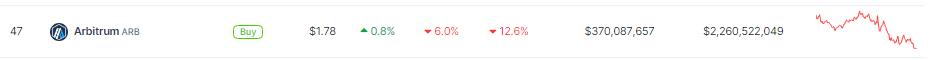

Arbitrum (ARB), the Ethereum Layer 2 scaling answer, has skilled a current value drop, falling under the $2 mark after a quick try to ascertain a brand new value flooring. This decline, attributed to a number of components together with elevated promoting strain and bearish technical indicators, raises questions concerning the token’s short-term trajectory whereas highlighting long-term potential.

ARB value dropping its grip on the $2 deal with. Supply: Coingecko

Promoting Spree Triggers Downward Spiral

The worth decline started with a surge in promoting strain, most notably from Convex Finance. Over the previous 24 hours, the DeFi big offloaded 901,392 ARB tokens, valued at $1.63 million, at a mean value of $1.8 per token.

This transfer, representing a revenue of over $400,000 since buying the tokens in an airdrop final yr, triggered a domino impact, with different buyers following swimsuit.

$ARB value dropped ~9% up to now 24 hours!@ConvexFinance additional deteriorates the value by promoting 901,392 $ARB ($1.63M) for 559.4 $ETH at ~$1.812 up to now 45 minutes.

They obtained these $ARB from the DAO airdrop in Apr 2023, which was then price solely $1.2M.

Token stream:… pic.twitter.com/09al0a71Oj

— Spot On Chain (@spotonchain) February 22, 2024

Bearish Indicators Reinforce Downtrend

Technical indicators on the every day timeframe chart additional paint a bearish image. The short-term transferring common (SMA), beforehand appearing as help across the $2 mark, has flipped to resistance. The Relative Energy Index (RSI) dipped under the impartial line, suggesting a dominant downward pattern, albeit a weak one.

Regardless of the decline, indicators of resilience emerge. The token skilled a slight restoration of 0.2%, at the moment buying and selling round $1.88. Moreover, the Funding Fee on derivatives platforms like Coinglass stays constructive at 0.014%, indicating that consumers nonetheless maintain some management, albeit with much less aggressiveness in comparison with earlier than.

ARBUSD buying and selling at $1.77 on the 24-hour chart: TradingView.com

Low Spinoff Curiosity: A Level Of Warning

Nevertheless, the spinoff market paints a much less optimistic image. Open Curiosity, a metric reflecting the whole quantity of capital locked in futures contracts, stands at round $254 million, indicating comparatively low curiosity in ARB in comparison with different tokens. This lack of engagement may probably restrict upward momentum and value stability.

Lengthy-Time period Prospects Stay Promising

Regardless of the current value dip, Arbitrum boasts sturdy fundamentals and long-term potential. Its quick and reasonably priced transactions, coupled with rising developer adoption and ecosystem improvement, proceed to draw curiosity. Latest partnerships like ApeCoin’s ApeChain launch on Arbitrum additional solidify its place as a number one Layer 2 answer.

Whereas the present value motion suggests a interval of consolidation, Arbitrum’s long-term prospects stay promising. Traders ought to rigorously contemplate market traits, technical evaluation, and basic components earlier than making any funding choices.

Featured picture from Kamil Pietrzak/Unsplash, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual threat.