Este artículo también está disponible en español.

The world’s largest cryptocurrency could also be prone to a provide shock as demand from United States (US) Spot Bitcoin Alternate Traded Funds (ETFs) has surged far past expectations. In December 2024, the amount of BTC acquired by Spot Bitcoin ETFs greater than tripled the quantity mined throughout that very same month, underscoring the extreme imbalance between provide and demand.

Spot Bitcoin ETFs Set off Provide Shock Dangers

In December 2024, US Spot Bitcoin ETFs bought an astonishing 51,500 BTC. Then again, BTC miners produced solely 13,850 cash throughout the identical interval, in response to knowledge from Blockchain.com. This means that Bitcoin ETFs alone bought practically 4 instances the quantity BTC miners generated and equipped to the market that month.

Associated Studying

In keeping with reviews, the demand for ETFs in December was nothing wanting extraordinary, exceeding the accessible provide by roughly 272%. This large improve in demand for Spot Bitcoin ETFs has raised considerations a few potential BTC provide shock, with analysts suggesting that it might occur quickly.

Particularly, Lark Davis, a crypto analyst, introduced earlier in December that “a large provide shock is imminent.” The analyst based mostly this alarming forecast on the numerous accumulation of BTC from US Spot Bitcoin ETFs. Davis disclosed that sooner or later in December, BTC ETFs had purchased 21,423 BTC; in the meantime, miners had produced solely 3,150 BTC across the similar time.

The analyst additionally famous that BTC ETFs globally held roughly 1,311,579 BTC as of December 17, 2024. This quantity, valued at $139 billion, accounts for six.24% of BTC’s whole provide of 19.8 million. Given this staggering determine, Davis tasks that in peak bull market phases, Spot Bitcoin ETFs might maintain 10-20% of BTC’s whole provide, elevating extra considerations a few main provide shock.

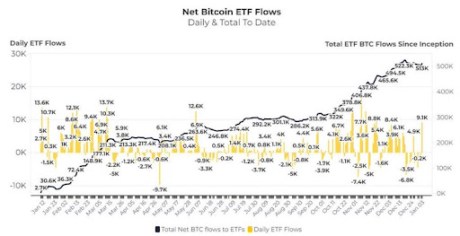

Focus Of Spot BTC Inflows In December

Knowledge from Glassnode has revealed that Spot Bitcoin ETFs recorded a complete web influx of $4.63 billion in December, virtually doubling their 2024 month-to-month common of $2.77 billion. Notably, Glassnode disclosed that the surge in Spot Bitcoin ETF inflows was extra concentrated in the course of the first half of the month, whereas the second half noticed outflows, with December 26 being the exception.

Associated Studying

Not surprisingly, the timing for this surge and subsequent decline in Bitcoin ETF inflows aligns with BTC’s worth actions in December. At first of the month, BTC skilled upward momentum, skyrocketing to a new ATH above $108,000 on December 17, fueled by the bull market hype and hovering demand. Nevertheless, following this peak, BTC’s worth noticed a pointy decline, a drop that coincided with the timing of great outflows from Spot Bitcoin ETFs, as reported by Glassnode.

Regardless of the surge in demand for Spot Bitcoin ETFs in December, new knowledge exhibits that traders have prolonged their accumulation development into January 2025. On January 3, traders bought over $900 million price of BTC by Spot Bitcoin ETFs. Extra just lately, US Spot Bitcoin ETFs acquired an extra 9,500 BTC, price over $966 million on the present market worth.

Featured picture created with Dall.E, chart from Tradingview.com