Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

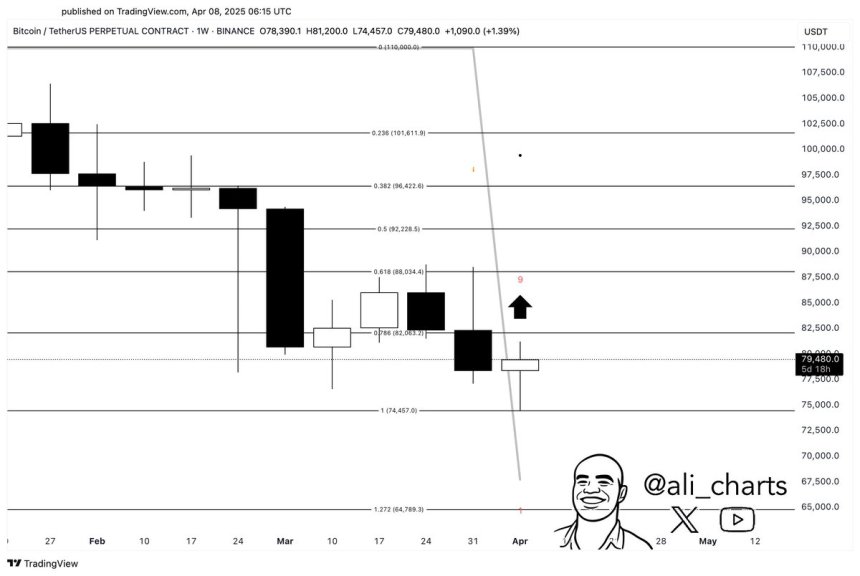

In an X put up shared earlier immediately, crypto analyst Ali Martinez famous that Bitcoin (BTC) is flashing a purchase sign. One other analyst, Titan Of Crypto, highlighted that BTC is at present buying and selling in a reversal zone – suggesting that the main cryptocurrency could quickly expertise a shift in worth momentum.

Bitcoin Flashes Purchase Sign Amid Market Pullback

In comparison with the worth motion seen final 12 months, Q1 2025 has been comparatively sluggish for digital belongings. On a year-to-date (YTD) foundation, BTC is down practically 30%, dropping from round $97,600 on January 1 to roughly $78,000 on the time of writing.

Associated Studying

Following yesterday’s tariff-induced crypto market pullback – which wiped over $140 billion from the full crypto market cap – BTC is now starting to indicate early indicators of energy. Martinez emphasised that Bitcoin is flashing a weekly TD Sequential purchase sign.

For the uninitiated, the weekly TD Sequential purchase sign is a technical indicator that means a possible development reversal or shopping for alternative after a chronic downtrend. It sometimes seems when a selected 9-count sample completes, signalling that promoting stress could also be exhausted and a worth rebound might be close to.

