In a disheartening flip of occasions, the decentralized finance (DeFi) protocol Balancer (BAL) confirmed a hack simply days after warning a few essential vulnerability impacting a number of Swimming pools. The assault, which passed off on August 27, resulted in a lack of almost $1 million for Balancer.

Beforehand, on August 22, NewsBTC reported that Balancer had found a essential vulnerability affecting its protocol. Nevertheless, regardless of efforts to mitigate the dangers and warning customers, Balancer couldn’t pause the affected swimming pools. In response, the protocol urged customers to withdraw from the impacted liquidity swimming pools to forestall additional exploits.

Balancer Exploit Unveiled

On Sunday, Balancer took to X (previously generally known as Twitter) to acknowledge the existence of an exploit associated to the beforehand disclosed vulnerability. Whereas mitigation measures have been applied to scale back dangers, they have been inadequate to halt the affected swimming pools.

Consequently, customers have been suggested to withdraw their funds from the susceptible liquidity swimming pools to safeguard their investments.

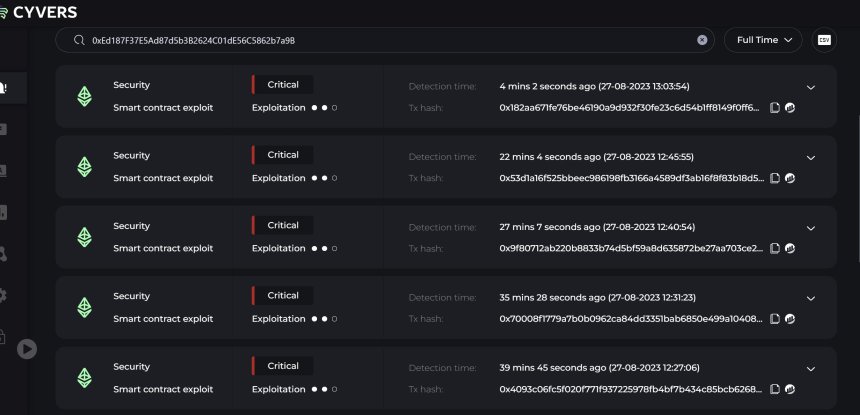

Meir Dolev, a Web3 safety knowledgeable, make clear the state of affairs, revealing that the attacker was persistently finishing up their operation. Roughly $900,000 was affected, with over $600,000 already transferred to the tackle 0xB23711b9D92C0f1c7b211c4E2DC69791c2df38c1.

On the identical notice, Blockchain safety agency Beosin additional divulged that the hack was executed by means of a number of flash mortgage assaults. Flash loans, a function enabling customers to borrow funds with out collateral, have been more and more utilized as instruments for exploitation within the DeFi house.

The Balancer exploit underscores the continuing challenges DeFi platforms face in making certain person funds’ security. Because the business continues to innovate and appeal to important capital, securing protocols and addressing vulnerabilities should stay a high precedence.

BAL Value Plunges, Exploit Triggers 20.81% Decline

Within the aftermath of the current exploit that focused Balancer, the challenge’s native token, BAL, has skilled important market repercussions.

The exploit, which resulted in a lack of roughly $1 million, has had a noticeable influence on BAL’s value and varied key metrics, reflecting the challenges confronted by the platform, in line with Token Terminal information.

As a consequence, BAL’s value has witnessed appreciable volatility. Over the previous 30 days, the token has skilled a pointy decline of 20.81%, as seen within the chart under.

This downward development is additional highlighted by the token’s efficiency over an extended interval of 180 days, throughout which it has plummeted by 51.69%, underscoring the influence of the exploit on investor sentiment and market confidence in BAL.

Moreover, BAL’s all-time excessive (ATH) stands at $74.45, serving as a reminder of the token’s earlier value peak. Nevertheless, the all-time low (ATL) of $3.36 reveals the extent of the token’s decline following the exploit.

The exploit’s aftermath has additionally affected Balancer’s market capitalization metrics. The circulating market cap, representing the worth of BAL tokens in circulation, at the moment stands at $150.06 million. Nevertheless, this metric has suffered a notable decline of twenty-two.60%, indicating a lower in token valuation and investor confidence.

One other essential metric the exploit impacts is Balancer’s complete worth locked (TVL). TVL represents the quantity of capital locked throughout the protocol.

Within the aftermath of the exploit, Balancer’s TVL has declined by 33.86%, signaling a shift in investor sentiment and potential reallocation of funds to safer platforms.

Featured picture from iStock, chart from TradingView.com