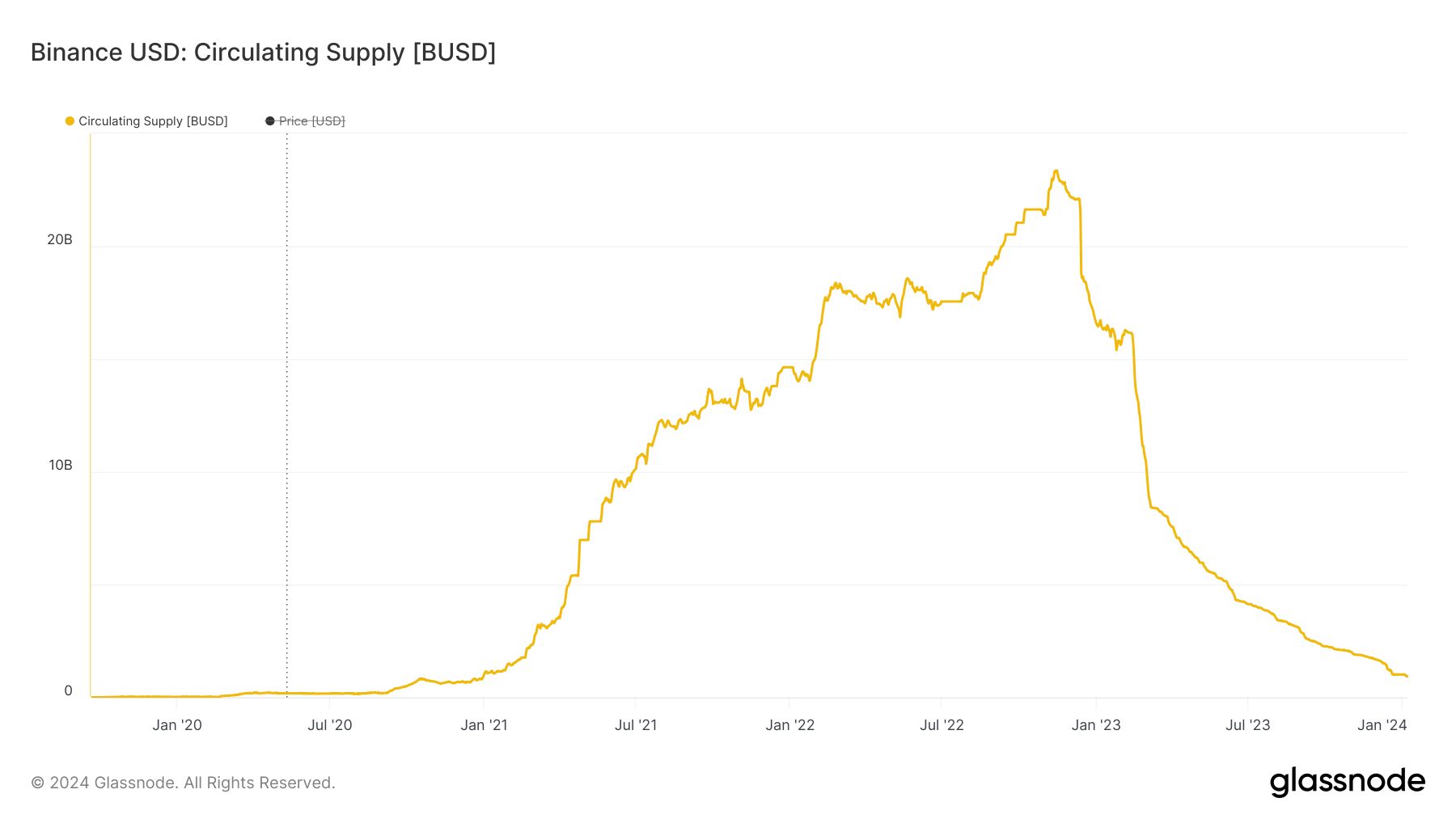

Binance USD (BUSD) slipped out of the highest 5 stablecoins by market capitalization over the weekend after its circulating provide dipped beneath 1 billion, its lowest level since Dec. 2020.

Knowledge from CryptoSlate reveals that BUSD’s circulating provide sits at 927 million tokens, marking a staggering 96% lower from its peak provide of 23.45 billion. This decline has additionally considerably impacted its buying and selling quantity of lower than $50 million throughout the previous 24 hours.

The Binance-backed stablecoin troubles started final yr after the U.S. Securities and Trade Fee (SEC) labeled it a safety in its authorized actions towards the cryptocurrency trade. Moreover that, BUSD issuer Paxos was pressured to cease different mints of the asset by the New York Division of Monetary Companies. Binance and Paxos vehemently rejected this SEC classification.

These developments prompted a swift exodus from the troubled stablecoin throughout the crypto neighborhood as Binance instantly started to push a number of stablecoin alternate options, together with TrueUSD (TUSD) and First Digital USD (FDUSD), to its customers.

On Jan. 5, Binance revealed that it accomplished the automated conversion of eligible customers’ balances within the BUSD token to FDUSD. It additional defined that it not helps the withdrawals of BUSD and urged its customers to manually swap these BUSD tokens for FDUSD tokens at a 1:1 conversion fee on Binance Convert.

Regardless of this, Binance and Paxos have dedicated to supporting BUSD till its full phase-out this yr.

USDT, USDC keep stablecoin dominance

With BUSD’s decline, the highest 5 stablecoins market by market capitalization now consists of new entrants like TUSD and FDUSD—two stablecoins that had been closely promoted by Binance.

Nonetheless, Tether’s USDT stays the dominant participant within the house, controlling round 70% of the market with a market capitalization of greater than $90 billion. It’s adopted carefully by Circle’s USDC, whose market cap sits at $24.56 billion.

21Shares researcher Tom Wan emphasized that for a stablecoin to contend successfully towards these behemoths, it could require integration into centralized exchanges, incorporation into DeFi platforms, and software in fee and remittance features.