The buildup pattern rating is an on-chain indicator used to find out whether or not entities are actively accumulating cash. It’s a a lot better indicator of the general market sentiment towards shopping for and promoting, as one can apply it to any cohort to find out the habits of any specific group.

The indicator contains two metrics — an entity’s participation rating and steadiness change rating. An entity’s participation rating represents its total coin steadiness, whereas the steadiness change rating represents the variety of new cash purchased or bought over one month.

An accumulation pattern rating nearer to 1 exhibits that the most important a part of the community is accumulating, whereas a rating nearer to 0 exhibits that the community is especially distributing its cash.

When utilized to Bitcoin, the buildup pattern rating supplies nice perception into market members’ steadiness measurement and habits over one month. Exchanges and miners are excluded from the metric to make the info extra consultant of the market circumstances,

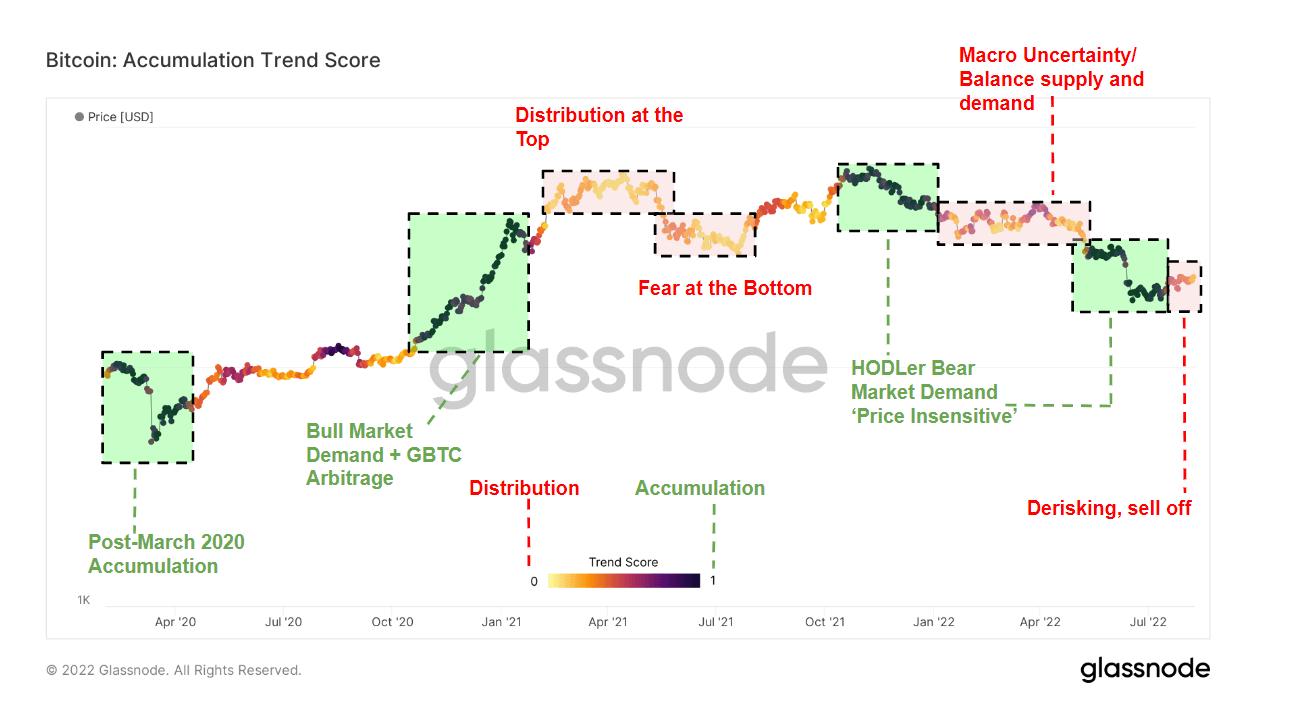

Bitcoin’s accumulation pattern rating from April 2020 to August 2022 exhibits 4 distinct accumulation intervals. Highlighted inexperienced on the chart above, the buildup intervals occurred in March 2020, early 2021, early 2022, and late Could 2022. Probably the most vital accumulation charge was seen in March 2020 because the onset of the COVID-19 pandemic crushed world markets. The main sell-off we’ve seen within the wake of the Terra (LUNA) crash in late Could and early July triggered a significant accumulation spree.

Highlighted in purple and yellow, intervals of coin distribution adopted all intervals of accumulation. Among the highest charges of coin distribution had been seen through the exodus of miners from China in the summertime of 2021 and the beginning of Russia’s invasion of Ukraine in February 2022. This summer season has additionally seen many addresses promote their BTC as macro uncertainty pushes extra traders to de-risk their portfolios.

