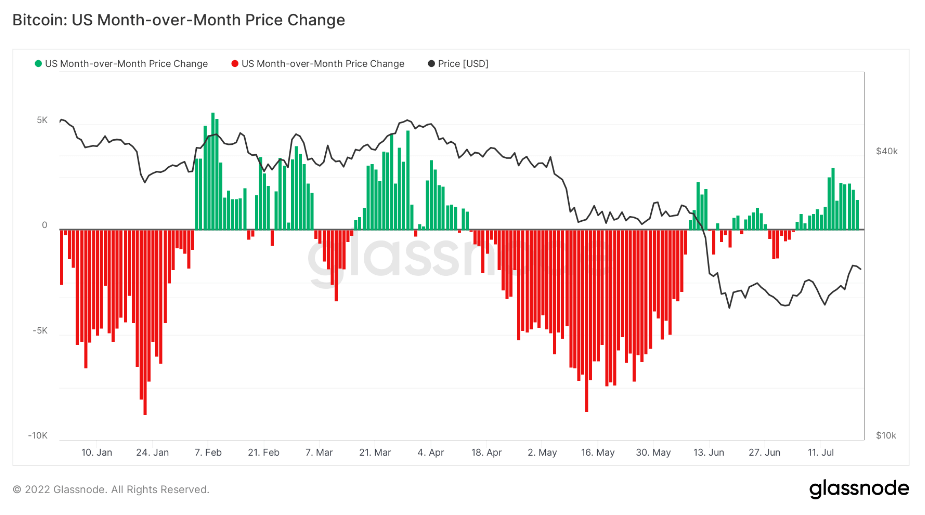

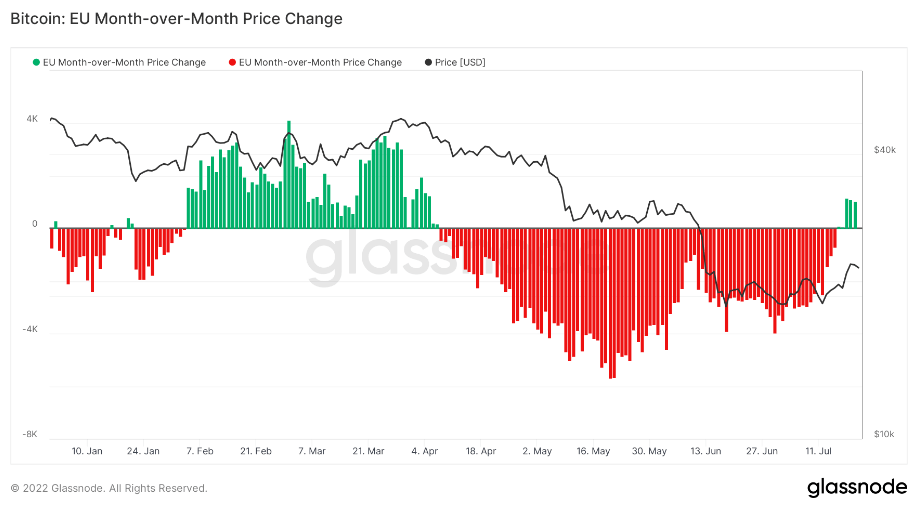

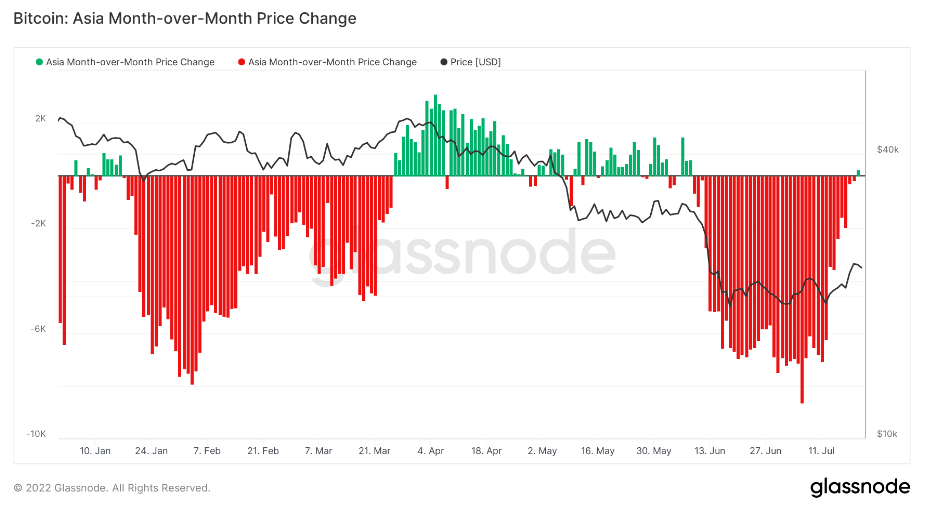

Getting a strong understanding of the worldwide market requires zooming out of day by day and weekly closes. One metric that gives a great perspective of the market’s general well being is the Month-over-Month (MoM) worth change. This metric exhibits the 30-day change in regional costs set throughout U.S., E.U., and Asian working hours. These regional costs are normally decided by calculating the cumulative sum of every area’s worth modifications over a interval of 30 days.

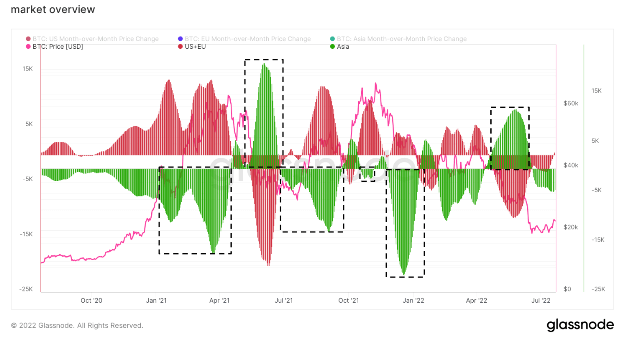

Analyzing the MoM worth change for Bitcoin from October 2021 to July 2022 reveals a number of attention-grabbing traits.

Initially of Could 2022, a development started in Asia that indicated the area’s more and more bullish sentiment towards Bitcoin. Highlighted within the black sq. within the graph above, the development exhibits traders in Asia have been reaping the most important positive aspects within the crypto trade.

The chart above clearly exhibits that Asian traders have dominated the crypto market previously two years and that a lot of the market’s sensible cash appears to be coming from the far east. Traders in Asia have been in a position to promote the early 2021 high after which purchase the 2021 summer season backside, in addition to promote the primary pump of the summer season’s lows.

When Bitcoin dropped to $40,000 in late summer season final 12 months, Asian traders have been the primary to purchase the dip and the primary to promote in November 2021 when Bitcoin reclaimed its all-time excessive.

In Could 2022, buying and selling volumes in Asia have been the very best since final summer season, when the area was profiting from decrease costs on the expense of mass sell-offs within the U.S. and E.U. The Luna collapse and the following insolvency of a number of the trade’s largest gamers like Three Arrows Capital and Voyager have brought on Europeans and Individuals to grow to be extra fearful than ever in terms of the crypto market. Miner capitulation and the broader macroeconomic outlook did not make the scenario higher.

Nevertheless, the Asian-led narrative appears to be altering quickly.

Information for July 2022 has proven that accumulation is going on outdoors of Asia as effectively, with the U.S. and E.U. markets starting to build up collectively for the primary time because the starting of April. This might point out that the West is starting to see Bitcoin as a invaluable asset in occasions of macro and geopolitical uncertainty.