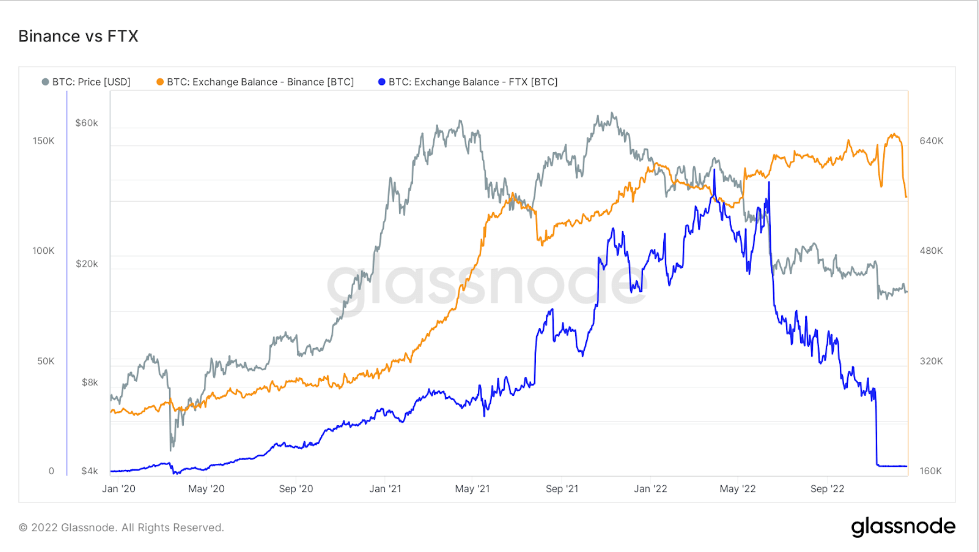

The collapse of FTX left a gaping gap within the crypto market. The failed change accounted for a big chunk of the worldwide buying and selling quantity and saved Binance from changing into the de facto ruler of the market.

With FTX now gone, Binance took the throne and have become the most important and probably an important firm within the crypto trade. The change now accounts for over 50% of the worldwide spot and derivatives market, with its dominance growing every day.

Nonetheless, solely taking a look at Binance’s buying and selling quantity fails to color the whole image of the place the change stands.

To find out the market’s sentiment, one should at all times take a look at Bitcoin first. The driving drive of the crypto trade, Bitcoin’s motion, and distribution throughout exchanges present the market’s sentiment and can be utilized to find out future market developments.

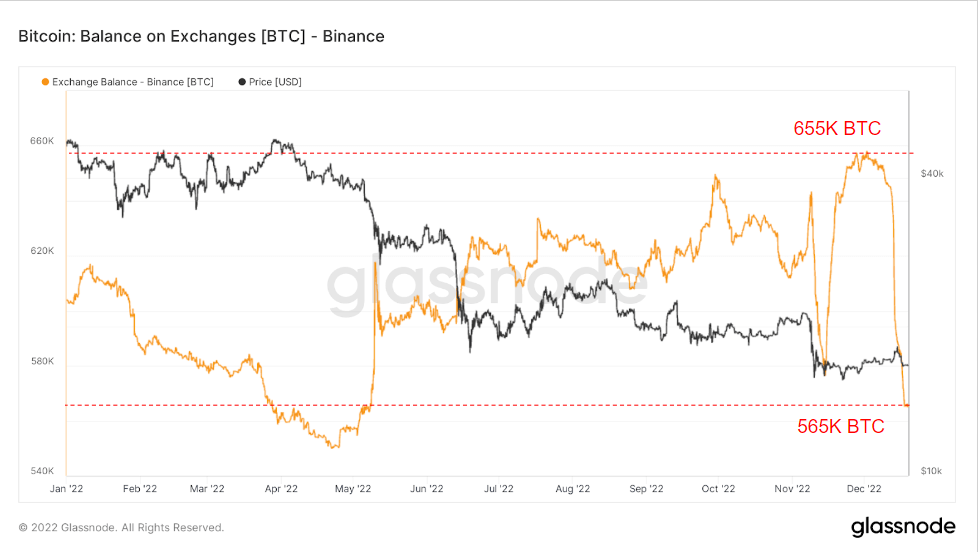

Bitcoin balances on exchanges exhibits the quantity of BTC that might be used to generate promoting strain. It additionally illustrates the general maturity and well being of the market — the much less Bitcoin there may be on exchanges, the extra individuals see it as a long-term funding.

