With inflation skyrocketing throughout the worldwide economic system, the prices of dwelling in many countries have soared. A mixture of elements like COVID-19-related provide chain disruptions, labour shortages, and Russia’s invasion of Ukraine have inflicted ache on the economic system and threatened the worldwide meals provide.

In Australia, the annual Client Value Index (CPI) of meals and non-alcoholic drinks rose 4.3% from March 2021 to March 2022. Amid rocketing grocery costs and powerful demand, one should search for shares whose costs may improve with inflation. Additional, meals shares are usually a hedge in opposition to plummeting markets as their merchandise are at all times in demand.

Additionally learn: AAC, GNC, RIC: How are these ASX meals shares performing?

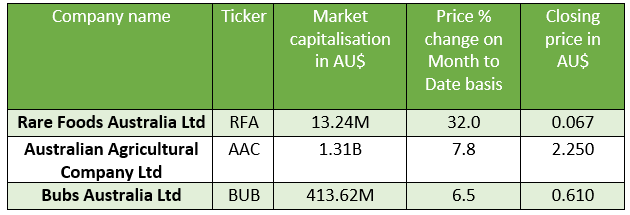

On that be aware, let’s have a fast look at three ASX meals shares which have supplied first rate value returns on a month-to-date foundation.

Knowledge supply: Refinitiv as of 20 June

Uncommon Meals Australia Ltd (ASX: RFA)

Uncommon Meals Australia provides premium, wild-harvested, Greenlip abalone (a marine snail) to native and abroad prospects. The corporate has developed the world’s first industrial Greenlip abalone sea ranching enterprise and has constructed proprietary, purpose-built synthetic abalone reefs.

Just lately, Uncommon Meals obtained a certification from the Marine Stewardship Council (MSC) as a completely accredited and internationally recognised Wild Enhanced and Sustainable Fishery for Greenlip Abalone. Additionally, on 01 June 2022, the corporate launched its direct-to-customer eCommerce channel.

Australian Agricultural Firm Restricted (ASX:AAC)

Picture supply: © 2022 Kalkine Media®

Within the half-year ended 31 December 2022, AAC drastically elevated its Statutory Web Revenue after tax to AU$136.9 million vs AU$45.5 million of the earlier corresponding interval (pcp).

Based on the corporate, the important thing driver behind improved outcomes is its gross sales within the USA. Its branded meat gross sales worth grew by 56% in North America, and gross sales quantity elevated by 21%.

Bubs Australia (ASX: BUB)

Bubs Australia offers in a variety of premium Australian toddler diet and goat dairy merchandise. It additionally contains speciality and dietary milk powder merchandise for the entire household. The corporate gives a variety of merchandise for feeding instances in addition to levels of growth from new child via to childhood.

Final week, BUB upgraded its FY22 income and earnings expectations. Now the corporate is anticipating gross income to be greater than AU$100 million for FY22, topic to scheduled operations occurring with out disruption, with a minimum of a 100% improve on the AU$1.2 million underlying EBITDA (excluding non-cash fairness compensation bills).

Associated learn: Bubs (ASX:BUB) expands US presence, turns into provider to Walmart