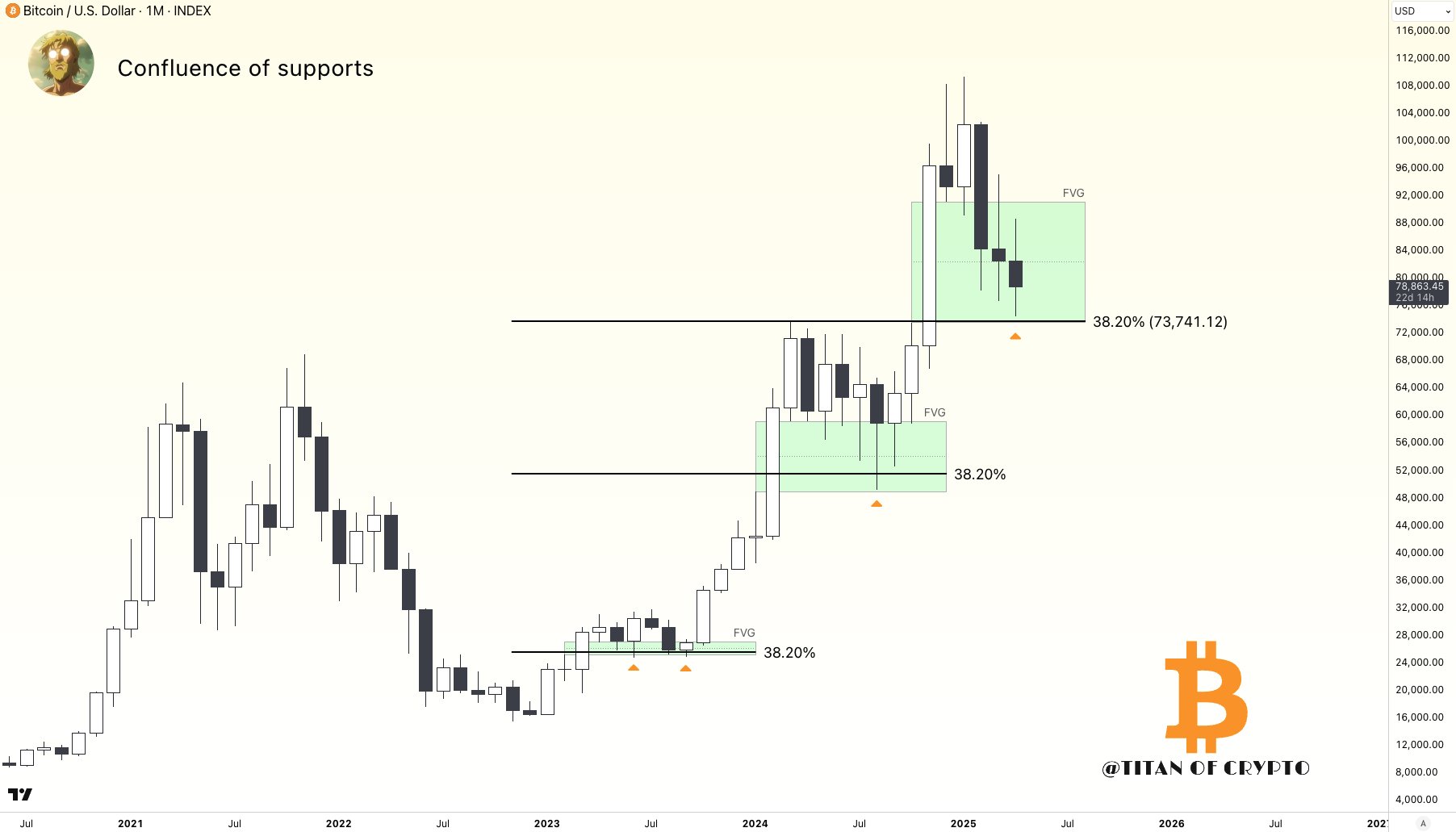

In the meantime, fellow crypto analyst Titan Of Crypto identified that BTC is buying and selling inside a possible reversal zone. He famous that so long as BTC stays above the 38.2% Fibonacci retracement stage, the broader uptrend would stay intact.

Moreover, Titan highlighted that BTC’s Honest Worth Hole (FVG) at $80,000 has now been crammed – a improvement that additional boosts the case for a possible development reversal or vital worth motion at present ranges.

To elucidate, an FVG is a worth imbalance on a chart, usually created by a robust transfer in a single path, the place little to no buying and selling occurred. It signifies a possible space the place worth could return to “fill the hole” earlier than persevering with its development.

Current BTC Value Drop Not Out Of The Atypical

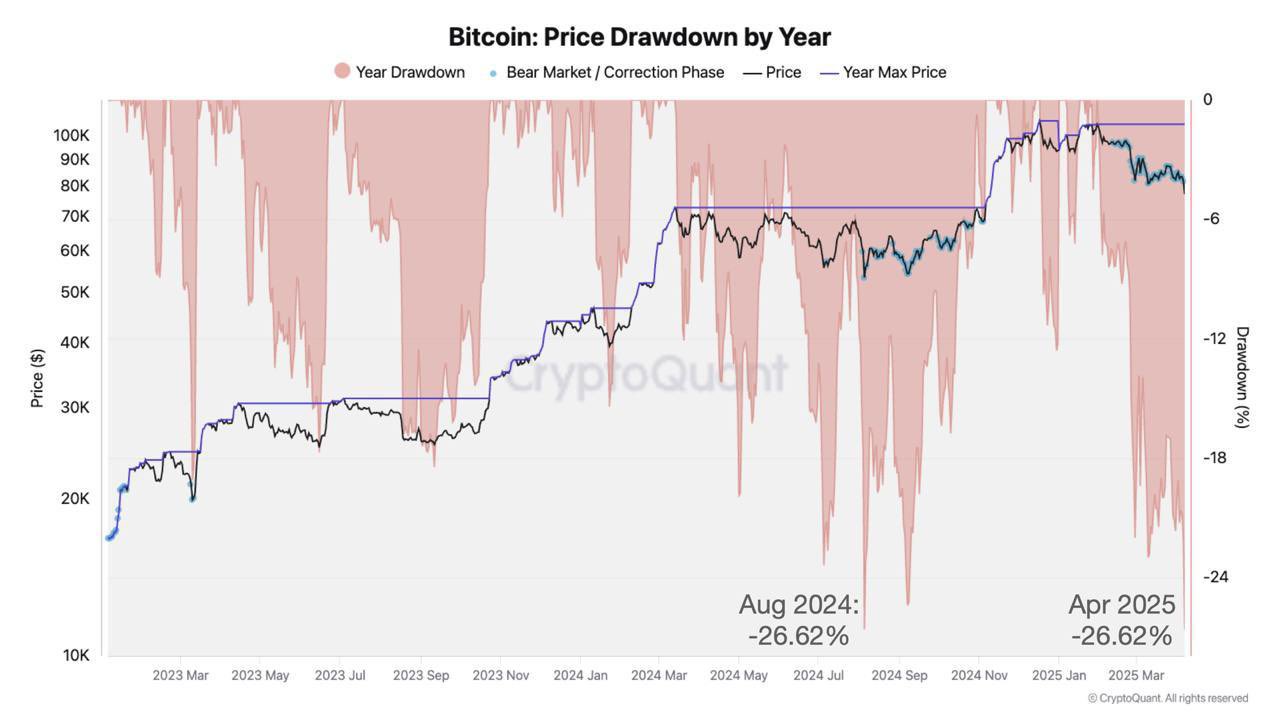

One other crypto analyst, Grasp Of Crypto, remarked that though the latest BTC worth decline could have alarmed some buyers, it’s effectively throughout the bounds of historic norms. The analyst identified that BTC is at present buying and selling about 26.6% under its all-time excessive (ATH) of $109,500.

Associated Studying

Nonetheless, this decline continues to be much less extreme than earlier market cycle drawdowns, similar to 83% in 2018 and 73% in 2022. The analyst added that moreover the worth pullback, BTC’s weekly Relative Power Index (RSI) has additionally been trending down for 5 weeks.

That stated, technical indicators counsel that it could take extra time earlier than BTC sees a significant shift in worth momentum. For example, the highest cryptocurrency lately flashed a loss of life cross, a bearish sample that might sign additional short-term draw back. At press time, BTC trades at $78,543, down 0.3% prior to now 24 hours.

Featured picture from Unsplash, Charts from X, and TradingView.com