Fast Take

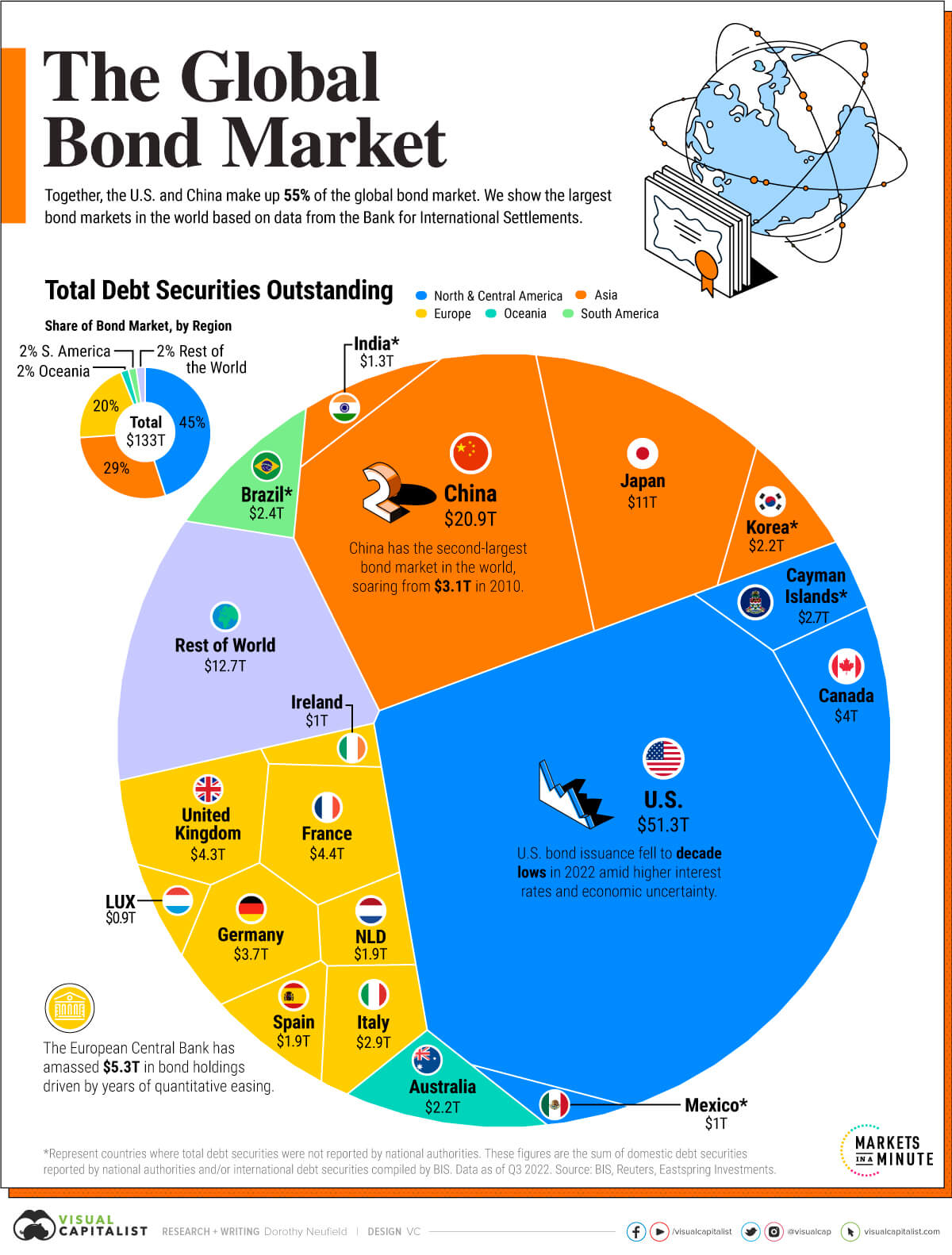

One of the sturdy markets globally is the bond market, which, in keeping with Visible Capitalist, was estimated to be price $133 trillion in 2022. This colossal market has seen constant progress over the past 4 a long time, primarily pushed by authorities debt will increase on account of rate of interest reductions throughout every recession and the implementation of quantitative easing measures.

The US leads the worldwide bond market, holding a commanding 39% market share, equal to over $51 trillion. Nonetheless, China is catching up and at the moment occupies the second spot with a 16% share on this thriving market, in keeping with Visible Capitalist.

Japan presents an intriguing case research on this context. Visible Capitalist knowledge signifies that Japan’s central financial institution owns roughly half of the nation’s complete debt. This vital holding prompted an in-depth evaluation by the CryptoSlate analysis staff.

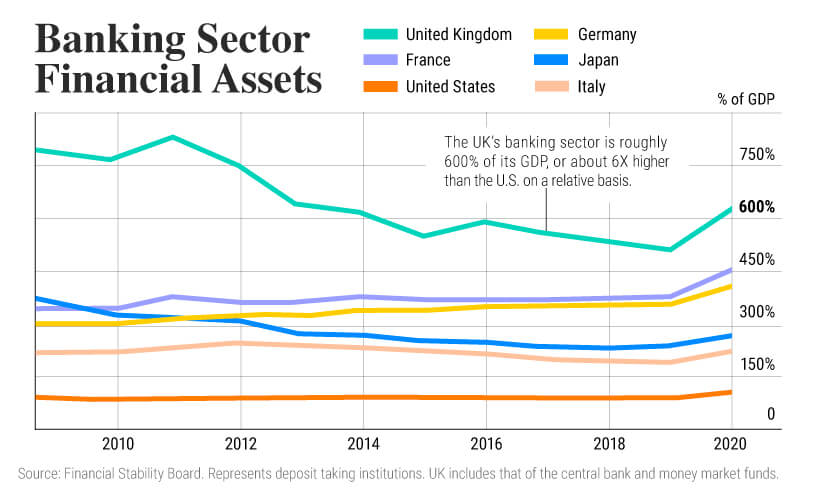

A pertinent query that arises on this state of affairs pertains to the consumers of this debt, significantly contemplating that a big portion yields adverse returns. The reply lies primarily within the banking sector, as indicated within the chart supplied beneath.

Nonetheless, an rising concern is the disproportionate dimension of the banking sector in comparison with the GDP in some nations, such because the UK, the place the previous is roughly six instances bigger, in keeping with Visible Capitalist.

It’s important to recollect the inverse relationship between bonds and yields; when yields enhance, bond values lower. Therefore, cautious consideration is important for potential buyers navigating this complicated market.

The thought is that buyers will get bored with adverse actual charges in bonds and transfer over to property reminiscent of Bitcoin that comfortably beat inflation over the long term.

The publish Bitcoin could possibly be the refuge as bond market faces adverse returns appeared first on CryptoSlate.