Within the lead-up to the Federal Open Market Committee (FOMC) assembly scheduled for Wednesday, March 20, the Bitcoin and crypto market is experiencing a extreme downtrend. BTC value has plunged roughly -10% previously two days, and Ethereum (ETH) is down -12% in the identical interval.

The anticipation surrounding the Fed’s stance on rates of interest has heightened within the wake of current financial indicators, together with sudden spikes within the US Shopper Value Index (CPI) and Producer Value Index (PPI), stirring volatility throughout markets, together with digital property.

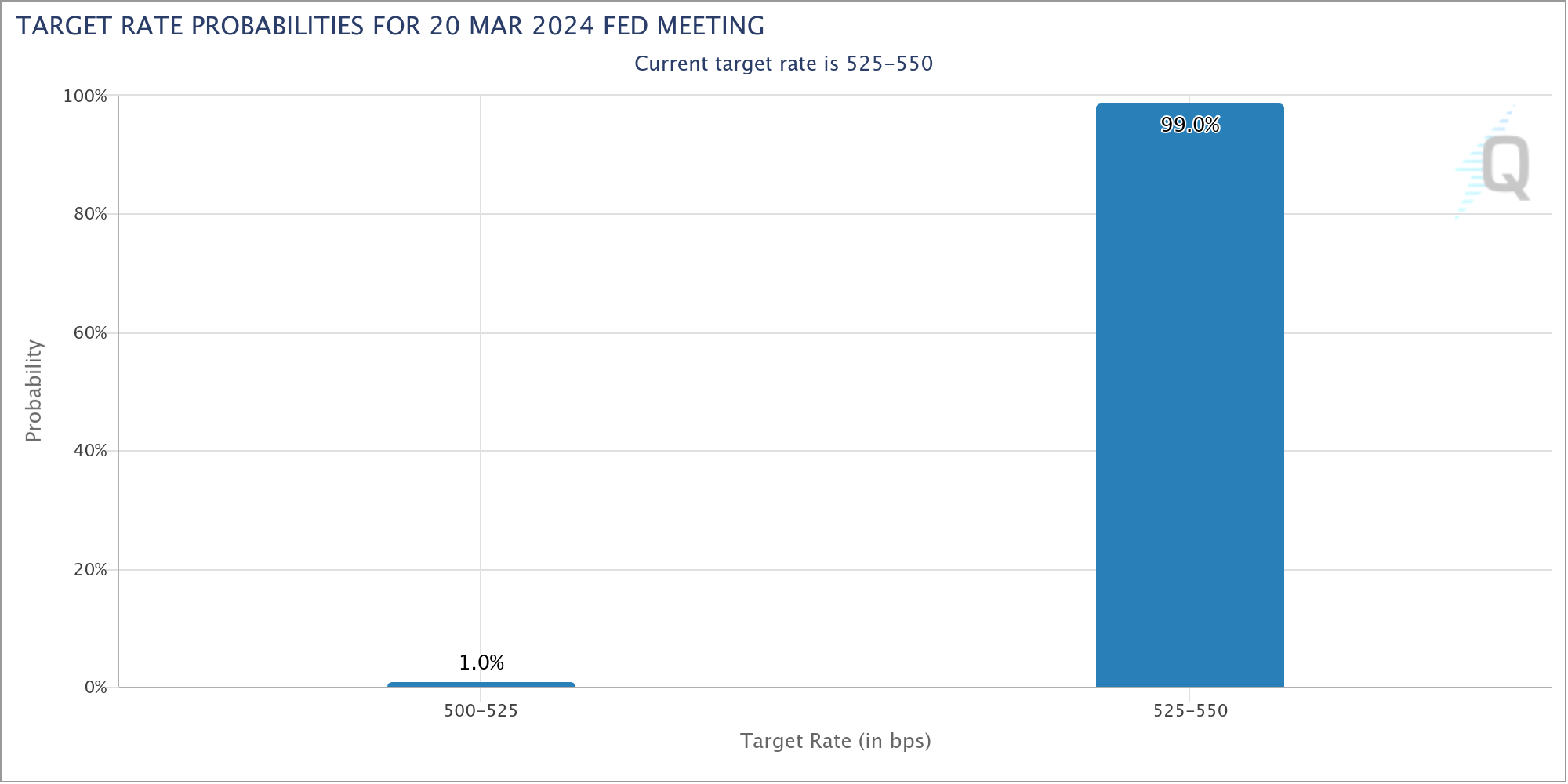

The consensus, with a 99% likelihood in response to the CME FedWatch instrument, suggests rates of interest will maintain regular. Nonetheless, the highlight turns to the Fed’s dot plot, a graphical illustration of the person members’ expectations for future rates of interest, which may present essential insights into the financial coverage outlook for the approaching months and years.

