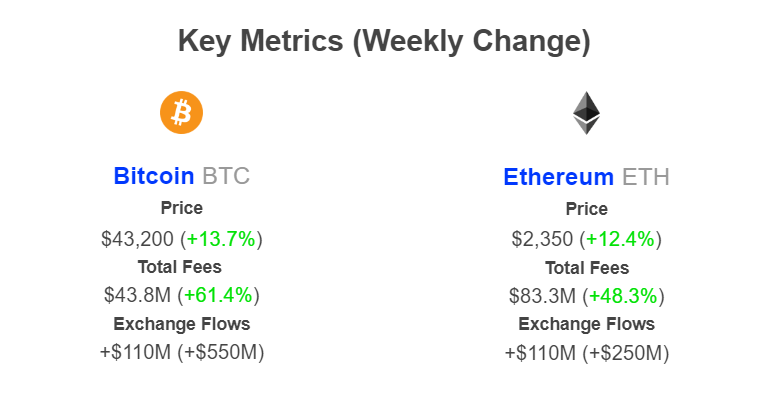

There’s a spike in crypto on-chain exercise if transaction charges lead. In line with IntoTheBlock data on December 8, Bitcoin transaction charges are up by over 60%, whereas “gasoline” in Ethereum has climbed by almost 50% up to now week.

Bitcoin And Ethereum Transaction Charges Rise By Double-Digits

This surge in exercise may be pinned to a number of elements, primarily rising consumer curiosity and the continuing crypto bull market. For example, Bitcoin and Ethereum costs are trending at 2023 highs above $43,500 and $2,300 when writing.

Even so, the crypto group expects these cash to increase features within the coming weeks and months, partly due to anticipated institutional capital, projected to be of their billions, flowing to the sphere.

In line with IntoTheBlock information, cumulative charges collected in Bitcoin this week stand at $43.8 million, up 61%. Then again, $83.3 million in charges has been accrued from Ethereum.

Wanting on the historic transaction charges pattern, transacting on Ethereum, regardless of its comparatively excessive transaction processing speeds (TPS), is dearer than Bitcoin. This may be as a result of Ethereum’s function in decentralized finance (DeFi), non-fungible token (NFT) minting, and extra. Bitcoin is a transactional layer and doesn’t inherently assist good contracts.

Normally, rising on-chain transaction charges are bullish for worth and point out that their respective ecosystem is prospering from rising adoption. With transaction charges rising within the two main blockchain ecosystems, extra individuals need to work together with the challenge. Subsequently, this might assist costs since BTC or ETH is used for paying transaction charges.

Will BTC Ease Previous 2021 Highs Of $70,000?

As BTC is presently buying and selling above $43,500 and ETH just lately broke above $2,300, the potential of these cash retesting and easing previous their all-time highs of $70,000 and $4,800, respectively, can’t be discounted. One of many key drivers of the surge in on-chain exercise is the continuing bull market.

With crypto rising, extra individuals want to place themselves, hoping to revenue from additional worth appreciation. This wave of concern of lacking out (FOMO) has pushed larger charges and costs.

The demand for liquid and SEC-recognized digital belongings will seemingly improve as soon as the Securities and Alternate Fee (SEC) goes forward and authorizes the primary Bitcoin ETF. This spinoff product will permit establishments to put money into Bitcoin confidently by way of a regulated resolution.

As the chances of the SEC approving this product rose from early This autumn 2023, BTC and ETH costs began rising in sync. Nonetheless, how costs will react as soon as the spot Bitcoin ETF is accepted stays to be seen. As soon as the SEC green-lights a spot Bitcoin ETF, the crypto market will start Ethereum and whether or not the company will approve an identical resolution.

Characteristic picture from Canva, chart from TradingView