Este artículo también está disponible en español.

Avalanche has skilled a powerful 25% surge since Wednesday, pushed by the Federal Reserve’s announcement of a 50 bps rate of interest reduce. This has pushed AVAX to a essential resistance stage, which can doubtless form its worth motion within the coming weeks. At the moment buying and selling close to $28, the token is testing a key provide zone that has analysts and traders paying shut consideration to its subsequent transfer.

Associated Studying

Many market individuals are optimistic, projecting {that a} break above this resistance might pave the way in which for an aggressive rise in AVAX’s worth. This is able to doubtless push AVAX into a brand new uptrend, doubtlessly resulting in contemporary highs and even a 50% surge for the token. Nevertheless, if Avalanche fails to interrupt by means of this stage, it dangers a pullback that might see costs retest earlier assist ranges.

Analysts are highlighting this second as essential for figuring out AVAX’s market path, as broader crypto sentiment has turned extra bullish following the Federal Reserve’s latest choice. With rising buying and selling quantity and investor curiosity, the following few days shall be key in establishing whether or not Avalanche can maintain its momentum or face a short-term correction.

Avalanche Testing Key Provide Ranges

Avalanche has been one of many top-performing altcoins in latest days, displaying spectacular power amid a broader market surge. This latest momentum might be only the start of a extra important transfer for AVAX, as analysts and traders are projecting even bigger positive aspects if the token continues to interrupt by means of key provide ranges.

Some of the revered figures within the crypto area, Carl Runefelt, shared a bullish technical evaluation of Avalanche on X, stating that AVAX has damaged out of a falling wedge sample, a traditional indicator of bullish worth motion.

In accordance with his evaluation, AVAX efficiently retested the wedge and is now focusing on medium-term worth ranges. Runefelt’s worth targets for AVAX are $28, $33, $41.30, and $54, every representing essential provide zones that the token must surpass to proceed its upward trajectory. If AVAX hits $41.30, it can mirror a 50% surge from its present worth, marking important progress.

Associated Studying

At the moment, Avalanche has shaped a brand new excessive, confirming its power. Whereas the worth might consolidate earlier than making its subsequent transfer, many traders imagine that this consolidation might be a stepping stone towards a bigger surge.

With broader market sentiment turning optimistic after the latest Federal Reserve rate of interest reduce, AVAX is well-positioned to proceed climbing, particularly as extra traders look to capitalize on its robust technical setup.

If AVAX can keep this momentum, it might doubtlessly result in important positive aspects within the medium time period.

Value Ranges To Watch

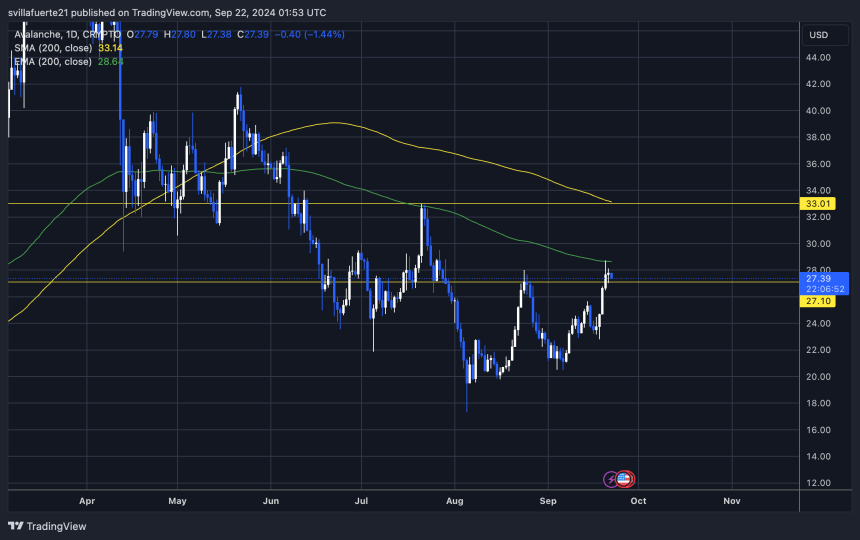

AVAX is at present buying and selling at $27.39 after testing the each day 200 exponential shifting common (EMA) at $28.66. The token has skilled a powerful 40% surge since early September, pushing it nearer to essential provide ranges that may doubtless form the worth motion within the coming weeks.

For bulls to take care of momentum and prolong the rally, AVAX wants to interrupt by means of the $28 resistance and reclaim the 1D 200 EMA as assist. Doing so would sign a extra sustained uptrend and place AVAX for additional positive aspects.

Associated Studying

Nevertheless, if the worth struggles to carry above the $25 mark, a deeper correction might observe, bringing short-term bearish strain. Regardless of this threat, there stays a risk for AVAX to consolidate between $25 and $28, giving the token room to collect power for a extra important surge within the close to future. Traders are intently watching these ranges because the market seeks path.

Featured picture from Dall-E, chart from TradingView