To enhance the nation’s high-value cost system, Colombia’s central financial institution is experimenting with Ripple’s new end-to-end central financial institution digital forex expertise. How will this collaboration have an effect on the value of XRP?

On Thursday, Ripple introduced that the central financial institution of Colombia and the Ministry of Info and Communication Applied sciences (MinTIC) can be exploring the usage of blockchain expertise within the nation’s excessive worth digital cost system with Ripple.

The central financial institution didn’t particularly state it’ll pilot check a central financial institution digital forex, although it’ll make use of Ripple’s CBDC platform, supported by a personal model of the XRP Ledger.

Ripple and @Peersyst are partnering with Colombia’s @BancoRepublica along side @Ministerio_TIC to pilot use instances that can improve Colombia’s high-value cost system.🇨🇴

Be taught extra concerning the partnership: https://t.co/X9jyJ3pvDa

— Ripple (@Ripple) June 15, 2023

Ripple has not let regulatory constraints forestall it from innovating and increasing its attain, notably in Colombia, even if the blockchain startup continues to be engaged in a extremely publicized authorized dispute with the US Securities and Change Fee.

A Technological Answer In The Offing For Colombia?

Blockchain expertise was highlighted by Colombia’s minister of knowledge and communication expertise, Mauricio Lizcano, who claimed that it could supply a technological resolution (Prototype) that will allow simulations of assorted use instances within the high-value cost system.

Peersyst Know-how, a blockchain expertise firm primarily based within the area, is MinTIC’s direct companion.

In keeping with James Wallis, vice chairman of central financial institution engagements and CBDCs, Ripple:

“By harnessing the ability of the CBDC Platform, primarily based upon the XRPL, this venture will pave the way in which for transformative developments within the utilization of blockchain expertise inside the public sector.”

Ripple beforehand launched its end-to-end XRPL-driven CBDC resolution, which might allow central banks, monetary service suppliers, and governments to determine their very own digital currencies whereas additionally aiding them in resolving points with CBDC deployments.

The Colombian authorities stated in August 2022 that it was trying into introducing a CBDC to facilitate transactions and reduce tax evasion, and that it additionally deliberate to ban money transactions for portions greater than 10 million Colombian pesos (about $2,390).

A digital asset custody expertise supplier, Metaco was purchased by Ripple a couple of months in the past, and its clientele contains a number of giant, systemically vital establishments.

What The Newest Collaboration Means For XRP Worth

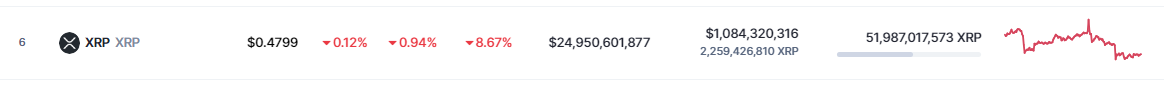

In the meantime, XRP is again within the pink regardless of briefly rising above $0.55 earlier, including greater than $2 billion to its market capitalization in a 24-hour span, and the publication of the contentious papers pertinent to the Ripple lawsuit.

On the time of writing, and after information of the Ripple-Colombia central financial institution partnership broke out, the value of the XRP token appeared it may use extra vitality to extricate itself out of adverse territory.

In keeping with the latest knowledge offered by cryptocurrency market tracker CoinMarketCap, XRP was down by virtually a p.c within the twenty-four hour time-frame, down 8.56 p.c within the final seven days, and threatening the 18 p.c achieve over the previous month. XRP is at the moment buying and selling at $0.47.

XRP market cap at the moment at $24.8 billion. Chart: TradingView.com

There are a selection of potential explanations for the current drop within the value of XRP following the announcement of the partnership between Ripple and the central financial institution of Colombia.

XRP value all in pink. Supply: CoinMarketCap

First, traders could not put a lot inventory within the relationship due to the regulatory considerations that usually accompany partnerships between cryptocurrencies and conventional monetary establishments.

The pattern of XRP’s value might be affected by promoting strain attributable to this uncertainty. The final state of the market and the angle of traders is also components within the drop of cryptocurrency costs.

XRP Worth Trajectory: Components To Contemplate

The worth of XRP could fall no matter particular information or collaborations if there’s a insecurity within the crypto sector or a common slowdown within the broader economic system.

Investor emotion, market circumstances, and regulatory issues all play a job in how a lot of an impact the Ripple-Colombia central financial institution settlement has on XRP’s value.

On the identical time, the dispute between the SEC and Ripple is a significant factor influencing the worth of XRP. Though the discharge of the Hinman paperwork first boosted XRP since they appeared to help Ripple’s case, the altcoin’s value finally fell as traders’ confusion and fear overcame their preliminary pleasure.

(This website’s content material shouldn’t be construed as funding recommendation. Investing entails threat. If you make investments, your capital is topic to threat).

Featured picture from The Coin Republic