Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

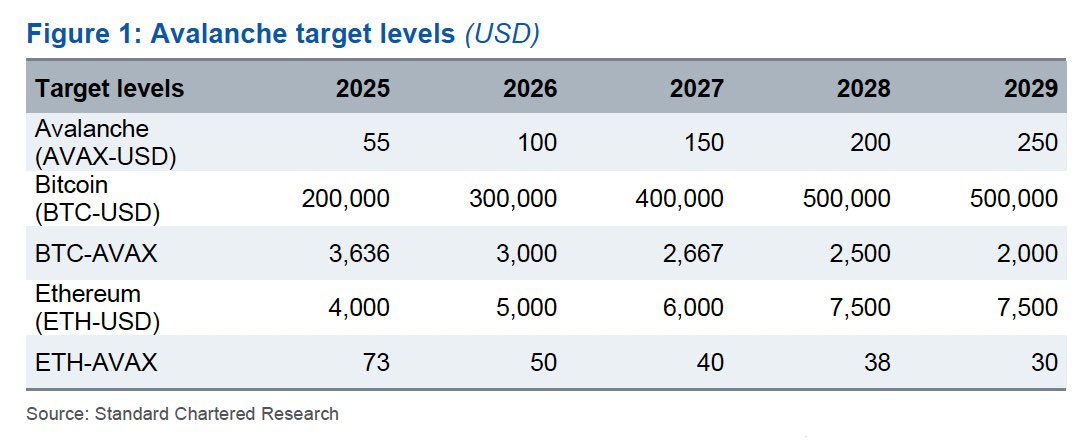

World banking big Normal Chartered revealed new five-year value projections for 3 main cryptocurrencies: Avalanche (AVAX), Bitcoin (BTC), and Ethereum (ETH). In keeping with these forecasts, Avalanche is poised to realize vital floor on each Bitcoin and Ethereum by 2029.

Ryan Rasmussen, Head of Analysis at Bitwise, drew consideration to those formidable targets by way of X. “World banking big Normal Chartered simply revealed 5yr value targets for Bitcoin, Ethereum, and Avalanche,” Rasmussen wrote, pointing to a chart that outlined the financial institution’s estimates.

Normal Chartered expects Avalanche (AVAX) to achieve $55 by the tip of 2025, $100 by 2026, $150 by 2027, $200 by 2028, and in the end $250 by the tip of 2029. This projected progress represents a greater than 1,200% improve from its present buying and selling stage of round $20.

In the meantime, Bitcoin (BTC) up to date its forecast and now tasks BTC to understand from $200,000 in 2025 to $300,000 in 2026, adopted by $400,000 in 2027, and at last hitting $500,000 in 2028—a stage it’s anticipated to take care of by 2029.

For Ethereum (ETH), Normal Chartered tasks the token to hit $4,000 in 2025, $5,000 in 2026, $6,000 in 2027, and $7,500 by 2028, with no change anticipated in 2029. The forecast signifies regular however much less dramatic progress relative to Avalanche.

Associated Studying

When it comes to comparative valuation, the financial institution offered ratio metrics to indicate how AVAX would possibly carry out in opposition to BTC and ETH. The BTC-to-AVAX ratio, which measures what number of AVAX tokens equal one BTC, is anticipated to drop from 3,636 in 2025 to 2,000 in 2029.

This lowering pattern implies that AVAX will recognize sooner than Bitcoin over the interval. Equally, the ETH-to-AVAX ratio is projected to say no from 73 to 30 throughout the identical timeframe, pointing to an identical outperformance in opposition to Ethereum.

Normal Chartered’s Bullish Case For Avalanche

Normal Chartered has initiated protection of Avalanche, stating it expects AVAX to rise from its present value of roughly $20 to $250 by the tip of 2029. “One optimistic of the tariff noise is that it provides us an opportunity to re-set and decide winners for the following upswing in digital asset costs,” mentioned Geoffrey Kendrick, the financial institution’s world head of digital belongings analysis, in an electronic mail to The Block on Wednesday, referencing his newest report. “And I believe Avalanche can be one other winner, maybe the winner in EVM [Ethereum Virtual Machine] chains.”

Associated Studying

Kendrick emphasised that Avalanche’s strategy to scaling—notably after its Etna improve, often known as Avalanche9000—positions the community for long-term success. Activated in December 2024, the Etna improve dramatically decreased the price of launching subnets (which Avalanche now calls Layer 1 blockchains), slashing setup bills from as much as $450,000 to almost zero.

Kendrick famous that these modifications look like attracting new developer exercise: “1 / 4 of Avalanche’s lively subnets are actually Etna-compatible, and developer numbers have jumped 40% for the reason that improve.”

He additionally talked about that some builders are migrating from Ethereum Layer 2 options to Avalanche because of its compatibility with Ethereum code and the decrease overhead for launching new subnets or L1 chains. Whereas charges on Avalanche can nonetheless run increased than sure Ethereum L2s like Arbitrum, Kendrick believes attracting fully new functions—particularly in fields corresponding to gaming and consumer-focused instruments—can be crucial to Avalanche’s progress.

“In consequence, we see AVAX outperforming each Bitcoin and Ethereum when it comes to relative value features within the coming years,” Kendrick remarked, whereas noting Avalanche’s increased volatility ranges in comparison with BTC.

At press time, BTC traded at $83,334.

Featured picture created with DALL.E, chart from TradingView.com