Crypto and Bitcoin merchants ought to put together for an additional sharp leg up, particularly if the coin breaks above the $35,750 to $36,000 resistance wall this week. In response to an X user, Alex Thorn, the Head of Firmwide Analysis, the $250 zone between these costs is an important liquidation barrier that derivatives merchants carefully watch.

If bulls have the higher hand and push above the higher restrict of the belt, costs may rip increased this week primarily due to the ensuing demand within the spot market.

Is Bitcoin Prepared For One other Rally?

Thorn compares the present setup evolving within the Bitcoin chart to the occasions final week, which noticed the coin explode. At spot charges, Bitcoin is secure however trending round 2023 highs, with patrons anticipating extra beneficial properties as market sentiment improves.

Although most customers are the USA Securities and Alternate Fee (SEC) and the potential approval of a spot Bitcoin Alternate-Traded Fund (ETF) as a set off for the subsequent leg up, Thorn is carefully monitoring occasions within the Bitcoin buying and selling scene, particularly, the derivatives market. Within the analyst’s evaluation, choices merchants would be the main drivers of the subsequent bull run.

Why $36,000 Is A Key Worth Stage To Watch

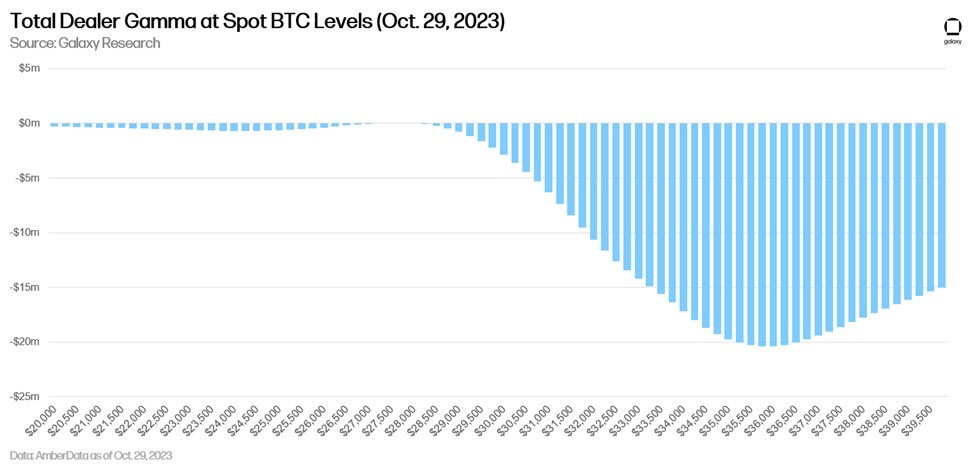

Primarily based on the analyst’s evaluation, as soon as Bitcoin breaks the $35,750 to $36,000 zone, “choices sellers might want to purchase $20m in spot BTC for each 1% upside transfer,” driving costs increased. The rationale sellers have to purchase or promote Bitcoin on the spot market is determined by whether or not they’re “brief or lengthy gamma.”

The target, when this occurs, is to remain “delta impartial.” The choice to purchase on the spot market comes after a “gamma squeeze,” which, as Thorn notes, lifted costs final week.

Technically, a gamma squeeze arises when there’s a spike in name (or purchase) choices being bought, forcing choices sellers, most of whom are market makers, to purchase the underlying asset, on this case, Bitcoin, to hedge their positions and keep “delta impartial.” Going by traits and the present setup, particularly within the day by day chart, this might occur.

different metrics, Thorn observed a divergence in provide held by speculators and long-term holders, opining that on-chain liquidity could possibly be dwindling. Nevertheless, on the intense facet, the Z-Rating ratio of market value to realized value reveals that Bitcoin is in a “wholesome” place.

As of October 30, Bitcoin is inside a bullish breakout formation, with merchants bullish. Whether or not the uptrend stays is determined by whether or not patrons comply with by, pushing the coin above current highs, away from the breakout degree at round $32,000.

Function picture from Canva, chart from TradingView