US spot Bitcoin exchange-traded funds (ETFs) skilled a second straight day of outflows for the second day this week after ending their 19-day influx streak on June 10.

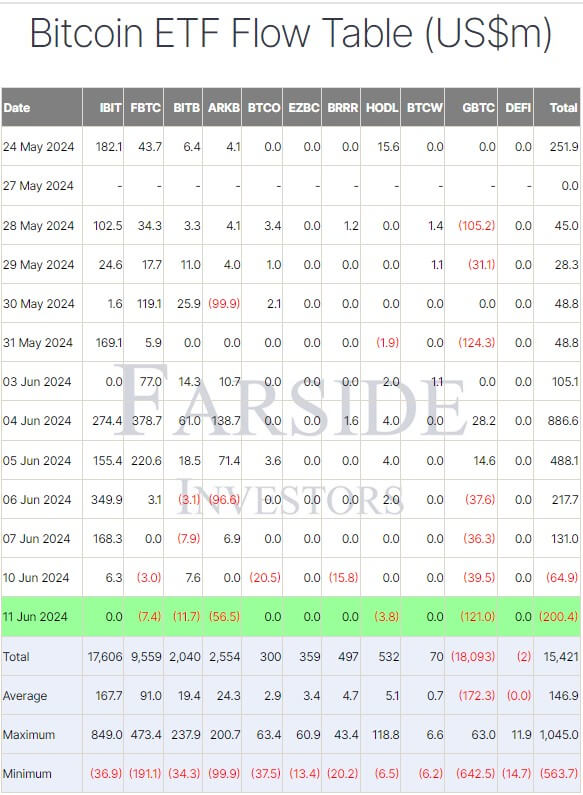

Knowledge from Farside exhibits that on June 11, Bitcoin ETFs had cumulative outflows of $200 million, with withdrawals pushed by 5 issuers.

ETF outflows

Grayscale’s GBTC led the outflows with $121 million, elevating its complete outflows to $18.03 billion. Ark Make investments’s ARKB adopted with practically $57 million in internet outflows. Bitwise’s BITB reported roughly $12 million in outflows, whereas Constancy and VanEck noticed smaller internet outflows of $7.4 million and $3.8 million, respectively.

Regardless of these vital outflows, the funds have accrued a complete internet influx of $15.42 billion since their launch in January.

These substantial outflows contributed to Bitcoin’s value drop to as little as $66,207 previously 24 hours. Crypto analyst Patrick Scott commented:

“Bitcoin ETFs are including a brand new reflexive aspect to cost, the place off-hours dumps translate to outflows on the subsequent buying and selling day.”

Bitcoin has since recovered to $67,449 as of press time.

FOMC forward

Market consultants imagine that BTC’s current value efficiency and the ETF outflows point out buyers’ warning forward of the essential Federal Open Market Committee (FOMC) assembly.

Notably, three US lawmakers—Senators Elizabeth Warren, Jacky Rosen, and John Hickenlooper—have urged the Federal Reserve to decrease the federal funds fee from its two-decade excessive of 5.5%. They argued:

“This sustained interval of excessive rates of interest is already slowing the economic system and is failing to deal with the remaining key drivers of inflation.”

Regardless of this, the market expects no change in rates of interest. In keeping with the CME FedWatch Software, 99.4% of buyers predict the speed will keep on the present stage of 525-550 bps.

The put up Bitcoin ETF outflows hit $200 million forward of FOMC assembly appeared first on CryptoSlate.