The general cryptocurrency market seems to be struggling, together with main gamers like Bitcoin (BTC), Ethereum (ETH), and others. Amid this ongoing downturn, whale transaction tracker Lookonchain shared a submit on X (previously Twitter), reporting {that a} newly created pockets had withdrawn a big 1,850 BTC value $183.37 million from Binance, the world’s largest cryptocurrency change.

Whale Buys $183 Million Value Bitcoin

Nonetheless, this notable withdrawal comes at a time when BTC has dropped to a help stage close to $97,300. Moreover, it follows MicroStrategy’s acquisition of 21,550 BTC value $2.1 billion, bought at a median worth of $98,783, as reported by CoinPedia.

These latest acquisitions counsel that this whale and the establishment are capitalizing on an ideal buy-the-dip alternative.

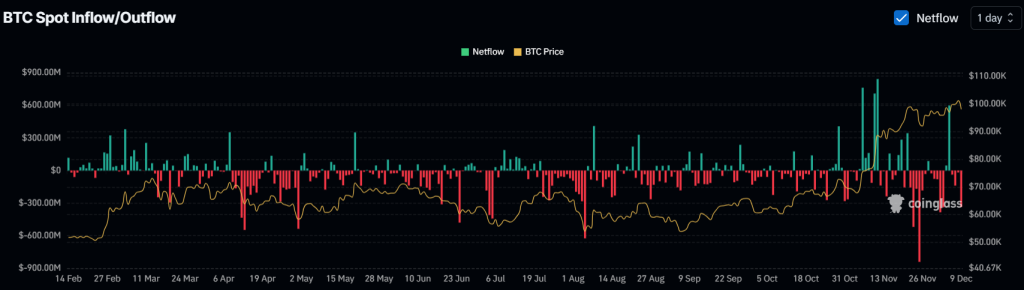

$335 Million of BTC Outflow from Exchanges

Along with the latest BTC withdrawals by whales and establishments, on-chain analytics agency Coinglass revealed that exchanges have skilled a big outflow of $335 million value of Bitcoin up to now 24 hours. This means a possible shopping for alternative and suggests doable upside momentum within the coming days.

Bitcoin Technical Evaluation and Upcoming Stage

In accordance with professional technical evaluation, BTC has been buying and selling in a sample of upper highs and better lows since November 11, 2024. At present, BTC has reached a better low on this sample.

Traditionally, at any time when BTC reaches this stage, it tends to expertise upside momentum. Nonetheless, this time, traders and merchants are speculating about whether or not the identical upside momentum will happen, which could clarify the rising curiosity from whales and establishments.

Primarily based on latest worth motion, there’s a robust risk that BTC may soar by 6.5% to succeed in the $104,160 stage within the coming days.

On the constructive aspect, BTC’s Relative Energy Index (RSI) at the moment stands at 44, close to the oversold area, suggesting a possible upside rally within the coming days. Moreover, BTC is buying and selling above the 200 Exponential Shifting Common (EMA) on the every day timeframe, indicating an uptrend.

Present Value Momentum

At present, BTC is buying and selling close to $97,700 and has registered a worth decline of over 2.15% up to now 24 hours. Throughout this era, its buying and selling quantity surged by 85%, indicating heightened participation from merchants and traders amid bullish worth exercise.