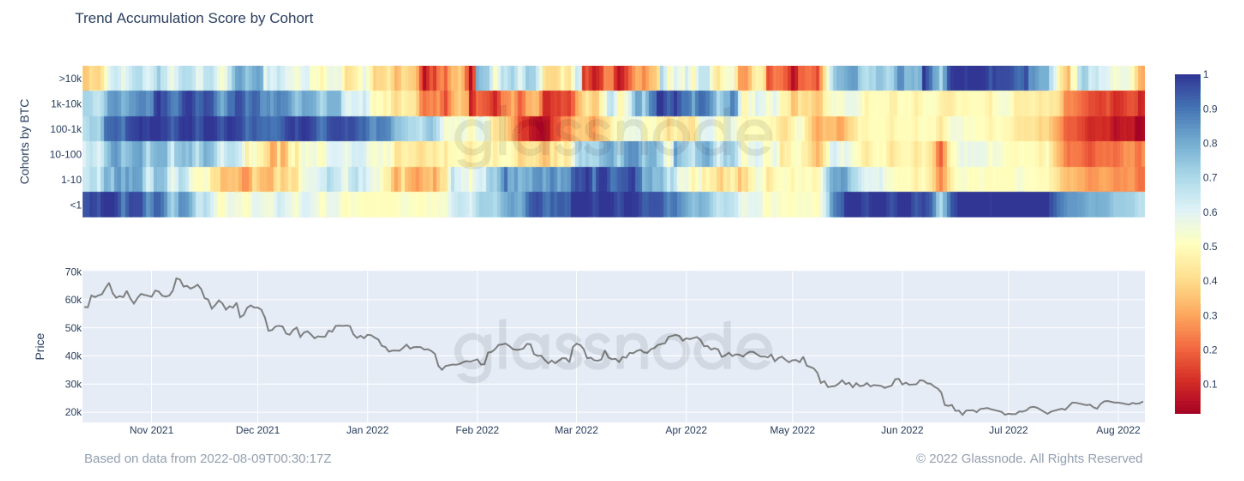

Breaking down the buildup pattern rating by cohorts reveals the behaviors of two main teams on the Bitcoin community — whales and shrimps. Whales are outlined as addresses proudly owning greater than 1,000 BTC, whereas shrimps are addresses with lower than 1 BTC.

All through July, each whales and shrimps have been aggressively accumulating BTC. The chart beneath exhibits the speed of accumulation by cohorts, with whales, shrimp, and everybody in between accumulating for all the month.

Nevertheless, as August progresses, the speed of accumulation amongst whales is starting to lower. The general macro uncertainty has pushed many massive holders to de-risk and unload their BTC holdings. Many traders are anticipating a tough winter and trying to get as a lot liquidity as doable.

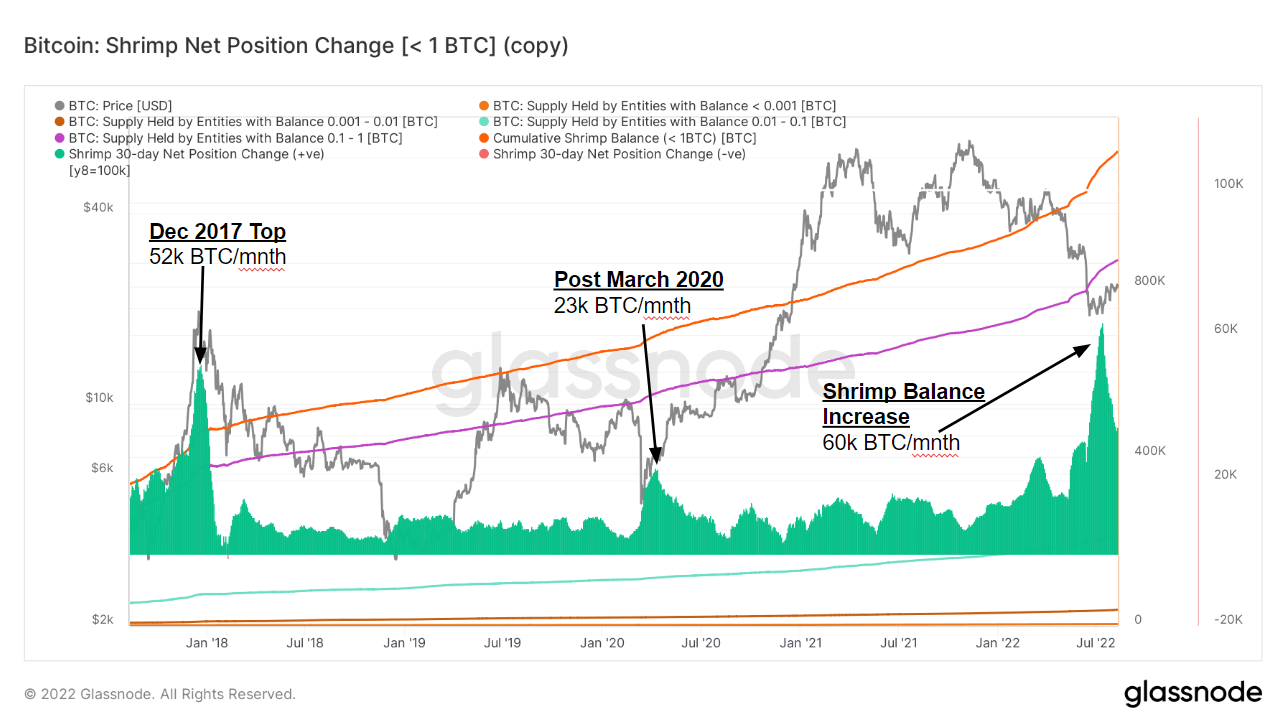

The one entities nonetheless stacking BTC are shrimps, which have saved accumulating even when the vast majority of massive holders started promoting off. July was probably the most vital accumulation month for small holders since 2018, with shrimp rising their steadiness by over 60,000 BTC in a single month. The second-largest accumulation was in December 2017 as Bitcoin reached its all-time excessive when shrimp accrued 52,000 BTC in a month.

This exhibits that small holders see Bitcoin’s value of round $20,000 as very engaging and proceed to amass cash for long-term funding, even when its value stays flat.

![[UPDATE]NCSoft’s Horizon MMO Has Reportedly Been Shelved Following Feasibility Review [UPDATE]NCSoft’s Horizon MMO Has Reportedly Been Shelved Following Feasibility Review](https://www.psu.com/wp/wp-content/uploads/2025/01/Horizon.jpeg)