As of Dec. 23, the full quantity of BTC held on Binance stands at 565,00 BTC. This can be a sharp drop from the yearly excessive of 655,000 BTC recorded in December when over $1 billion value of BTC was deposited into the change.

The 90,000 BTC distinction in Binance’s stability was created in a single week in mid-December. CryptoSlate evaluation of on-chain knowledge confirmed that over $600 million value of BTC was withdrawn from the change in a single day.

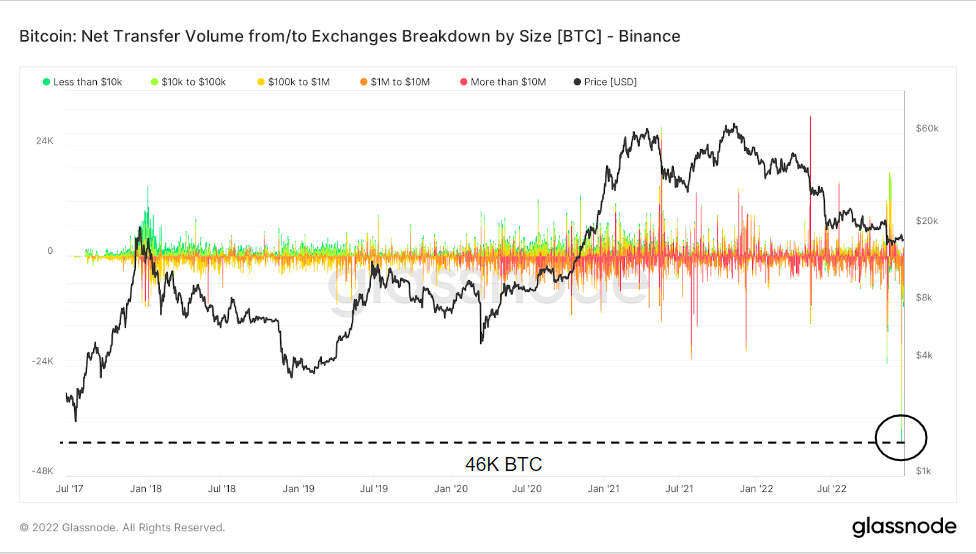

Trying on the internet circulate of Bitcoin by the worth of the transactions exhibits that the retail market was accountable for a lot of the withdrawals in December.

The graph beneath ranks Bitcoin internet flows by their USD worth, starting from lower than $10,000 to greater than $10 million—transfers with a worth smaller than $10,000 represented the vast majority of inflows to Binance till 2021.

From 2021 till now, giant transfers with a worth between $1 million and $10 million made up essentially the most vital a part of inflows and outflows from Binance.

