On-chain information from Santiment means that altcoins throughout the complete cryptocurrency sector could also be underbought proper now.

MVRV Of The Numerous Altcoins Suggests Underpriced Situations

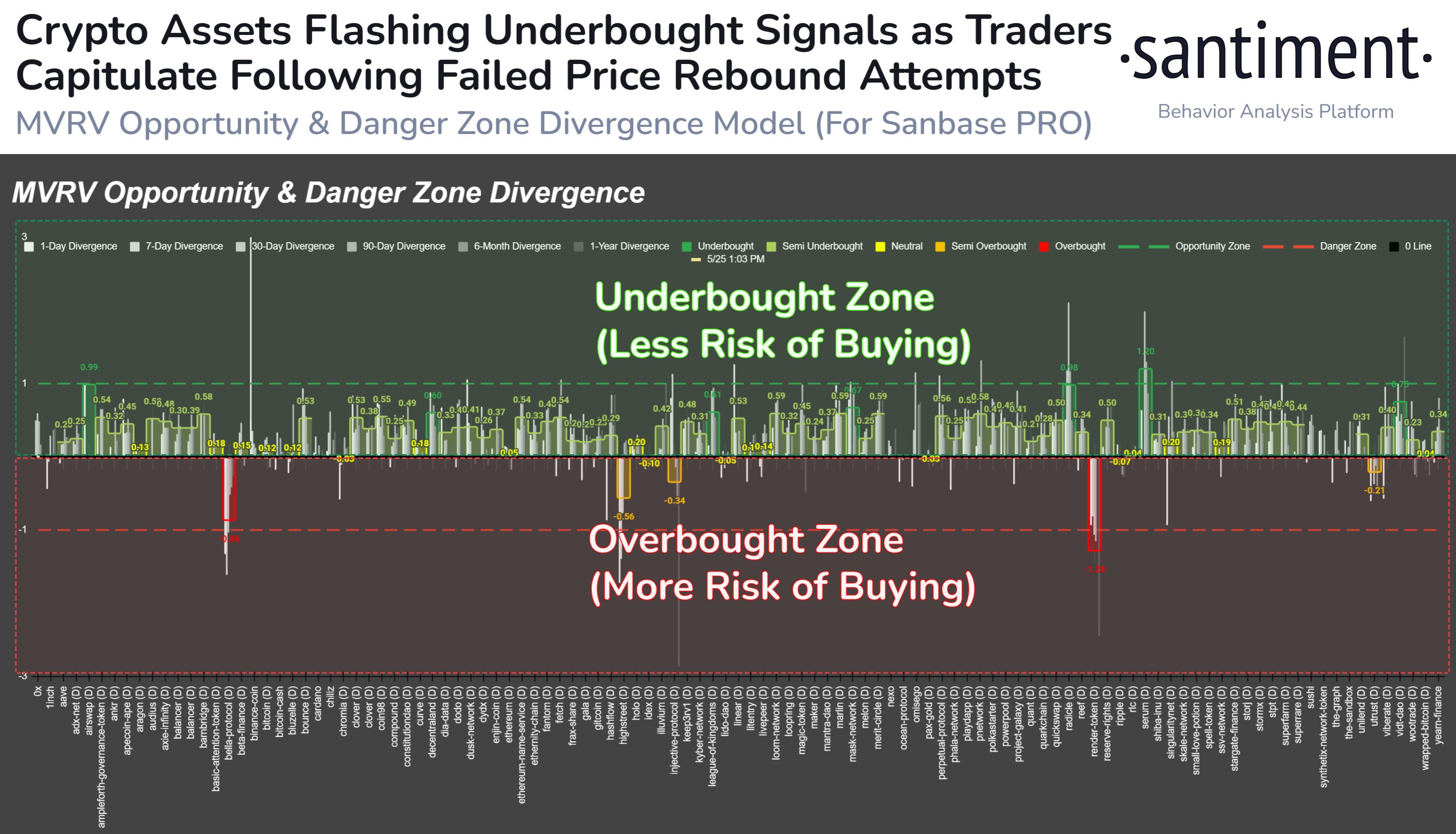

In accordance with information from the on-chain analytics agency Santiment, cryptocurrency property have develop into underbought as merchants at the moment are capitulating following a failed worth rebound.

The related indicator right here is the “MVRV” (Market Worth to Realized Worth), which measures the ratio between the market cap and the realized cap of a given cryptocurrency.

Right here, the “realized cap” refers to a capitalization mannequin for BTC the place the worth of any coin within the circulating provide is assumed to be not the present spot worth, however the worth at which it was final transacted on the blockchain.

This mannequin goals to calculate a form of “truthful worth” for the asset. Because the MVRV compares the market cap (that’s, the present worth) with the actual worth of the cryptocurrency, it could present hints about whether or not the worth is presently overinflated or not.

Santiment has outlined an “alternative” zone and a “hazard” zone for this indicator. As their names already suggest, the asset in query turns into underpriced when the metric is within the former space, whereas it turns into overpriced within the latter one.

Here’s a chart that reveals the development within the divergence of the MVRV from these zones for the assorted altcoins within the sector:

The worth of the metric appears to be above zero for many of the market | Supply: Santiment on Twitter

Every time the MVRV divergence has a worth of 1 or extra, the indicator is claimed to be inside the chance zone. Equally, the hazard space happens beneath a worth of -1.

Whereas these are the 2 excessive zones, the metric being firmly inside both the optimistic or the detrimental zone (however not hitting both of those thresholds), nonetheless alerts slight underbought or overpriced situations, respectively.

Which means the probabilities of bullish rebounds can develop into larger every time the indicator enters optimistic territory. From the chart, it’s seen that the overwhelming majority of the cash within the digital asset sector are at the very least contained in the optimistic territory in the mean time.

This may suggest that these cash could have develop into underpriced just lately. A few of the altcoins are additionally outright inside the chance zone, suggesting that they might offer low-risk shopping for alternatives proper now.

There are a number of cryptocurrencies, nonetheless, which are contained in the detrimental zone, with a few them even being inside harmful territory. Such alts have extra probabilities of registering a decline within the close to future.

Not too long ago, the assorted altcoins have tried to amass collectively a rebound, however to this point, they’ve solely seen failure. Nonetheless, now that the costs have began to develop into undervalued, maybe a break could also be discovered quickly.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,400, down 1% within the final week.

Appears to be like like BTC has as soon as once more plunged beneath $27,000 | Supply: BTCUSD on TradingView

Featured picture from Artwork Rachen on Unsplash.com, charts from TradingView.com, Santiment.web