A crypto strategist who precisely referred to as the pre-halving Bitcoin (BTC) correction thinks altcoins are near taking heart stage.

Pseudonymous analyst Rekt Capital tells his 473,400 followers on the social media platform X that he’s keeping track of the OTHERS chart, which merchants use to trace the altcoin market because it measures the entire market cap of crypto excluding the highest 10 digital property and stablecoins.

In line with Rekt, OTHERS seems to be following a script he specified by February, suggesting that the broader altcoin market is poised to print positive aspects of about 42% from its present stage of $297.5 billion.

“Altcoin Market Cap [performed] its highest weekly shut since early April 2024. Additionally, completely following the last word altcoin market cap recreation plan outlined earlier this 12 months.”

Rekt’s chart, he appears to foretell that OTHERS will rally to its weekly resistance at $425 billion.

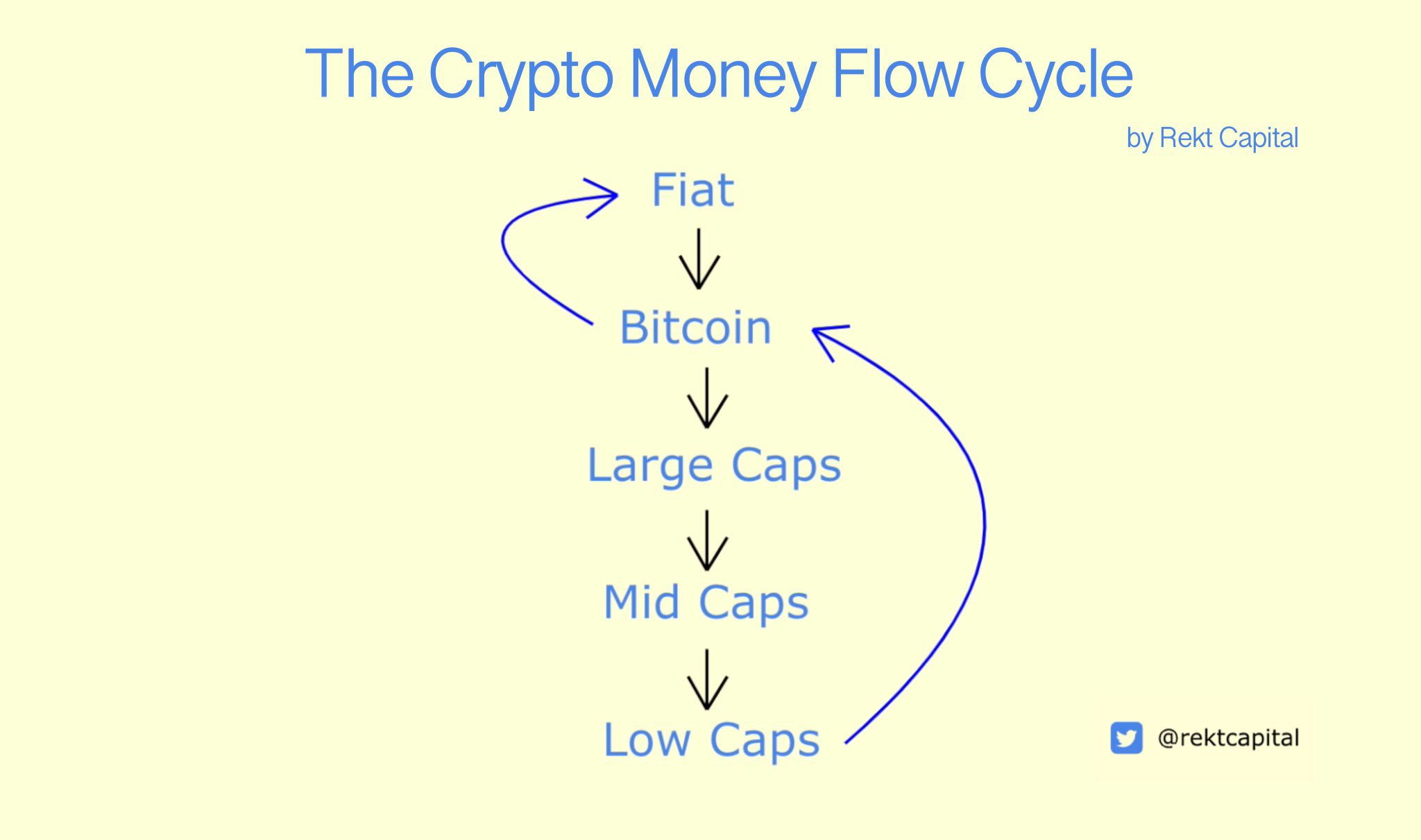

As for the timeline of altcoin surges, Rekt believes that capital rotation into alts will occur as soon as Ethereum (ETH) takes a breather.

