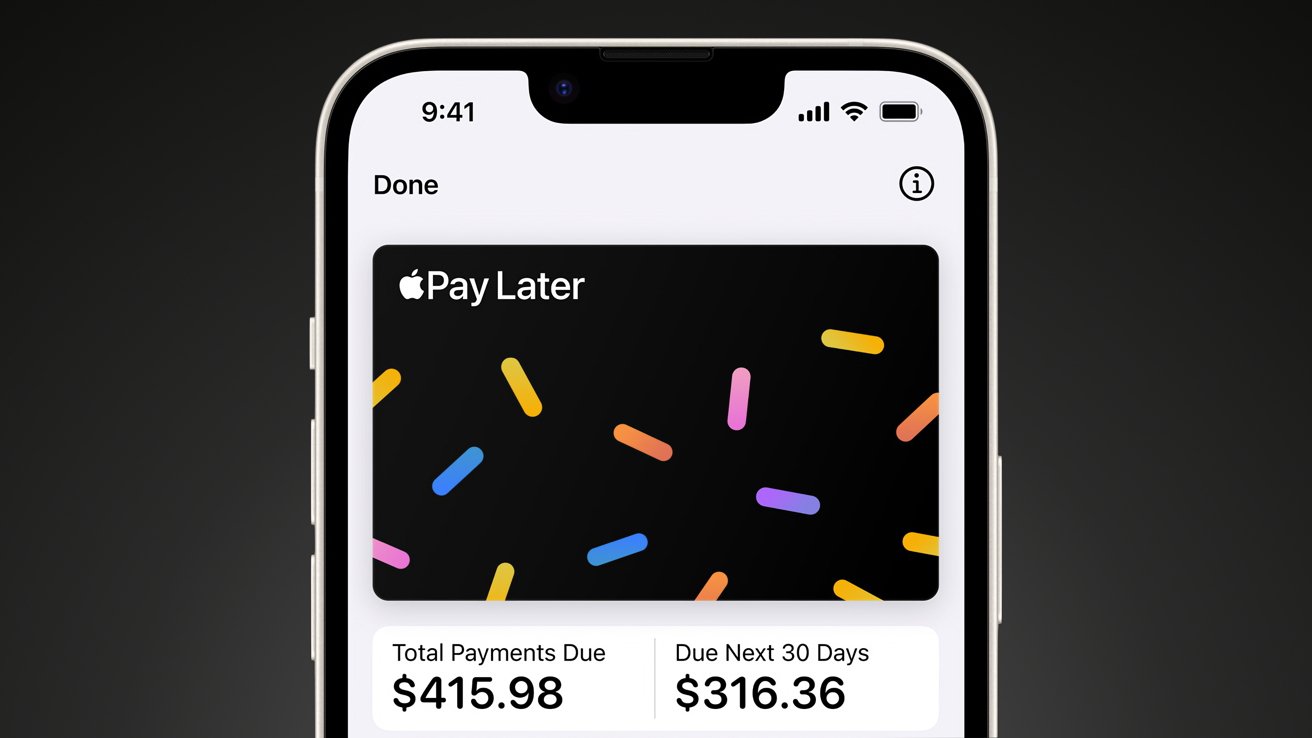

Apple Pay Later

Apple has introduced that it is going to be ending its Apple Pay Later program, roughly one 12 months after it launched it.

Initially launched in October 2023, Apple Pay Later was Apple’s stab at providing Apple customers a short-term financing resolution that unfold funds over six weeks.

Now, regardless of its success, plainly the tech large is killing off this system in favor of latest options being launched later this 12 months.

Apple offered an announcement to 9to5Mac that stated the corporate would as a substitute be working with current short-term mortgage applications, corresponding to Affirm, to combine these into Apple Pay.

Apple seemingly determined it did not wish to be within the short-term mortgage recreation, for causes recognized solely to itself proper now. Whereas Goldman Sachs issued the Mastercard cost credential, Apple Pay Later loans have been really backed by the tech large itself.

Customers with lively Apple Pay Later plans can nonetheless handle and pay their loans by the Pockets app. Installment buy plans for Apple {hardware} are unrelated, and are unaffected by the closure presently.

Positive aspects or losses from Apple Card and Apple Pay Later are embedded in Apple’s Companies income reporting. It is by no means been clear what number of Apple Pay Later loans have been issued.

In early June, Apple had introduced that it will roll out new Apple Pay options within the fall. The announcement even telegraphed that Apple could also be making ready to exit the short-term mortgage area.

The corporate stated Apple Pay would supply higher flexibility and selection for testing on-line and in-app. It will enable customers to redeem rewards and entry installment mortgage choices from eligible credit score or debit playing cards when buying on-line or in-app with iPhone and iPad.

The announcement additionally identified that Apple Pay customers can apply for pay-later loans instantly by Affirm when testing with Apple Pay.