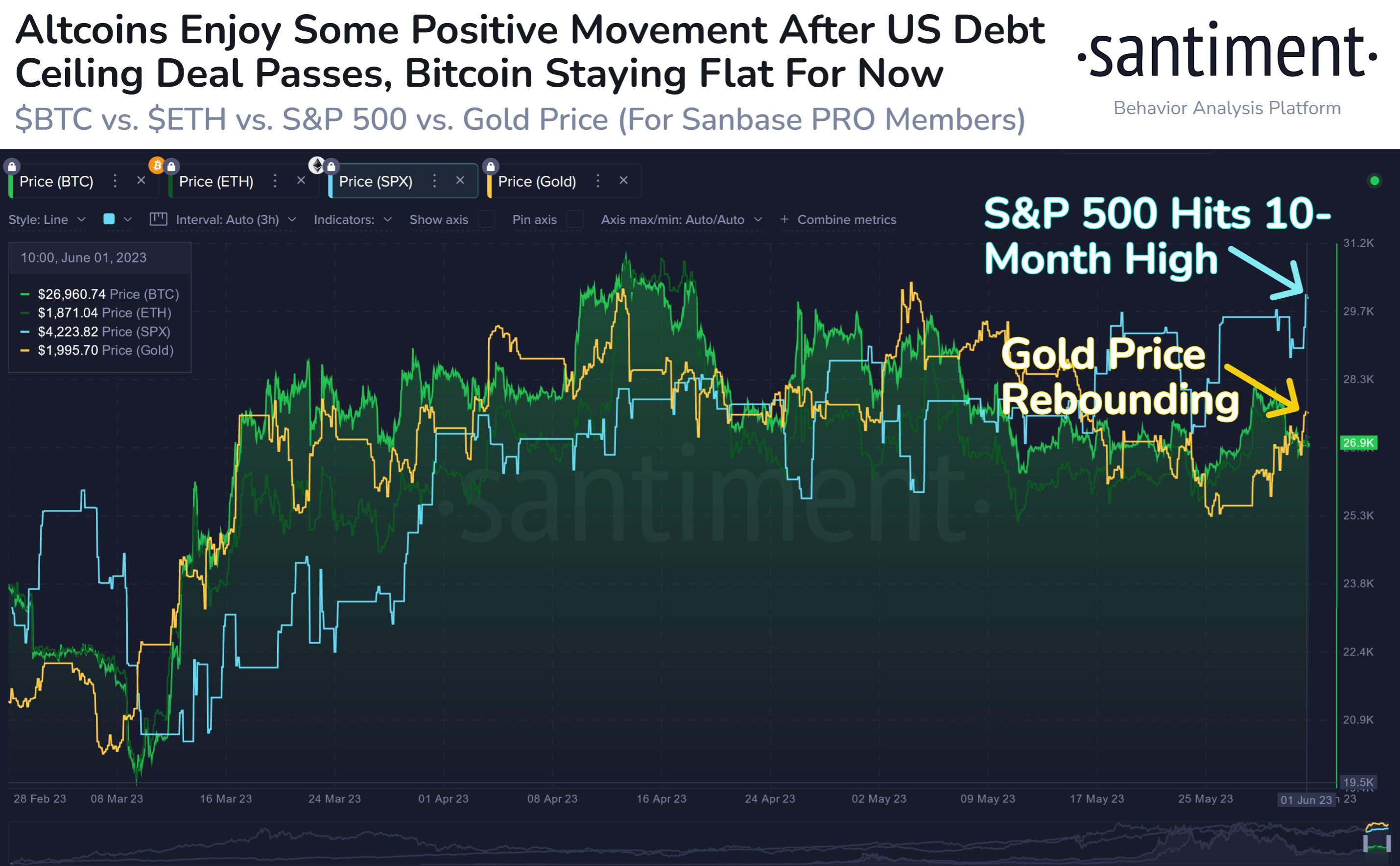

Blockchain analytics platform Santiment is saying that Bitcoin (BTC) has principally stayed flat amid the latest bounce within the inventory market.

Santiment says that the inventory market has climbed to its highest degree in about 10 months because the US authorities resolves the debt ceiling difficulty.

Whereas Bitcoin has fallen behind the robust efficiency of the S&P 500 as of late, the analytics agency says that BTC might quickly comply with swimsuit.

“The US Home has handed a key debt ceiling deal, launching the S&P 500 to its highest worth since August. Altcoins like LTC, LEO, and FGC have jumped as we speak. With crypto lagging behind equities, there may very well be some BTC catch-up time coming quickly.”

Turning to XRP, Santiment says that the sixth-largest crypto asset by market cap is having fun with file deal with exercise and excessive ranges of crowd optimism.

