A collection of pretend banking apps are making the rounds in India, mimicking trusted establishments to steal credentials and, in the end, cash.

The size of the marketing campaign is spectacular, that includes practically 900 totally different malware samples tied to round 1,000 totally different telephone numbers used to perpetrate the fraud. Researchers from Zimperium noticed all these malware couched in apps that mimic billion-dollar monetary establishments, designed to focus on common individuals throughout India.

Banking Fraud in East India

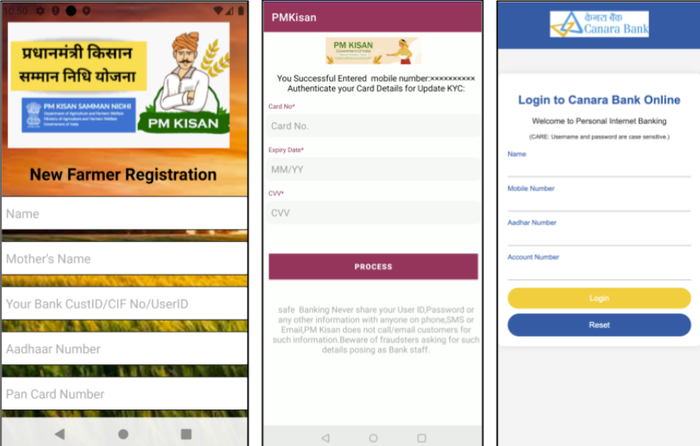

Throughout India, common individuals have been receiving WhatsApp messages carrying malicious Android Package deal Package (APK) recordsdata. As soon as downloaded, these APKs open into faux apps mimicking one in every of greater than a dozen banks, together with a lot of the largest in India: HDFC Financial institution, ICICI Financial institution, the State Financial institution of India (SBL), and others.

Supply: Zimperium

The apps ask victims to submit their most delicate monetary data, together with their cell banking credentials, credit score and debit card numbers, ATM PINs, Everlasting Account Quantity (PAN) Card — used for varied monetary and authorities functions, like paying taxes or opening a checking account — and Aadhar Card, and equal to a Social Safety quantity (SSN).

To permit the attackers to log into victims’ financial institution accounts, the malware intercepts one-time passwords despatched through SMS, and redirects them both to an attacker-controlled telephone quantity, or a command-and-control (C2) server working on Firebase.

The malware additionally sports activities stealth and anti-analysis measures, like “packing,” the place the malware is compressed, encrypted, and obfuscated to the purpose of illegibility. It will possibly set up itself invisibly by profiting from accessibility providers, and procure all conceivable permissions on customers’ units by merely prodding a consumer to thoughtlessly hit “Permit” when it asks properly.

“Since you do not see the app, it isn’t straightforward to uninstall it,” explains Nico Chiaraviglio, chief scientist at Zimperium. “And then you definately [have to deal with the] increased permissions. So if you wish to uninstall the app, the system will say you can’t set up it as a result of it is a system app. You principally want to attach the telephone to a pc and uninstall it utilizing the Android Debug Bridge (ADB). It isn’t one thing that you are able to do from a daily consumer’s standpoint.”

Why Fraud Works in India

Cellphone numbers tied to the marketing campaign lovingly named “FatBoyPanel” have tended to pay attention in jap states: West Bengal (30.2%), Bihar (22.6%), Jharkjand (10%).

That FatBoyPanel appears to be going so properly, Chiaraviglio thinks, comes right down to a few apparent elements. First: older, outdated telephones are frequent in East India, and, “If you wish to run some form of exploit, it is simpler to do on older units,” he says.

“It is also broadly recognized that there are numerous scammers in India,” he provides. On this marketing campaign, “They’re focusing on some particular apps, and this principally tells you that the attackers are Indians, and that they know the market that they’re working in.”

One factor stunned him, he says: “We publish a report yearly on banking Trojans, and we see most of them focusing on many various international locations on the similar time. It’s totally unusual that we see a marketing campaign that’s solely focusing on one nation.”