Buyers consider it’s extremely probably that the goal fee will stay unchanged on the June 14 Federal Open Market Committee (FOMC) assembly, following the U.S. Federal Reserve’s resolution to extend the federal funds fee by 25 foundation factors on Might 3. Because the battle towards inflation within the U.S. rages on, the Biden administration appointed Philip Jefferson as the brand new vice chair to interchange Lael Brainard. The American president said that his nominees will play a “essential function” in sustaining worth stability and overseeing the nation’s monetary establishments.

Fedwatch Software Factors to Low Likelihood of Charge Hike

Simply over every week in the past, on Might 3, 2023, the U.S. central financial institution raised the federal funds fee to five.25% after a quarter-point fee hike. Fed chair Jerome Powell was fast to emphasise that inflation was nonetheless a serious concern and that the FOMC was dedicated to bringing the inflation fee again all the way down to the two% goal. Nevertheless, the most recent Shopper Value Index (CPI) report, launched on Might 10, revealed that over the previous 12 months, “the all gadgets index elevated 4.9%.”

Final Friday was a tough day for the inventory market, with the S&P 500, Dow Jones Industrial Common, Nasdaq Composite, and Russell 2000 Index all closing within the purple. The crypto economic system has additionally been experiencing a downward development, whereas treasured metals like gold and silver have been buying and selling sideways.

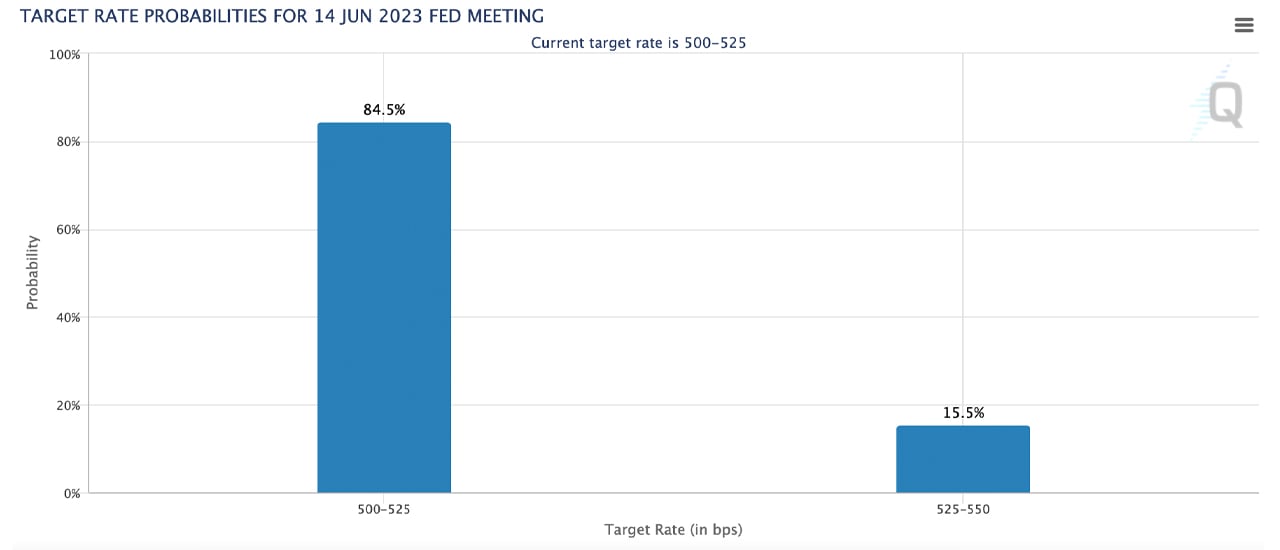

The following FOMC assembly is shaping as much as be a nail-biter, with the most recent information from the CME Fedwatch software indicating that there’s an 84.5% probability the rate of interest will stay unchanged. Nevertheless, there’s additionally a slim probability of a quarter-point fee hike to five.50%, with the Fedwatch software displaying a likelihood of roughly 15.5%.

Biden’s New Fed Vice Chair Faces Excessive Expectations

Forbes journalist Simon Moore experiences that the majority policymakers favor retaining rates of interest at their present stage, in response to the most recent information from March. Nevertheless, Moore says just a few consider charges must be nearer to six%, and one participant predicts charges is not going to stay at their present stage by the tip of the 12 months.

In line with the reporter, the query on each market investor’s thoughts is whether or not or not the central financial institution will pivot this 12 months. Along with the expectations in regards to the subsequent FOMC assembly, president Joe Biden has additionally made some main adjustments to the Fed’s management.

With contemporary blood on the helm, many are questioning how this may impression the central financial institution’s insurance policies and priorities shifting ahead. Powell will now have a brand new second-in-command as president Biden appointed Philip Jefferson as the brand new vice chair. Biden said that Jefferson was confirmed by the Senate with a robust bipartisan vote of 91-7 and harassed that he appears ahead to his “swift affirmation” as vice chair.

Reviews recommend that Jefferson is aligned with Powell’s efforts to curb inflation and is unlikely to push again towards the Fed’s present insurance policies.

What do you assume the appointment of Philip Jefferson as the brand new Fed vice chair means for the way forward for the central financial institution’s insurance policies? Share your ideas about this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct supply or solicitation of a suggestion to purchase or promote, or a advice or endorsement of any merchandise, companies, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss induced or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or companies talked about on this article.