“It’s not but clear if the ETH rally is over, however when ETH is able to consolidate after its ETF (exchange-traded fund)-fuelled breakout transfer… Altcoins ought to be capable of profit from newfound cash circulate.”

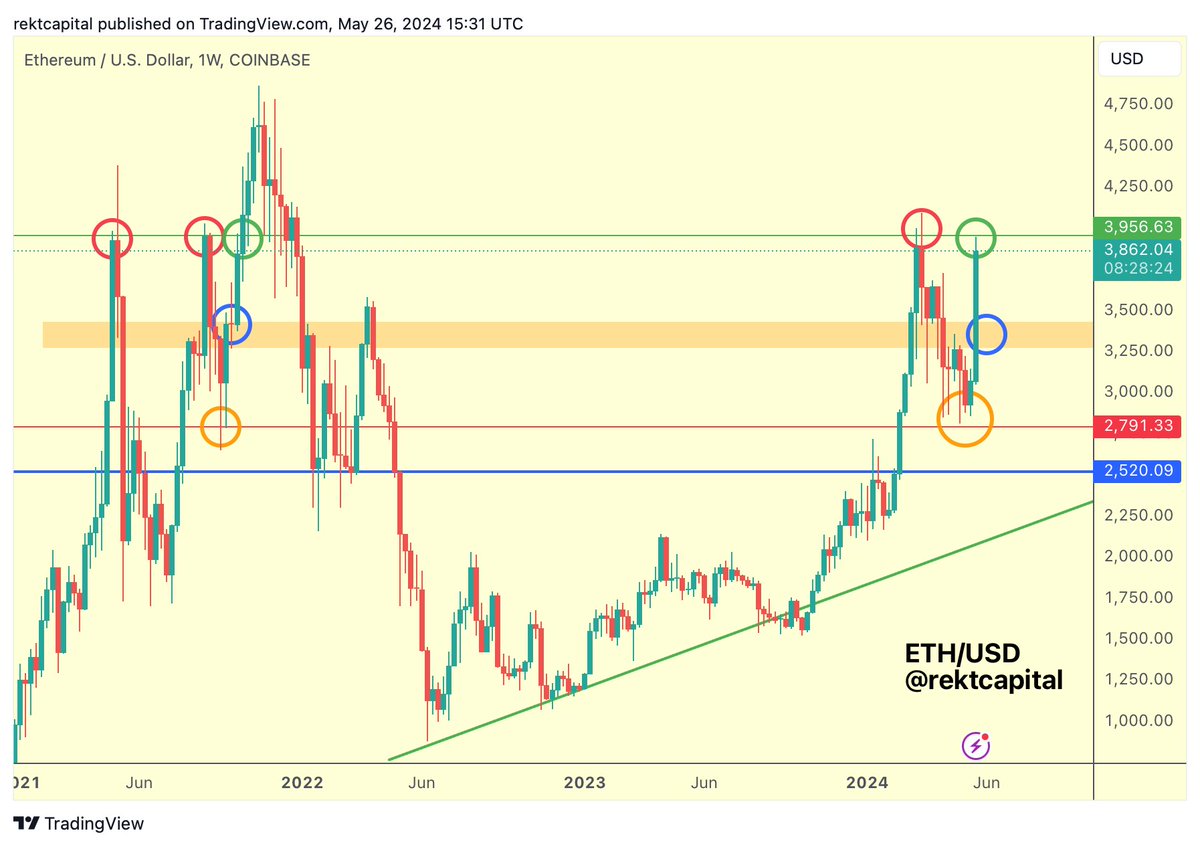

Ethereum itself, Rekt says the main layer-1 platform is in a strong place to maneuver above $4,000 as ETH bulls now have the momentum following a weekly shut above the $3,300 resistance space.

“ETH spent loads of time across the orange-circled lows (~$2791). That is the extent that has traditionally preceded upside again into ~$4,000 (inexperienced). Weekly Shut above the orange field appears inevitable and can verify that bulls have reclaimed momentum.”

At time of writing, Ethereum is buying and selling at $3,888.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Value Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses it’s possible you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet online affiliate marketing.

Generated Picture: DALLE3