“XRP Community is the highest trending asset in crypto as costs have jumped +22% the previous 19 days. We’re additionally seeing traditionally excessive deal with exercise surges for the sixth-ranked market cap asset. Count on XRP’s worth to behave uniquely in the interim.”

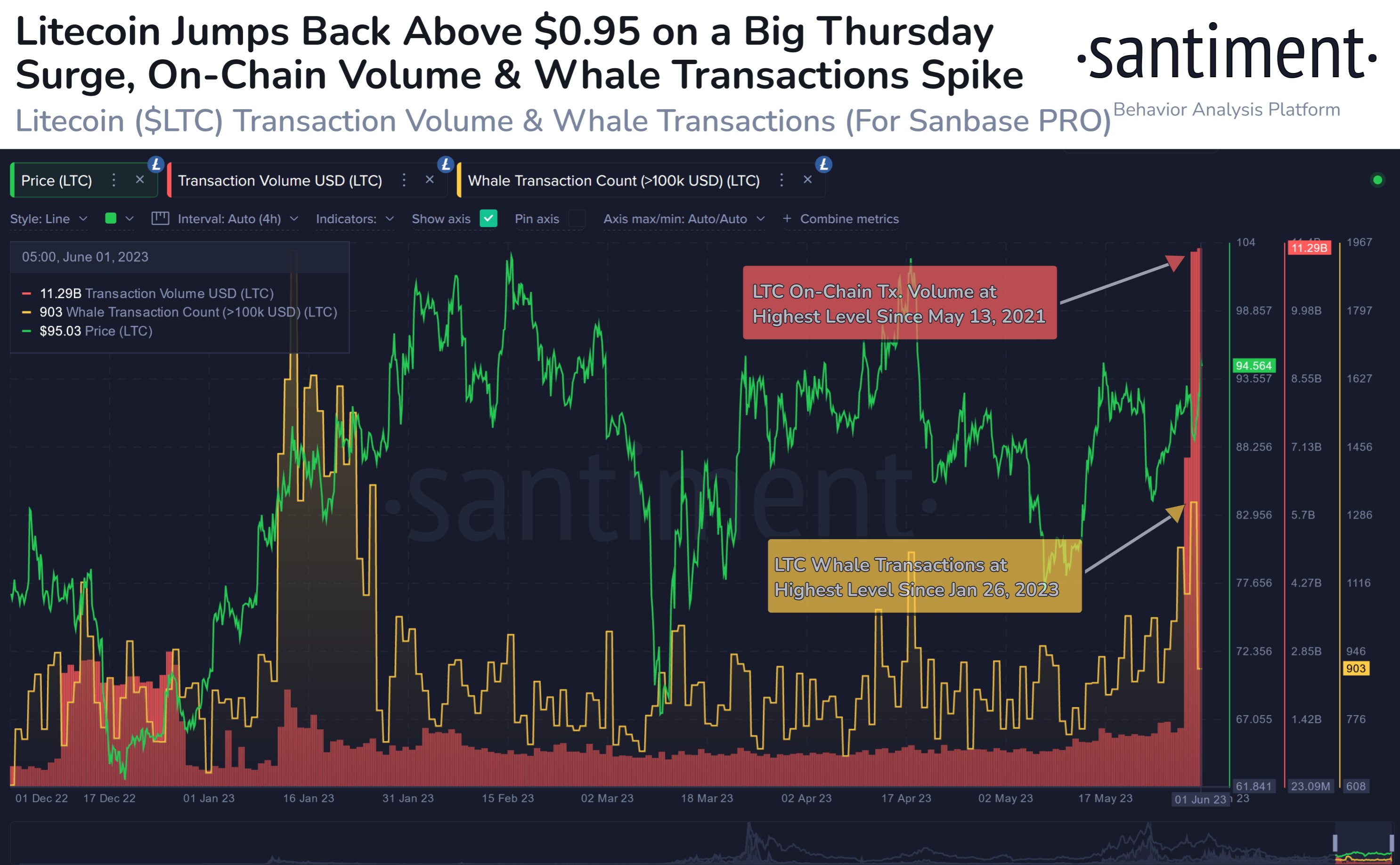

Wanting on the peer-to-peer funds community Litecoin (LTC), Santiment says that the altcoin’s rise above a key psychological degree comes amid a rise in on-chain transaction quantity and excessive whale exercise.

“Litecoin’s market worth is +6.5% up to now 24 hours as its halving is now simply over two months away. This surge has been powered by an enormous two-year excessive in on-chain transaction quantity, and the very best whale exercise since January.”

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please observe that The Every day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney