Apple Card Financial savings has lower its rate of interest once more

Initially marketed as a high-yield account, Apple Card Financial savings has as soon as extra had its rate of interest diminished.

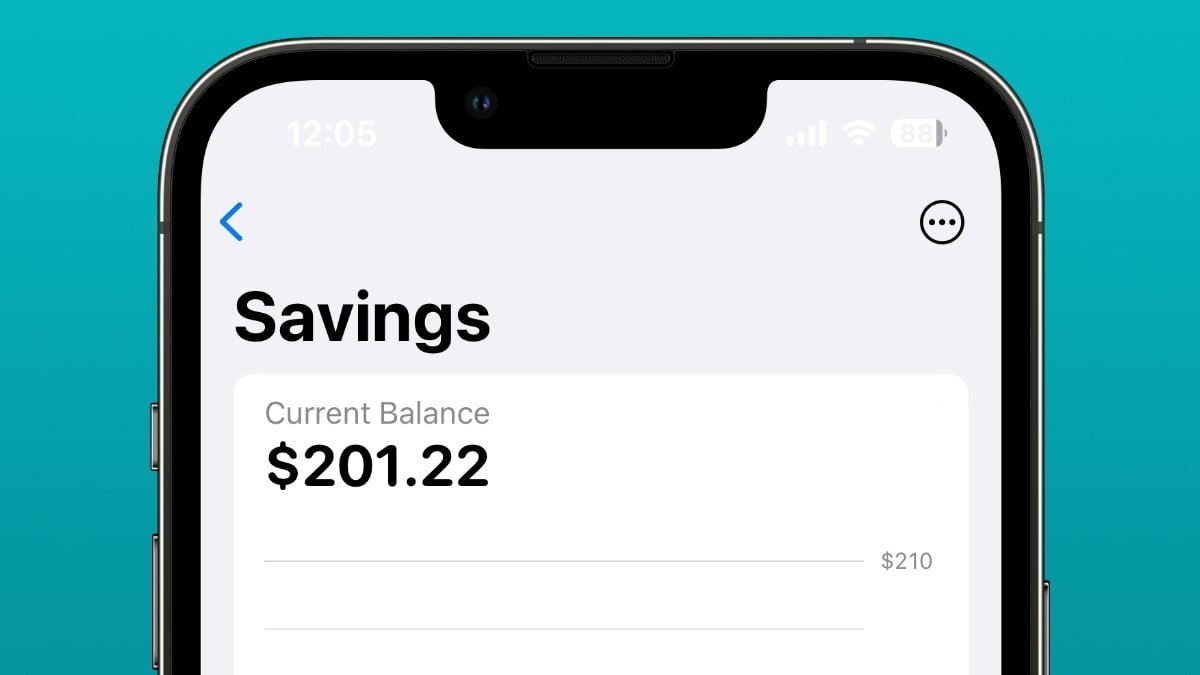

Following its first lower from 4.5% to 4.4% in April 2024, the annual proportion yield (APY) for Apple Card Financial savings is now to be 4.25%. That is nonetheless larger than the financial savings account’s unique 4.15% in 2023, nonetheless.

When the account first launched, that charge was not the perfect however was thought-about excessive yield. Subsequently, although, many different banks have elevated their APY.

By the point Apple launched its first lower in April 2024, Apple Card Financial savings had change into round common, or maybe barely under that. All financial institution APYs fluctuate, nonetheless, so there isn’t a constant league desk of that are the perfect.

Apple Card Financial savings customers had been knowledgeable of the speed change in a notification despatched collectively by Apple and the finance firm at present behind the service, Goldman Sachs. Individually, Goldman Sachs is trying to stop its take care of Apple because it pulls out of client bank cards completely.

Whereas each Apple Card Financial savings and the common Apple Card will doubtlessly proceed, no substitute for Goldman Sach has been introduced. Most just lately, nonetheless, it has been reported that JP Morgan could take over.