Este artículo también está disponible en español.

Bitcoin ETFs ended final week on one other optimistic be aware with $997.70 million in web inflows and demand reaching its highest degree in six months. Undoubtedly, these ETFs have marked the turning level for Bitcoin and different cryptocurrencies because the starting of the yr, because it opened up the cryptocurrency to inflows from each aspect.

Associated Studying

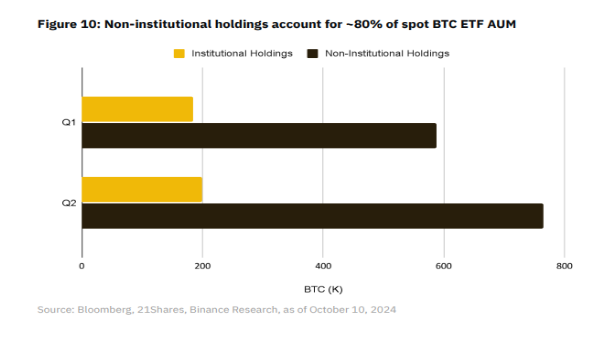

Apparently, knowledge has proven that retail traders are answerable for many of the demand for Spot Bitcoin ETFs, accounting for 80% of the overall belongings beneath administration.

Bitcoin ETFs Altering The Narrative

Based on Bloomberg knowledge, Bitcoin ETFs have dominated the ETF panorama in 2024, claiming the highest 4 positions for inflows amongst all ETFs launched this yr. Particularly, out of the 575 ETFs launched so far, 14 of the highest 30 are new funds specializing in Bitcoin or Ethereum. The standout performer is the BlackRock IBIT fund, which has attracted over $23 billion in year-to-date inflows.

Final week was one other instance of the optimistic efficiency in Spot Bitcoin ETFs, regardless of the coin’s consolidation under the $68,000 worth degree. Based on circulate knowledge from SosoValue, weekly inflows began on a optimistic be aware on Monday, October 21, with $294.29 million getting into the funds and ended the week with $402.08 million in inflows on Friday, October 25.

Apparently, Spot Bitcoin ETFs now maintain about 938,700 BTC in 10 months since launch and are steadily approaching the 1 million BTC mark. Though these ETFs have opened doorways for institutional traders, a current report from crypto trade Binance signifies that retail traders are the first drivers of this surge in demand, accounting for 80% of the holdings in Spot BTC ETFs.

Initially meant to offer institutional traders entry to BTC, Spot Bitcoin ETFs have now develop into the popular selection for a lot of particular person traders trying to reap the benefits of the regulatory readability they provide. Nonetheless, there was a gradual demand from the institutional aspect, with institutional holdings rising by 30% since Q1.

Amongst institutional traders, funding advisers have emerged because the fastest-growing celebration, with their holdings growing by 44.2% to succeed in 71,800 BTC this quarter.

What’s Subsequent For Spot Bitcoin ETFs?

Because of the speedy progress of Bitcoin exchange-traded funds, a formidable 1,179 establishments, together with monetary giants resembling Morgan Stanley and Goldman Sachs, have joined the crypto’s cap desk in lower than a yr. For comparability, Gold ETFs had been solely capable of appeal to 95 establishments of their first yr of buying and selling.

Associated Studying

This upward trajectory of institutional investments in Bitcoin is poised to proceed into the foreseeable future, which bodes properly for the general worth outlook of Bitcoin. As these ETFs appeal to extra institutional capital, they’re prone to produce second-order results like elevated BTC dominance, improved market effectivity, and diminished volatility that would considerably profit the cryptocurrency ecosystem.

On the time of writing, Bitcoin is buying and selling at $67,100.

Featured picture from Reuters, chart from TradingView