Bitcoin proponents have motive to be merry because the alpha coin has gracefully ascended to a promising valuation of practically $38,000 as of late Wednesday, reclaiming its throne with the best worth seen within the final 12 months.

Bitcoin bounced again strongly from its battering the day earlier than, reaching inside hanging distance of a brand new 18-month excessive simply shy of the vaunted value goal.

A drop in federal rates of interest, the expectation that Sam Bankman-Fried’s apology for his actions at FTX is a recent begin for the distressed sector, and the SEC’s approval of a bitcoin exchange-traded fund (ETF) are among the issues that triggered costs to rise.

ETFs are a kind of funding product that tracks an index or a commodity. Bitcoin ETFs would permit buyers to revenue from bitcoin’s rising worth with out really proudly owning any bitcoin.

ByteTree identified that Bitcoin was doing significantly better than normal property like gold and U.S. inventory indexes, which have additionally been going up.

Stories say {that a} choice may usher in an additional $600 billion in demand. An approval for an ETF, in line with CryptoQuant consultants, will trigger Bitcoin’s market capitalization to swell by $1 trillion.

Bitcoin Up 117% This 12 months

As this developed, Bitcoin has had a big enhance of over 117% in worth over the course of this yr. The anticipation of the halving occasion in 2024 has additionally contributed to the rise in market optimism.

The value of Bitcoin (BTC) goes up as individuals attempt to make up for all the bottom they misplaced within the current crash, which erased as much as $90 million in open curiosity.

At $34,572, the 25-day Exponential Shifting Common (EMA) comes into view. BTC is attempting to get again above the essential assist degree at $36,788.

BTCUSD buying and selling at $37,379 on the each day chart: TradingView.com

Regardless of an array of financial challenges, BTC continues to surge upward, registering a 126% year-to-date acquire and choices market information level to speculators angling towards the $40,000 degree.

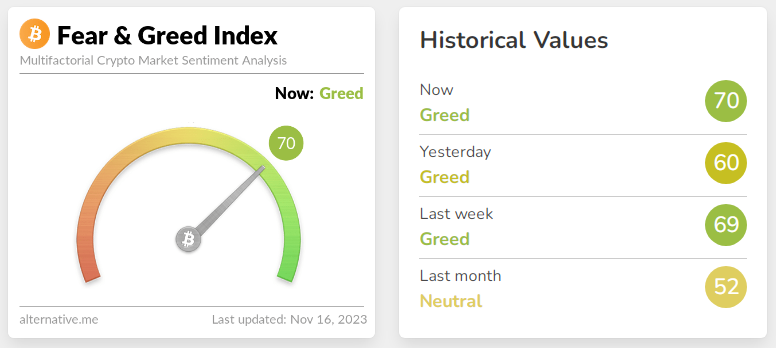

With the current value enhance, the Crypto Concern and Greed index has moved squarely into the “Greed” class, indicating that market temper has improved.

Supply: Different.me

In an atmosphere characterised by an optimistic and optimistic outlook, Bitcoin’s momentum might be amplified and gun for the psychological turning level of $40,000.

This may be a giant 10% rise from the place it’s now. It’s getting stronger as a result of the Relative Energy Index (RSI) is tilting northward, which exhibits a surge in momentum.

Is The Bear Market Behind Us?

In accordance with Zach Pandl, managing chief of analysis at crypto fund supplier Grayscale Investments LLC:

“The restoration in crypto valuations can proceed if actual rates of interest peak and we proceed to see progress towards spot ETF approvals within the US market.”

“Bitcoin is now going mainstream, and the bear is behind us,” Charlie Morris, founding father of funding advisory firm ByteTree, stated in a Wednesday market report.

“The great instances are right here,” he stated.

Supply: CoinShares

In the meantime, institutional buyers have already begun deploying capital to Bitcoin and cryptocurrencies, whereas retail buyers could also be ready for added liquidity from authorized ETFs.

Over the previous yr, institutional buyers have poured over $1 billion into cryptocurrency, CoinShares information present (chart above).

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. Once you make investments, your capital is topic to threat).

Featured picture from cottonbro studio/Pexels