Fast Take

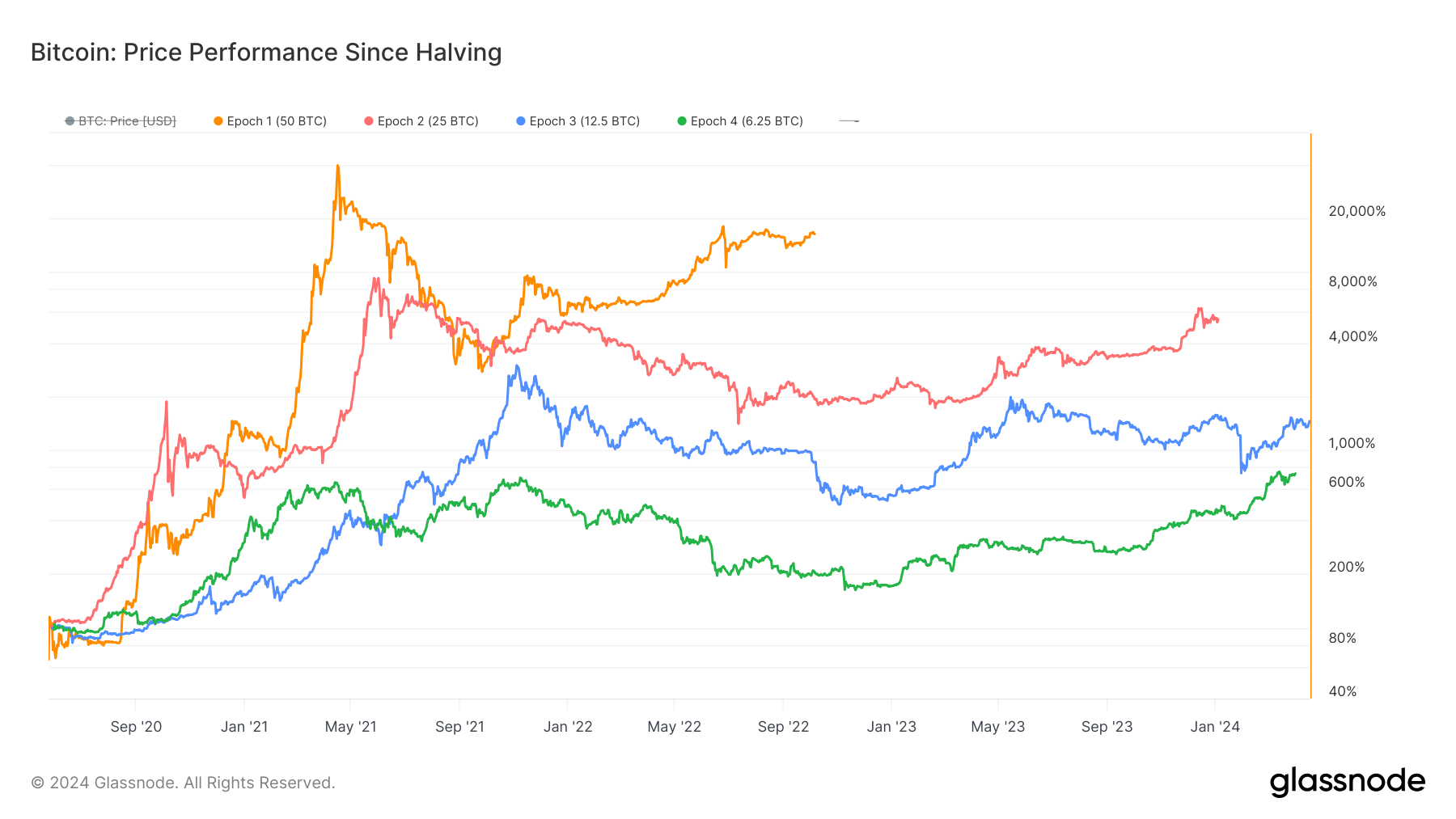

Because the extremely anticipated Bitcoin halving occasion attracts nearer on Apr. 20, the digital property neighborhood is keenly observing Bitcoin’s worth actions all through varied halving cycles. Whereas an examination of returns from cycle lows and highs means that the diminishing returns idea could not align, a deeper evaluation of worth efficiency between successive halving occasions presents a definite development.

Regardless of Bitcoin’s outstanding surge of roughly 620% from round $8,500 on the onset of the present halving cycle on Might 11, 2020, to its present worth of roughly $70,000, returns have exhibited a diminishing development with every successive cycle when assessed from one halving occasion to the next one. Notably, the earlier halving cycle, spanning from July 2016 to Might 2020, witnessed a outstanding 1,336% return.

To match or surpass the returns of the previous halving cycle, Bitcoin’s worth would wish to realize roughly $120,000—a big milestone. As anticipation builds across the halving occasion, consideration is concentrated on Bitcoin’s worth trajectory to establish whether or not it may problem the notion of diminishing returns and maintain its spectacular development.

The submit As Bitcoin approaches halving, diminishing returns idea faces crucial check appeared first on CryptoSlate.