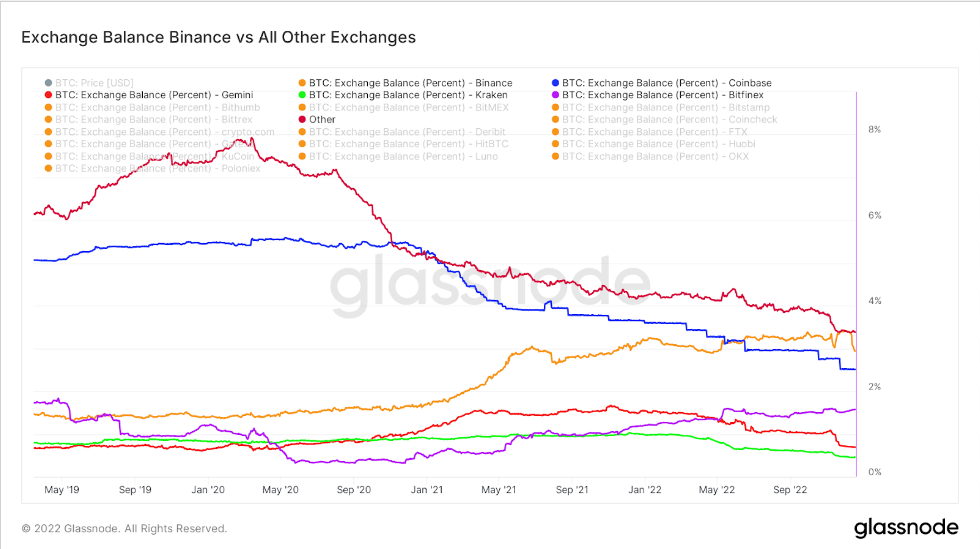

Evaluating Binance to different exchanges exhibits that the diminishing Bitcoin stability is a market-wide development. Nonetheless, Binance skilled the sharpest lower in its BTC stability this month, with different exchanges like Coinbase, Kraken, Gemini, and Bitfinex all seeing smaller drops.

The one change that noticed its Bitcoin stability improve this 12 months was Bitfinex. Conversely, Coinbase has seen nearly vertical drops in its balances all year long and at the moment holds round 2.5% of the Bitcoin provide.

It’s nonetheless too early to inform whether or not the drop in Binance’s BTC stability must be a trigger for concern. Nonetheless, the change maintains its enterprise as standard regardless of the market turmoil, assuring its customers and buyers that it has strong monetary footing and offers with wholesome buying and selling volumes.

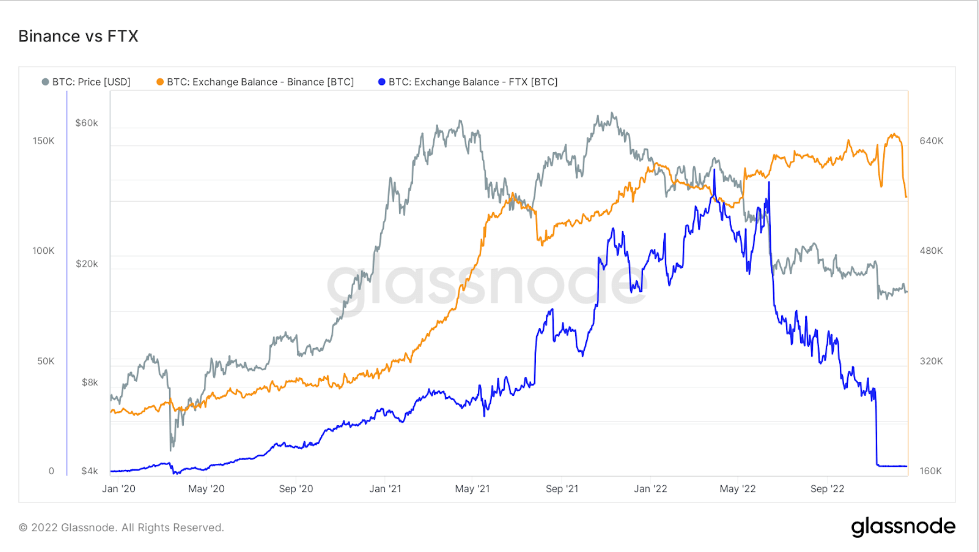

Nonetheless, evaluating Binance’s outflows to the outflows seen on FTX exhibits that they might be trigger for concern.

At first of the 12 months, FTX had round 150,000 BTC. After that, the change noticed its Bitcoin stability improve till a pointy correction within the spring, nevertheless it returned to the yearly excessive proper firstly of the summer time. Then, in June 2022, over 70,000 BTC left FTX in two weeks.

The sharp outflow triggered a downward spiral till November and noticed FTX’s Bitcoin stability attain a two-year low. The change then collapsed and triggered a world market meltdown, the implications of that are nonetheless being felt.

The 70,000 BTC outflow triggered FTX’s Bitcoin stability downside is way smaller than the 90,000 BTC outflow Binance noticed in every week. Nonetheless, we’re but to see whether or not the change’s Bitcoin stability will enhance or whether or not the downward spiral will proceed into 2023.