Anna Wong, Chief US Economist for Bloomberg, remarked through X (previously Twitter), “Another excuse why FOMC [is] not prepared to chop: members not but of broad settlement of that want. Right here’s visualizing the dispersion of FOMC views with the assistance of our new weekly NLP Fed spectrometer. “

Another excuse why FOMC not prepared to chop: members not but of broad settlement of that want. Right here’s visualizing the dispersion of FOMC views with the assistance of our new weekly NLP Fed spectrometer. (Interactive model at @TheTerminal BECO fashions —> Fedspeak —> spectrometer) pic.twitter.com/Kney89BERM

— Anna Wong (@AnnaEconomist) March 19, 2024

How Will Bitcoin And Crypto React?

Macro analyst Ted, expressing his perspective on X, underscores the nuanced relationship between macroeconomic tendencies and the crypto market in the intervening time. Ted elucidated that spot Bitcoin ETF flows have taken the backseat whereas macro elements got here to the foreground.

He stated through X, “If BTC is to be thought of digital gold, it’s anticipated to reflect gold’s market actions, albeit with the next diploma of volatility. Within the present local weather, with the market bracing for the Fed’s upcoming assembly, macroeconomic elements momentarily take priority, pushed by current developments in PPI and CPI figures.”

He additional speculates that “Regardless of the eventual remarks from [Fed Chair] Powell, the market has already adopted a hawkish stance in anticipation of a ‘increased for longer’ rate of interest situation.”

Michaël van de Poppe, a famous determine within the crypto evaluation area, provided his insights on the current downward value motion of Bitcoin through X, citing a mixture of elements together with the anticipation of the FOMC assembly and important capital outflows from Grayscale‘s Bitcoin Belief. Van de Poppe advises, “It’s sometimes in these pre-FOMC durations, perceived as risk-off intervals, that the savvy investor finds alternatives to ‘purchase the dip’.”

In a mirrored image of market sentiment changes, analyst @10delta on X pointed out the strategic positioning of buyers in anticipation of the Fed’s fee choices. “The market is at the moment pricing in a reversal to the November ’23 rate of interest ranges, a transparent indication that buyers are adjusting their expectations based mostly on the Fed’s potential pivot signaled within the earlier dot plot,” he famous.

Accordingly, he argues that the FOMC & dot plot will likely be a “purchase the information” occasion because the market expectations are being correctly adjusted. “The macro worries […] ought to dissipate & crypto idiosyncratic bullish elements, such because the ETF inflows […] in addition to the BTC halving take maintain. All thought of I believe there’s an excellent R/R for ‘shopping for the dip’ heading into the March 20 occasion,” the analyst added.

Goldman Sachs Predicts (Solely) 3 Charge Cuts This Yr

Goldman Sachs Analysis not too long ago offered an in depth evaluation of their March FOMC Preview. The report highlights the nuanced steadiness the Fed seeks to realize between controlling inflation and supporting financial development.

“Our revised forecast now anticipates three fee cuts in 2024, a slight adjustment from our earlier prediction, primarily attributable to a modest uptick within the inflation trajectory,” Goldman Sachs analysts elucidated. They additional speculate, “Whereas the speedy focus is on sustaining present fee ranges, the trajectory for fee cuts will hinge on inflation dynamics and financial efficiency indicators.”

Goldman Sachs additional predicts that the Fed will nonetheless goal a primary minimize in June. “This mixed with a default tempo of 1 minimize per quarter implies that essentially the most pure end result for the median dot is to stay unchanged at 3 cuts or 4.625% for 2024,” the banking big remarked.

Goldman: Inflation has been firmer in current months, however we predict it’s nonetheless on observe to fall sufficient by the June FOMC assembly for a primary minimize. pic.twitter.com/0I1BPYiU8W

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 17, 2024

Because the crypto market and broader monetary ecosystems await the outcomes of the FOMC assembly, the prevailing sentiment is one among cautious anticipation. Market contributors are carefully monitoring the Fed’s commentary for indications of future financial coverage instructions through the dot plot.

The query for the Bitcoin and crypto market is whether or not there will likely be an disagreeable shock or whether or not market contributors have been proper with their “increased for longer” coverage assumption.

At press time, BTC discovered assist on the $62,400 value stage, buying and selling at $63,118.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site solely at your personal danger.