Bitcoin, the world’s hottest cryptocurrency, seems poised for a serious transfer, however the path stays shrouded in thriller. Analysts are divided on whether or not a bullish breakout or an prolonged consolidation interval lies forward.

Associated Studying

Reaching New Highs: Euphoric Bulls On The Horizon?

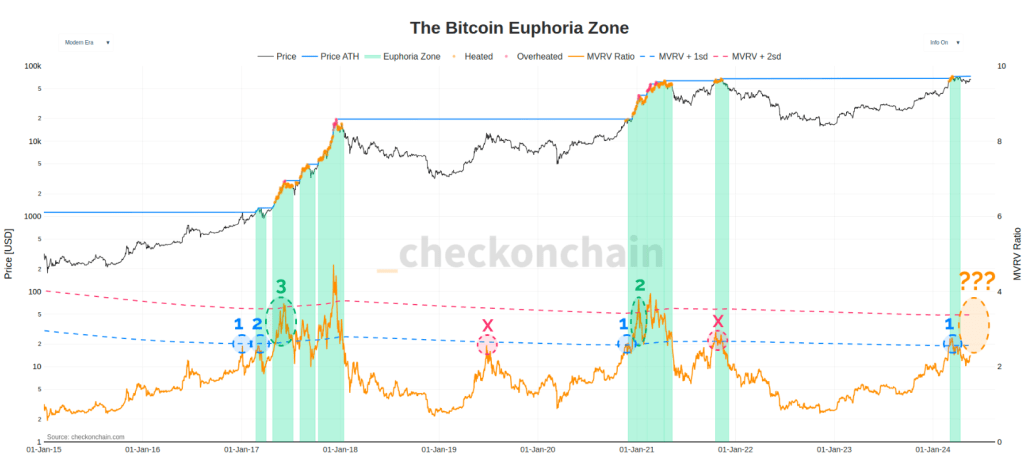

Famend crypto analyst Checkmate has ignited a spark of optimism along with his “Euphoric Bull” principle. In accordance with Checkmate, a surge to a brand new all-time excessive may sign a important shift in market sentiment. This kind of bull section would characterize a major acceleration in bullish momentum, doubtlessly resulting in a steeper worth enhance.

Checkmate’s principle hinges on the Market Worth to Realized Worth (MVRV) ratio, a metric that compares the present market worth of Bitcoin to the overall worth paid to accumulate all Bitcoins in circulation. Traditionally, when the MVRV ratio climbs above one customary deviation of its common, it has typically preceded a shift to a “Euphoric Bull” section.

#Bitcoin breaking to a brand new ATH has traditionally represented a transition level from the Enthusiastic Bull, into the Euphoric Bull.

It additionally coincides with the MVRV ratio getting above 1 customary deviation, however we not often clear it on the primary try.

Bull…Crab…Bull…

A… pic.twitter.com/4YyD179LRS— _Checkmate

(@_Checkmatey_) May 21, 2024

Nevertheless, Checkmate warns that Bitcoin doesn’t all the time observe the script on the primary attempt. The market typically displays cautious conduct, with Bitcoin doubtlessly trying to breach this key MVRV stage a number of instances earlier than a decisive breakout.

Bitcoin’s current consolidation interval comes after a surge that noticed the alpha crypto attain a six-week excessive of $71,950. Whereas a slight pullback has occurred, Bitcoin continues to be buying and selling comfortably close to the $70,000 stage, with a wholesome every day buying and selling quantity. This worth motion suggests a possible pause earlier than the subsequent vital transfer, making the present second a tense ready recreation for each merchants and traders.

Breakout Or Consolidation? A Bullish Dilemma

Crypto analyst Rekt Capital has emerged as a key voice within the ongoing debate. Rekt Capital believes a weekly candle closing above $71,500 might be the catalyst for a major breakout. This milestone, if achieved, may set off a surge in bullish momentum, propelling Bitcoin in the direction of a notable uptrend.

Nevertheless, Rekt Capital additionally acknowledges the potential for an prolonged consolidation section. Traditionally, Bitcoin has exhibited an inclination to consolidate inside its re-accumulation vary for a number of weeks earlier than experiencing a breakout. This prolonged consolidation, Rekt Capital argues, would carry Bitcoin nearer to aligning with historic halving cycles, occasions which have traditionally preceded main bull runs.

Associated Studying

Bitcoin Worth Prediction

In the meantime, different analysts are predicting a possible banner yr for the world’s main cryptocurrency in 2025. The high-end prediction of $168,459 represents a staggering potential enhance, fueled by components like historic worth developments and the upcoming Bitcoin halving cycle. Buoying this optimism are technical indicators pointing in the direction of a “Bullish” market sentiment with a hearty dose of “Excessive Greed.”

Nevertheless, a dose of actuality is important. The big selection between the expected excessive and low ($69,971) underscores the inherent uncertainty in these forecasts. Bitcoin’s infamous volatility, evident within the current 4.47% worth swings inside simply 30 days, additional complicates issues. Whereas this stage of greed suggests investor confidence, it will also be a warning signal of a possible market correction on the horizon.

Featured picture from Vecteezy, chart from TradingView