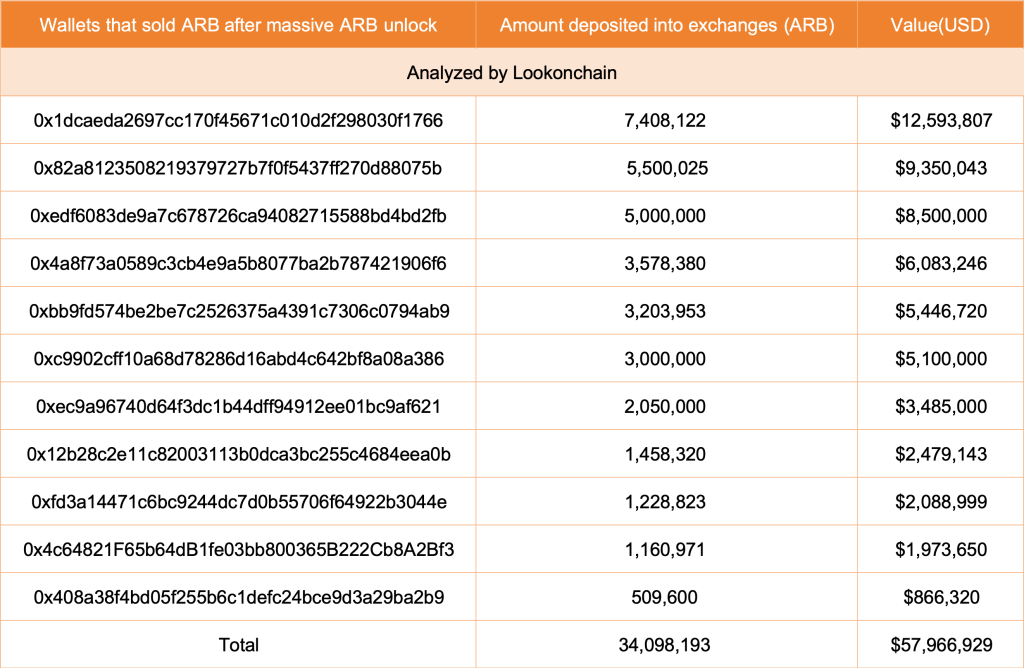

Whereas the latest unlocking of ARB triggered fears of a sell-off, Lookonchain information suggests a special story. On March 18, the analytics platform showed {that a} mere 58 million ARB, representing solely a tiny portion of the 1.1 billion tokens unlocked on March 16, have been despatched to exchanges by simply 11 large-scale traders, generally referred to as “whales.”

Are Whales Bullish On ARB?

This switch signifies that regardless of some profit-taking, different whales are HODLing on to their ARB, reflecting continued confidence within the undertaking’s future.

On March 16, Arbitrum despatched 1.1 billion ARB to traders, crew members, and advisors in a “Cliff Unlock.” Analysts describe a “Cliff Unlock” as a state of affairs through which all allotted tokens for that occasion are launched concurrently.

Arbitrum selected to launch all tokens directly. 673.5 million have been despatched to advisors and the crew. In the meantime, the rest, 438.25 million, was despatched to traders. The unlocking occasion, as anticipated, was a supply of concern that some receivers would select to promote within the secondary market.

As anticipated, ARB costs have decreased, reflecting the final sentiment throughout the crypto market board. Thus far, ARB is down 24% from March 2024 highs. Nevertheless, what’s clear is that the uptrend stays, and consumers stay in cost regardless of the promoting stress.

Based mostly purely on value motion, ARB bulls have an opportunity if costs are above the $1.6 to $1.65 assist zone. Conversely, any upswing above this degree may drive costs to the higher finish of the vary at round $2.20. Additional upswings will proceed the sharp growth from October 2023. On the time of writing, ARB is up 125% from This fall 2023 lows.

Arbitrum To Profit From Dencun, Cementing Its Layer-2 Dominance

Lookonchain information reveals that only some tokens have been despatched to exchanges lower than every week after the unlocking occasion, suggesting traders and whales are bullish in regards to the undertaking.

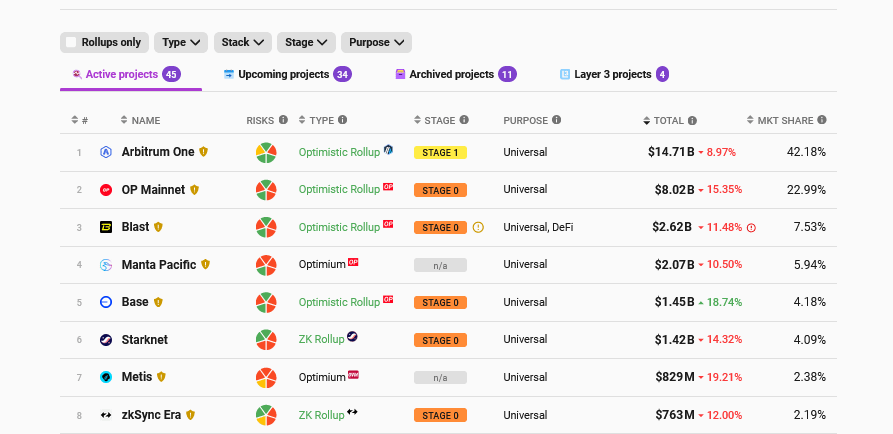

L2Beat information reveals that Arbitrum, a layer-2 scaling resolution for Ethereum, is the biggest in that class by whole worth locked (TVL). By March 18, Arbitrum managed $14.7 billion value of belongings, practically 2X that of Optimism.

Whereas ARB is below stress, the broader Ethereum and crypto neighborhood stays bullish. Final week, the “Dencun” replace was launched to the mainnet.

This replace is critical because it additional slashes transaction charges, making layer-2s, together with Arbitrum, extra engaging for customers. This improve is very interesting to builders and customers in search of to benefit from the excessive on-chain exercise on Ethereum with out fighting excessive gasoline charges and low scalability. As Layer-2 options discover adoption, Arbitrum may benefit from this inflow.

Function picture from Canva, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site totally at your individual danger.