The crypto market has been on a rollercoaster this yr, with costs fluctuating wildly and regulatory pressures inflicting vital drops. Nevertheless, latest developments have given buyers renewed confidence out there, resulting in a complete crypto market cap restoration.

On June fifteenth, the entire crypto market cap hit a low level of $972 billion, following the Securities and Change Fee’s (SEC) regulatory stress on the trade. However since then, the market has rebounded.

This restoration has been pushed partly by the doorway of main monetary gamers into the crypto area. A number of purposes for a Bitcoin Spot Change-Traded Fund (ETF) by main monetary gamers reminiscent of Blackrock and Constancy have been filed, indicating that they’re all for betting on cryptocurrencies.

This has helped to rebuild investor confidence out there, resulting in elevated investments and an increase within the whole crypto market cap.

Crypto Market Cap’s Second Of Fact

Cryptocurrency buyers are carefully monitoring the entire crypto market cap because it makes an attempt to interrupt by a big resistance degree. According to crypto analyst Rekt Capital, if the market can efficiently breach this degree, it may pave the best way for continued upward momentum and probably vital good points for the general market.

On the time of writing, the entire crypto market cap is round $1.17 trillion, with Bitcoin making up the lion’s share of this worth. Nevertheless, the market has been buying and selling in a comparatively tight vary over the previous few weeks, with many buyers on the lookout for a catalyst to drive costs larger.

Rekt Capital believes {that a} breakout above the present resistance degree might be simply the catalyst that the market must see a sustained uptrend. Rekt Capital means that the market may see good points of between 10% and 23% over time if this breakout happens.

As depicted within the chart, the instant resistance ranges for the worldwide market cap of the cryptocurrency trade are presently at $1.18 and $1.25. The latter represents the best degree achieved in 2023.

Nevertheless, sure situations have to be met for the market to interrupt by these ranges. Firstly, there must be an enchancment in present market situations, together with a rest of crypto laws by regulators globally, significantly within the US. Moreover, there must be a decision of the continuing Bitcoin Spot ETF purposes by main monetary gamers with the SEC.

If these situations are met, it may result in an inflow of monetary gamers and buyers into cryptocurrency. Many buyers wish to cryptocurrencies as a hedge towards inflation, and better regulatory readability and the approval of a Bitcoin ETF may make the trade extra enticing to conventional buyers.

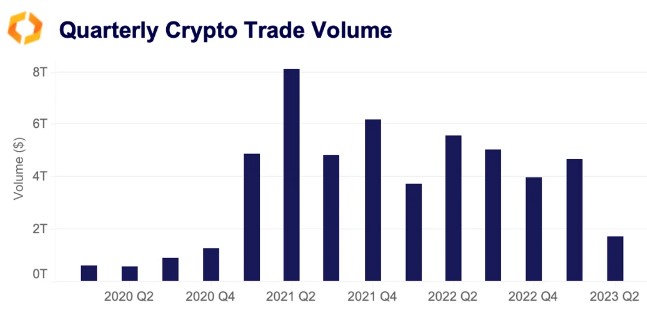

Cryptocurrency Buying and selling Quantity Drops To 2020 Ranges

Crypto buying and selling volumes have reached their lowest ranges since 2020, regardless of the continuing rally in June. In accordance to a report by crypto market information supplier Kaiko, spot commerce volumes have considerably declined in Q2, with Binance registering the strongest drop in buying and selling exercise.

Binance, one of many world’s largest crypto exchanges, noticed volumes fall by almost 70% after the trade reintroduced charges for its most liquid Bitcoin pairs. This transfer, aimed toward lowering market manipulation, seems to have considerably impacted buying and selling exercise on the platform.

Nevertheless, Binance was not the one trade to see a big decline in buying and selling volumes. Different well-liked exchanges, together with Coinbase, Kraken, OKX, and Huobi, additionally noticed volumes decline by over 50% in Q2.

The decline in buying and selling volumes is shocking, given the latest rally within the crypto market. Bitcoin, the most important cryptocurrency by market cap, has been bullish in June, reaching a excessive of over $31,000. Regardless of this, buying and selling volumes have remained subdued, suggesting that buyers are usually not as lively out there as they’ve been.

Featured picture from Unsplash, chart from TradingView.com