Altcoins have taken one other leg down to begin the week whereas most digital belongings proceed a multi-month downtrend.

At time of writing, the overall market cap of all crypto belongings (TOTAL) is valued at $2.32 trillion, down from $2.39 trillion earlier within the day – a $70 billion haircut.

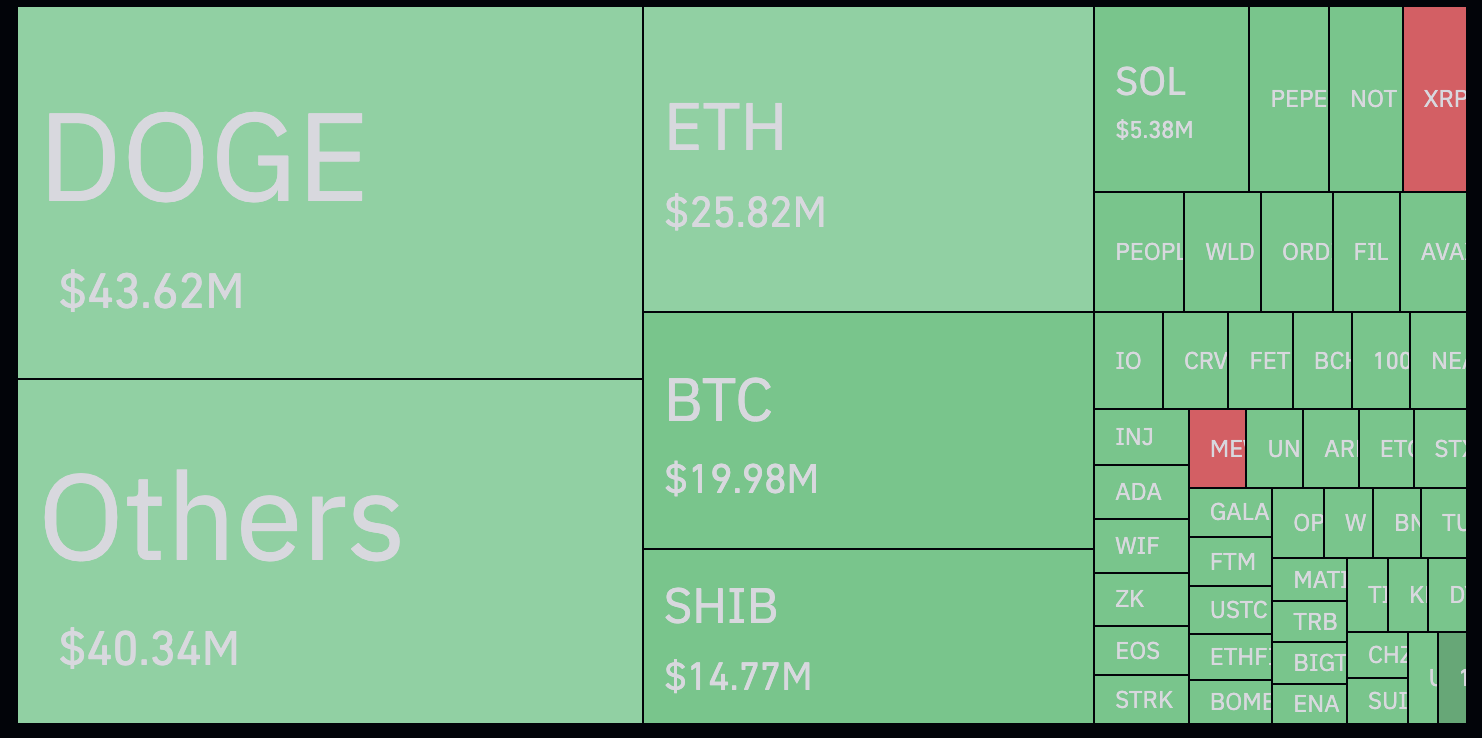

Based on crypto information aggregator Coinglass, there was over $242 million in liquidated positions, largely from merchants trying to lengthy altcoins.

Coinglass’s present information reveals that merchants bullish on Dogecoin (DOGE) have been the toughest hit of anybody within the final 12 hours, with different altcoins within the memecoin sector like Shiba Inu (SHIB) not far behind.

The decentralized finance (DeFi) sector can be dealing with a massacre, with a number of cash now at or near all-time lows.

DYDX, the native token of the Ethereum-based decentralized change (DEX), hit $1.40 early on Monday and is now 95% down from its all-time excessive and solely a 28% transfer from all-time lows.

Curve Finance (CRV), one of many greatest DEXes within the house, hit an all-time low of $0.23 late final week after its founder confronted roughly $100 million in liquidations.

Based on digital belongings supervisor CoinShares, institutional buyers withdrew over $600 million in capital from exchange-traded merchandise (ETPs) final week, probably because of the newest Federal Open Market Committee (FOMC) assembly being extra hawkish than anticipated.

“This occurred underneath related circumstances: a interval of great inflows adopted by a extra hawkish-than-expected FOMC assembly, prompting buyers to reduce their publicity to fixed-supply belongings. These outflows and up to date value sell-off noticed whole belongings underneath administration (AuM) fall from above US$100bn to US$94bn over the week.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Natalia Siiatovskaia/A. Solano