Avalanche (AVAX) has wanted assist recovering its losses on this unstable crypto market. In comparison with different Layer-1 (L1) blockchains, AVAX consolidation may have been quicker, elevating issues about its future efficiency.

Associated Studying

Regardless of this uncertainty, latest value motion reveals AVAX consolidation above the $19.80 help, buying and selling at $22.11 when writing and making a optimistic sentiment amongst bulls. The Avalanche funding charge has turned optimistic for the primary time since late July, and a few analysts are even anticipating a possible reversal in Avalanche’s fortunes.

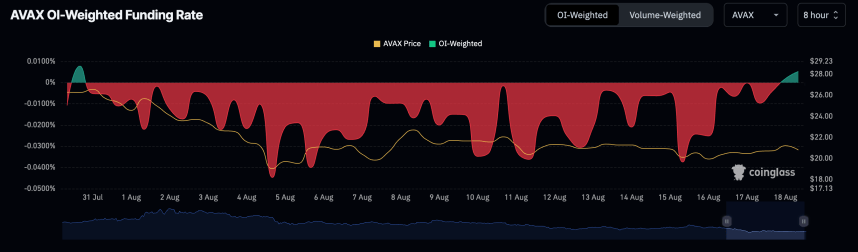

AVAX Funding Price Turns Constructive

In keeping with Coinglass knowledge, AVAX’s funding charge has flipped to optimistic territory, signaling a possible change in market dynamics.

A optimistic funding charge in futures buying and selling usually signifies elevated demand for lengthy positions, as merchants are keen to pay a premium to carry them. This bullish strain means that extra merchants are betting on AVAX’s value rising fairly than falling, a notable shift from the bearish sentiment that has dominated the market in latest weeks.

The present optimistic funding charge for AVAX signifies that bullish sentiment is gaining momentum, which may foreshadow a breakout if bulls efficiently push the value above the essential $23 degree.

October 2023 Vs. August 2024: Avalanche AT A Turning Level?

Patrons hope a breakout above $22.79 will change the weekly bearish construction, and a few traders are wanting again to October 2023 for similarities.

Analysts like Daghan on X anticipate a reversal and have in contrast the present market situations and people in October 2023, simply earlier than Avalanche’s value skyrocketed from $8 to this 12 months’s peak of $65 by March 18th.

In his comparability, Daghan explains the depth of AVAX’s uptrends after lengthy and deep corrections, displaying how briskly its value strikes after it shifts from bearish to bullish.

Presently, Avalanche is buying and selling at $22.11 and should break above this key resistance degree to problem the provision zone round $22.79 and set up a brand new larger excessive. If bulls can reclaim the $23 degree, it may sign a broader market restoration for AVAX. Nonetheless, if the market fails to carry above the August 5 low at $19.53, there’s a danger of a draw back transfer, probably retesting demand beneath $17.50, with the subsequent bearish goal at $15.

Because the funding charge indicators a doable shift in market sentiment, the approaching days shall be crucial in figuring out whether or not AVAX can break away from its present consolidation and resume its upward trajectory.

Cowl picture from Unsplash, chart from Tradingview