years, Bennett says that if the $3,575 stage holds, a rally may ignite and doubtlessly increase crypto as properly.

The analyst is trying on the upcoming client value index (CPI) studying for a possible catalyst for the market’s subsequent transfer.

“Not troublesome to think about a aid rally from right here, however lots is using on Thursday’s CPI.

3,575 is the extent to carry.”

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you could incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in online marketing.

Featured Picture: Shutterstock/Razulation

Generated Picture: DALLE-2