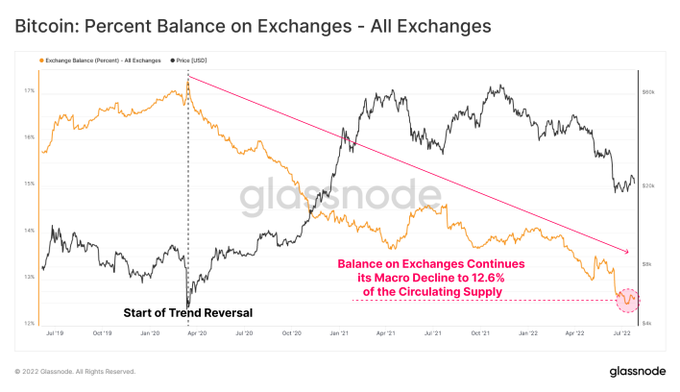

Bitcoin (BTC) continues to exit crypto exchanges because it’s recording a macro decline.

Market perception supplier Glassnode explained:

“Bitcoin stability on exchanges continues its macro decline, reaching 12.6% of the Circulating Provide (2.4M BTC). Change balances have now seen a macro outflow of over 4.6% of the circulating provide for the reason that March 2020 ATH.”

Supply:Glassnode

Bitcoin leaving exchanges is bullish as a result of it signifies a holding tradition, on condition that cash are transferred to digital wallets and chilly storage for future functions apart from holding.

This is likely to be a motive triggering BTC’s rise. The main cryptocurrency was up by 4.18% within the final 24 hours to hit $24,482 throughout intraday buying and selling, in response to CoinMarketCap.

The value surge has additionally boosted Bitcoin’s probabilities of breaking the 200-Week Transferring Common (WMA). Crypto analyst Rekt Capital pointed out:

“BTC may be very near performing a Weekly Shut above the 200-week MA. Technically, it appears to be like like BTC is doing nicely to reclaim the 200-week MA as assist.”

Supply:TradingView/RektCapital

The 200 WMA exhibits the long-term development of an asset and performs an instrumental position in displaying whether or not the market is bullish or bearish.

In the meantime, Bitcoin has been having fun with above-average shopping for quantity, on condition that it has been in a position to drift away from the psychological worth of $20K. Rekt Capital pointed out:

“BTC is having fun with above-average buy-side quantity for the primary time since January/February of this yr when BTC carried out aid rallies earlier than additional draw back.”

Bloomberg analyst Mike McGlone lately acknowledged that it appears Bitcoin was on the point of return to profitable methods, on condition that its volatility towards the Bloomberg Commodity Index (BCOM) had reached historic lows.

Picture supply: Shutterstock