The worth of Bitcoin has been struggling these days as a result of the market sentiment isn’t nice. Let’s break down what’s occurring with BTC and why issues look a bit gloomy.

A Powerful Spot for Bitcoin

In the event you’ve been watching Bitcoin’s 1-hour chart, you’ve most likely observed that BTC is caught at $56,700. It’s caught between the 20 day & 50 day transferring averages, sort of like being caught in a visitors jam.

The worth began dropping from $64,000 and located some assist at $53,800. However each time it tries to climb again up, it will get pushed down once more by the 50-day transferring common at $57,000. Even with some assist on the $56,000 degree, it’s not giving us a lot hope.

Rising Wedge Giving Warning

Proper now, the chart exhibits a rising wedge sample. This normally isn’t excellent news. It’s like BTC is attempting to climb a slippery hill, and for the previous 4 hours, all of the hourly candles have been dojis—small strikes that present the market is not sure. This implies even somewhat little bit of dangerous information may push BTC decrease, resulting in extra drops in worth.

Extra Dangerous Information

If we examine the weekly chart, we see one other dangerous signal there – The double prime or “M” sample. This usually indicators an enormous reversal after an uptrend, including gasoline to the unfavourable feeling.

By no means Ending Bearish Indicators

The MACD indicator can also be displaying unfavourable indicators. It’s one other clue that the bears are in management. The MACD line tried to cross the sign line, nonetheless failed.

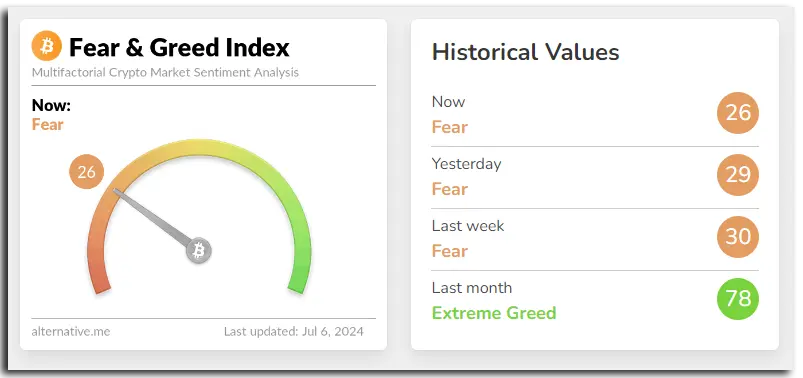

Then again, the Concern & Greed Index has additionally dropped 3 factors to 26, displaying that concern is growing out there in comparison with yesterday.

BTC Is perhaps Going to Bears

If the bears hold pushing, Bitcoin’s worth may drop all the best way right down to $48,500. The present patterns and indicators all level to a tricky time forward for BTC.

Bitcoin’s worth is at the moment struggling. A mixture of unfavourable patterns are seen on the chart. Patterns such because the rising wedge and double prime, together with unfavourable indicators just like the MACD and a lowering Concern & Greed Index, counsel that sellers are dominating the market. Merchants and traders ought to be cautious, because the market may expertise additional declines if the unfavourable sentiment persists. Nevertheless, it may also be a possibility for some folks.