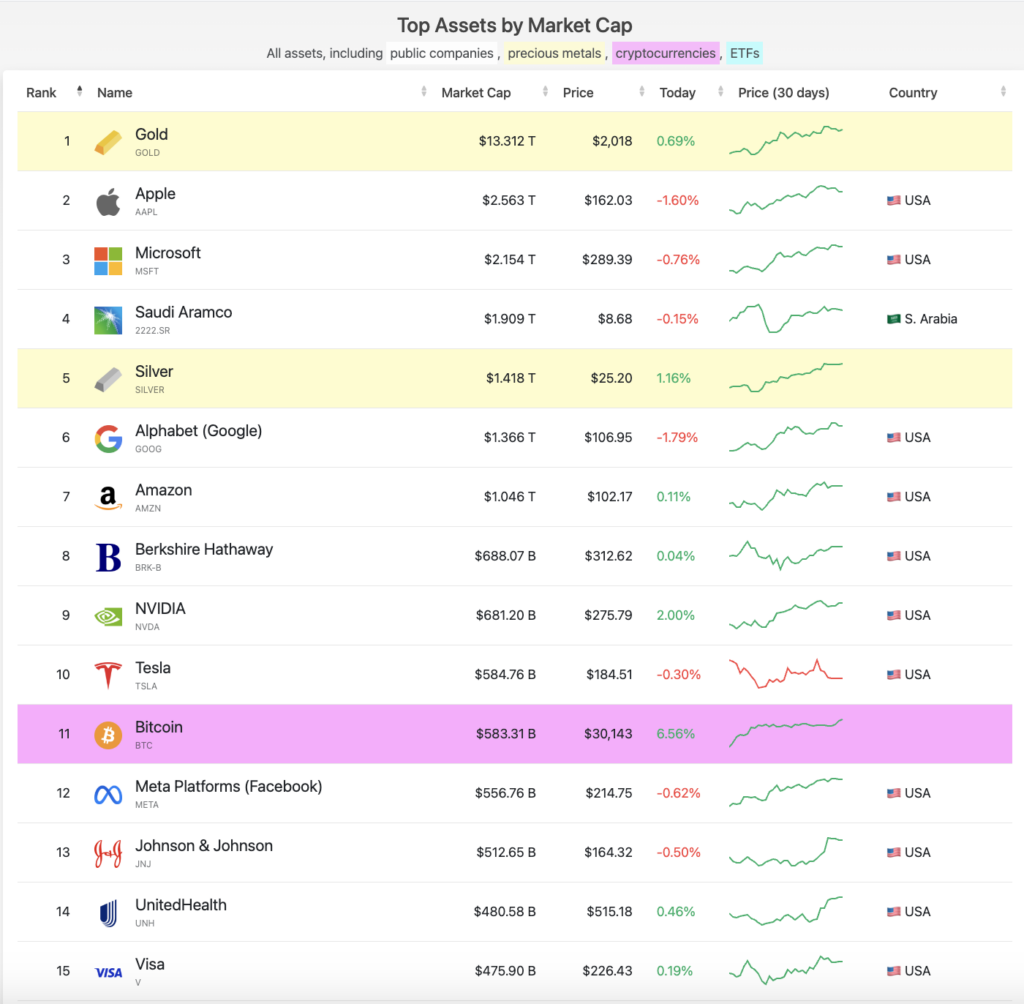

Bitcoin (BTC) rallied final night time to a 10-month excessive, peaking at $30,380 after two days of a meteoric rise. In that rally, BTC’s market cap hit $585.05 billion — briefly making it the tenth largest asset on this planet.

Whereas BTC has since consolidated to simply over $30,000 — probably creating some assist — the market sentiment stays overwhelmingly bullish.

Knowledge from CompaniesMarketCap confirmed BTC spent a number of hours above Tesla — whose $584.7 billion market cap ranked it eleventh among the many prime 100 public firms, , cryptocurrencies, and ETFs. The consolidation to $30,000 pushed Bitcoin again to eleventh place — permitting Tesla to reclaim its tenth place.

Nevertheless, BTC nonetheless ranks greater than Fb’s Meta — whose $556.7 billion market cap makes it the twelfth largest asset on this planet.

This isn’t the primary time Bitcoin surpassed established, legacy firms. Nevertheless, that is the primary time public firms may expertise vital turmoil within the close to future.

Present macroeconomic situations spell bother for shares and different property. If the U.S. market enters stagflation — relatively than a recession — inventory costs can be the primary to take a beating. A decade of low rates of interest and a traditionally unprecedented pandemic stimulus have pumped inventory costs to their all-time highs.

Sustaining these costs via rising rates of interest and a possible stagflation shall be troublesome and will result in large losses throughout markets. As extra buyers rush to Bitcoin as a technique to shield their liquidity, we may see one other main rally that pushes Bitcoin previous Tesla once more — and nearer to trillion-dollar giants like Amazon and Alphabet.

The publish Bitcoin briefly flips Tesla, turns into the tenth largest asset by market cap appeared first on CryptoSlate.