Liquid Staking Derivatives (LSDs) on Ethereum had been one of many largest subjects within the crypto market within the first months of 2023. Due to Ethereum’s shift from Proof of Work (PoW) to Proof of Stake (PoS), LSD initiatives equivalent to Lido Finance (LDO) and Frax Finance (FXS) flourished.

In easy phrases, LSDs are monetary devices that signify tokens which have been used as receipts inside a DeFi protocol. By means of these, customers are in a position to stake their token whereas having the flexibleness to make use of these LSDs in different decentralized functions.

Finest New Crypto Narrative For H2 2023?

And in keeping with some specialists, LSDfi might turn out to be the brand new largest development for the second half of 2023. Crypto analyst @DaanCrypto not too long ago wrote: “My greatest guesses for narratives going into the Summer time: BTC Chain/Layer, LSDfi. Been loading up on some ALTS that fall into these classes.” Remarkably, Binance Analysis additionally not too long ago printed an in depth report on LSDfi that’s effectively price studying for buyers.

LSDfi refers to DeFi protocols constructed on liquid staking derivatives. By offering further yield alternatives, LSDfi protocols permit LSD holders to leverage their belongings and maximize returns. In accordance with Binance’s report, LSDfi protocols have seen a speedy improve in Complete Worth Locked, TVL in latest months, benefiting from the introduction of liquid staking.

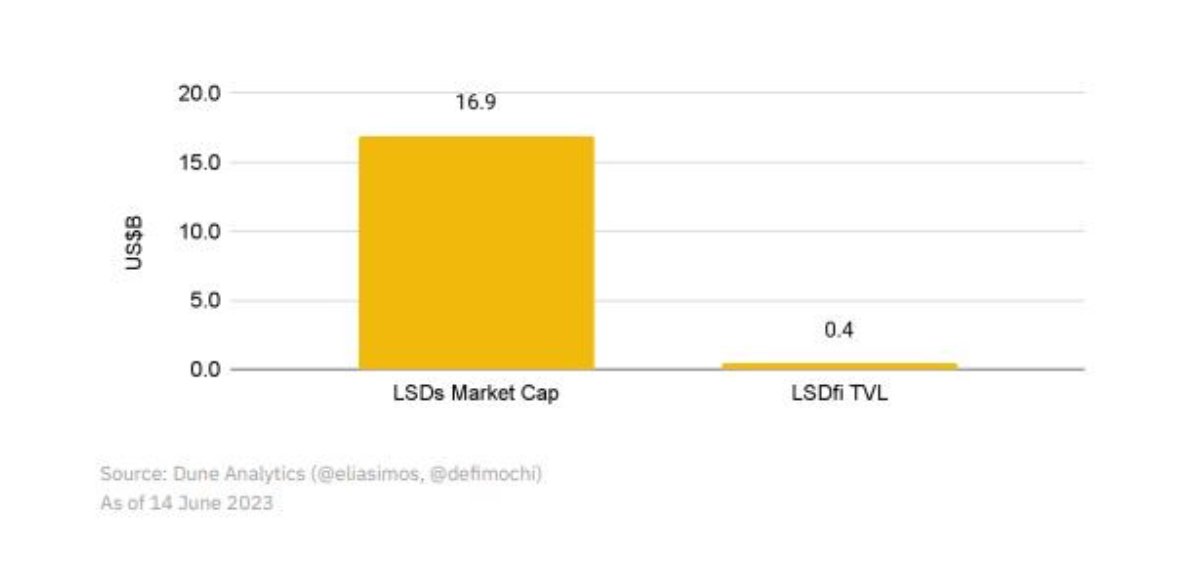

Cumulative TVL throughout the main LSDfi protocols has surpassed the $400 million mark, greater than doubling within the final month. Tailwinds for LSDfi development embrace the rise of staked ETH in addition to the present low adoption of LSDfi.

Remarkably, the development continues to be comparatively younger. LSDs at present maintain an $16.9 billion market cap, whereas LSDfi solely accounts for two% of that market, creating a large alternative.

As well as, ETH’s staking ratio is considerably decrease than the common of the highest 20 PoS chains. The ETH ratio is simply 16.1%, whereas the common ratio is 58.1%. The expansion potential is subsequently additionally enormous in view of this.

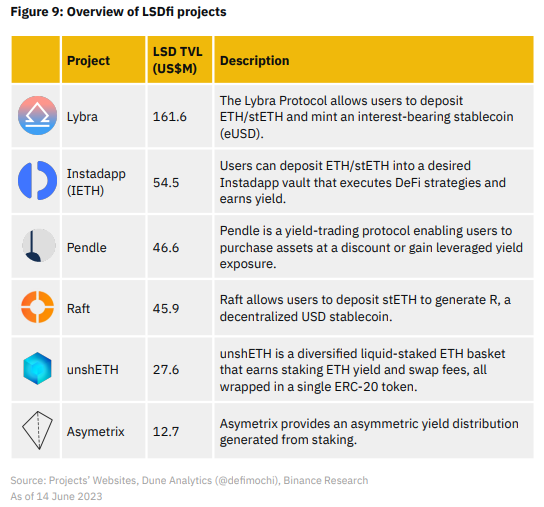

Common crypto researchers @MooMs and @Flowslikeosmo appeared into the Binance report and examined a very powerful initiatives within the LSDfi area in the meanwhile. Presently, the LSDfi panorama is comparatively concentrated, with the 5 largest gamers proudly owning over 81% of TVL. Lybra is the market chief, and its rise to the highest has been speedy, contemplating that the venture solely went on-line on its essential community in April.

Lybra Finance (LBR) was a pioneer within the LSDfi area, launching eUSD, one of many quickest rising yielding steady cash within the area. Up to now, Lybra holds over 36% of all LSD TVL and is engaged on some massive modifications to its tokenomics mannequin for V2.

LBR v2 is anticipated to carry some enormous modifications to the tokenomics mannequin. “With Lybra at present buying and selling at a big 70% low cost from its earlier highs, it’s positively price maintaining a tally of.” says @Flowslikeosmo.

In second place is at present Instadapp (INST), which is revolutionizing the DeFi trade by making a complete hub for all issues DeFi. Instadapp’s IETH has seen explosive development and at present holds 13.38% of the LSDfi market share. With the present good methods, customers can earn increased returns on their ETH by utilizing dApps equivalent to AAVE, Morpho, MakerDAO and Compound.

The third largest LSDfi protocol is at present Pendle, which permits customers to make use of “upfront” returns to create custom-made methods that match their threat tolerance and time preferences. Notably, Pendle has two return aggregators which have not too long ago launched so as to add worth to the Pendle ecosystem.

Necessary to notice: Regardless that LSDfi gives enticing alternatives for LSD customers, customers ought to concentrate on the dangers concerned.

At press time, Lybra Finance (LBR) traded at $1.65, down 66.9% from the all-time excessive on Could 29.

Featured picture from iStock, chart from TradingView.com