Avalanche worth has staged a major restoration up to now week within the wake of Bitcoin’s spectacular rally. The digital asset has gained almost 16% over the past week and greater than 22% within the yr up to now. Regardless of its current positive factors, AVAX remains to be struggling to get well from losses it revamped the previous month, because it stays 8.72% decrease over the interval.

Elementary Evaluation

Avalanche worth has been rallying for the previous few days amid bullish sentiment within the cryptocurrency market. Knowledge by Coinmarketcap exhibits that the worldwide crypto has elevated by 1.63% over the previous 24 hours to $1.19 trillion, whereas the entire crypto market quantity slipped by 4%. Bitcoin’s dominance has elevated to 50%, its highest degree because the begin of the yr.

The crypto market has been on a powerful bullish trajectory for the previous few days regardless of the regulatory crackdown on cryptocurrencies and macroeconomic uncertainties. Bitcoin’s break above the important resistance of $30,000 has additionally buoyed the constructive sentiment within the crypto trade. On the time of writing, Bitcoin worth was buying and selling at $30,699.

Buyers are carefully monitoring feedback by international central banks this week forward of the US and UK Gross Home Product (GDP) knowledge for Q1 later within the week. Markets are anticipating a decline within the US financial progress, forecasting a dip to 1.4%, down from 2.6%. UK’s quarterly GDP is anticipated to stay unchanged, whereas the yearly financial progress slips to 0.2%.

Buyers are anticipating feedback by the Federal Reserve Chairman, Jerome Powell, later within the week, searching for contemporary hints concerning the Fed rate of interest path. Wall Avenue scrutinized June’s shopper confidence report, that confirmed a stunning improve for the month.

The Convention Board Client Confidence Index rose to 109.7 in June, up from 102.5 in Could and its highest degree since January 2022. The Expectations Index, which measures shopper’s short-term outlook for enterprise, revenue, and labor market situations rose to 79.3, a shade beneath 80- the extent related to a recession within the subsequent yr. Focus will now be on the non-public shopper expenditure (PCE) index report set to be launched on Friday.

Avalanche Worth Technical Evaluation

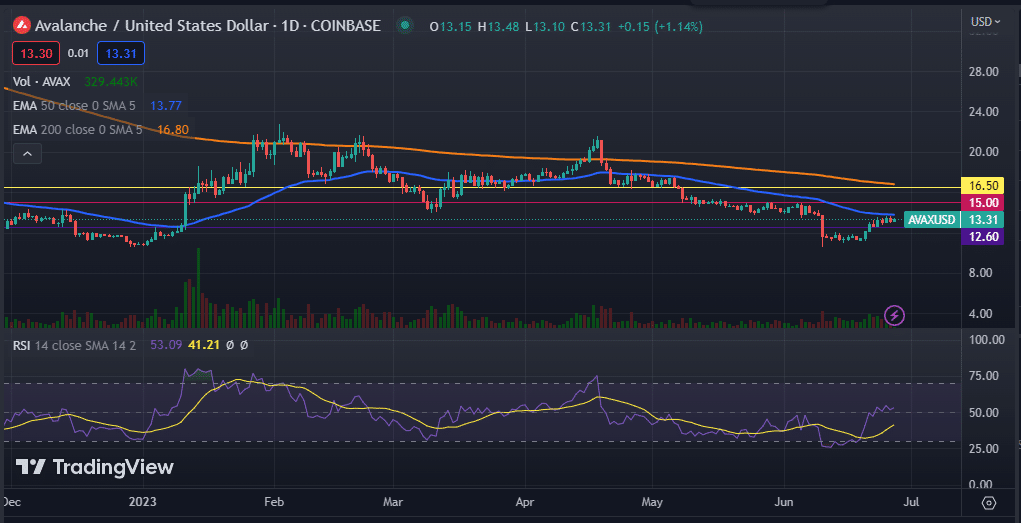

The each day chart exhibits that the Avalanche worth has been on a powerful upward trajectory for the previous few weeks. Even so, the digital forex has failed to maneuver above the 50-day and 200-day exponential transferring averages, in addition to the 50-day and 100-day easy transferring averages. The altcoin has additionally failed to interrupt the key hurdle at $15.

Nonetheless, its Relative Energy Index (RSI) has moved larger into the impartial zone, with the Transferring Common Convergence Divergence (MACD) indicator hinting at a bullish pattern. Its Momentum indicator can also be bullish.

Subsequently, I anticipate the Avalanche worth to proceed rising within the fast time period as consumers goal the following resistance degree at $15. A transfer previous the aforementioned degree may be sufficient to maintain the bullish pattern. Conversely, a transfer beneath the help degree of $12.60 will invalidate the bullish thesis.

AVAX Worth Chart