ARB, the native token of Arbitrum, the Ethereum layer-2 answer, is down 68% from January 2024 highs.

Nevertheless, there’s excellent news: Whereas ARB holders “undergo” within the face of unrelenting bears, constructive on-chain developments reveal a platform that’s not solely the biggest by complete worth locked (TVL) but in addition brimming with potential.

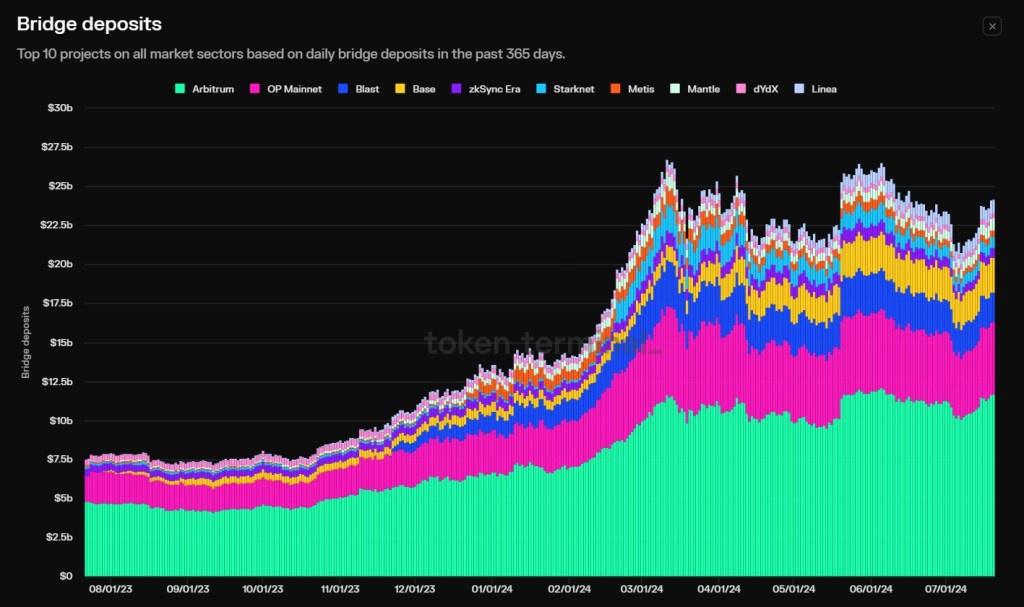

Over 48% Of Ethereum Bridged Belongings Finish Up In Arbitrum

Taking to X, one analyst notes a surge in person exercise on Arbitrum and that the platform leads throughout a number of key efficiency indicators (KPIs).

Of significance, the analyst noticed that although there are different Ethereum layer-2 options to select from, together with Base–which is backed by one of many world’s largest exchanges, Coinbase, and Optimism, over 48% of all property bridged from the mainnet discover their approach into Arbitrum.

Having customers go for Arbitrum, and never Base or different opponents, is a large confidence increase. It additionally signifies its technical capability to deal with scaling challenges plaguing the mainnet.

Past this dominance, the analyst, citing Token Terminal knowledge, additionally notes that Arbitrum, as talked about, reigns supreme concerning TVL. In keeping with on-chain asset stream from the blockchain analytics platform, Aave, a lending and borrowing platform, is the main contributor.

On the similar time, Arbitrum is essentially the most energetic community, trying on the variety of every day energetic addresses. Gauging from exercise ranges, the analyst notes that Arbitrum is much more busy than the mainnet.

Apparently, whereas exercise may very well be an element to contemplate, Arbitrum, the analyst additionally stated, leads different layer-2s within the variety of distinctive token holders. It signifies that layer 2s additionally lead in depth and breadth, indicating excessive engagement.

Will ARB Rise After Falling By 68% In 7 Months

Contemplating these spectacular on-chain statistics, it stays to be seen when ARB will recuperate. The token dropped by 68% in seven months. The token stays underneath immense promoting strain and is a shadow of its former self.

As Ethereum recovers, ARB might observe swimsuit. Platform-led initiatives will even assist the token. As an example, the group not too long ago launched the Gaming Catalyst Program (GCP) to speed up the constructing and deployment of GameFi platforms in its ecosystem.

Voting is ongoing and ends on August 1, when three candidates might be elected to kind the GCP Council. The council might be a decentralized autonomous group (DAO) overseeing the GCP’s features.