Cryptocurrency fanatics are ecstatic after AVAX mapped out the primary indicators of a possible breakout, and a well-known crypto analyst fueled the wave of optimism together with his bullish forecast. The professional, Alan Santana, believes that AVAX graphs look just about alike in comparison with Bitcoin earlier than it surged in worth. Now, can AVAX be about to replay this state of affairs? An in-depth evaluation and additional clarification are offered right here.

Associated Studying

Drawing Parallels With Bitcoin

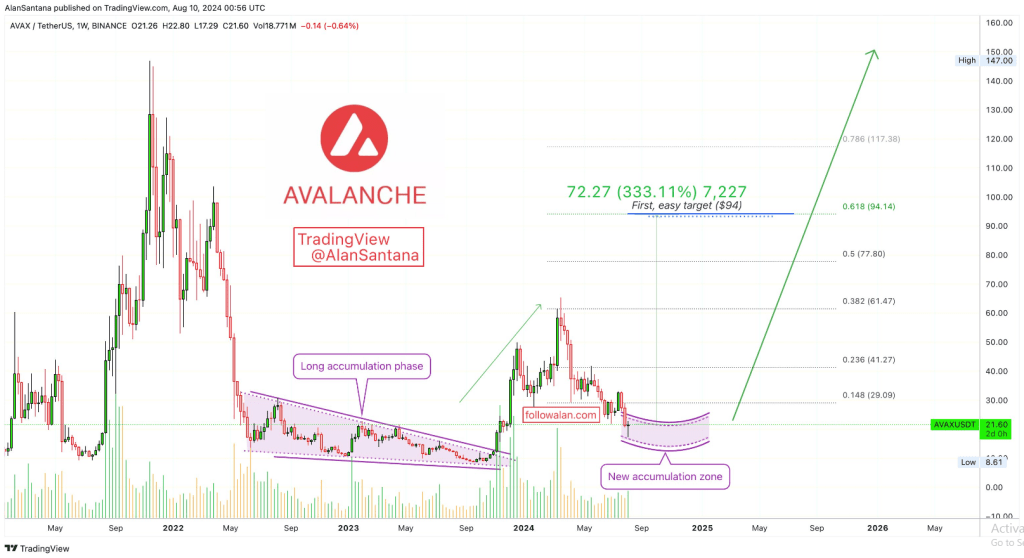

Santana’s evaluation hinged on the concept that Avalanche’s elongated consolidation part all through 2022 and 2023 is sort of in resemblance with these phases in Bitcoin’s historical past. He had, particularly, talked about that the plunge of Bitcoin from $70,000 to $49,000 was adopted by a 4.5-month consolidation part earlier than the cryptocurrency started to recuperate. Equally, Bitcoin’s resurgence above $20,000 in 2023 got here after a seven-month accumulation interval.

✴️ Avalanche Pre-2025 Bull-Market Accumulation Zone & Technique

By now, you already know the theme… Accumulation earlier than bullish-wave. Bullish wave to finish in a bullish-run.

Avalanche vs Bitcoin: An Analogy

The buildup part could be seen because the coaching part, the… pic.twitter.com/bEsEAD1QJk

— Alan Santana (@lamatrades1111) August 10, 2024

Santana believes these historic circumstances show that AVAX is likely to be gearing for a mammoth bull market as far forward as 2025. In line with him, this average wave of bullishness seen in the direction of the tail finish of 2023 and early 2024 is only a minor part throughout the grand plan of the larger market construction.

It’s an period of correction that has to occur, based on Santana, which might then give method to one other accumulation interval and is meant to be paving the way in which for a considerable bullish breakout.

New All-Time Highs Forward?

Santana believes AVAX might attain a brand new ATH of $382. He primarily based his projection on the extension of Fibonacci ranges from the low of the bear market to the earlier ATH. In line with Santana, two key ranges on this evaluation are 1.618 and a pair of.618, with respective worth targets of $232 and $370 respectively.

Underneath the belief that the whole lot unfolds as predicted, then, on this case, AVAX will develop into among the many greatest performing cryptocurrencies throughout the subsequent few years.

Whereas these figures might look optimistic, they’re in direct adherence to the development seen in different well-liked cryptocurrencies. As Santana factors out, long-term predictions comparable to this needs to be taken very cautiously, however he exudes full confidence in AVAX.

AVAX: The Case For A ‘Purchase And Maintain’ Technique

Santana was advising a “purchase and maintain” method for traders. He suggested in opposition to excellent timing of the market, lest one is just not investing in any respect whereas ready for a doable worth dip. As an alternative, Santana instructed establishing a worth vary inside which AVAX could possibly be steadily collected, particularly under $20, after which simply holding the tokens for the long run till the market turns bullish.

Associated Studying

Market Sentiment & Technical Indicators

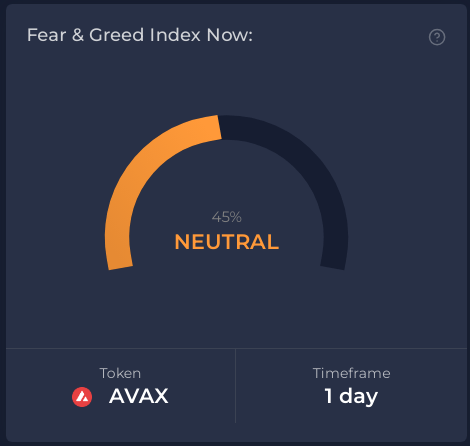

Though the market sentiment in the mean time would transform extra impartial, as mirrored by a Worry & Greed Index rating of 45, there are some rays of optimism. In line with CoinCodex, the value prediction backing the robust bull run states that AVAX would possibly rise to a price as excessive as $72.68, up by 230.17%, as quickly as September 2024.

If one needed to view the current efficiency of the asset, with its common volatility and modifications of 12.42% over the previous month, it could give the sensation that AVAX is buying and selling low-cost. Alternatively, contemplating that the Worry & Greed Index is comparatively low, it underprices the potential of AVAX throughout the market correspondingly, making it a superb alternative for getting earlier than a possible rally.

Featured picture from Pexels, chart from TradingView